Jul 22, 2024

How to start the biweekly money-saving challenge

Saving up money calls for ongoing effort over time. Not sure where to start? You might want to try a biweekly money-saving challenge. This is a simple yet powerful way to build a consistent saving habit. The concept involves saving a specified amount of money every two weeks over the course of a year. Breaking your savings into these chunks of time can make it easier to track your progress and stick to your commitment.

The biweekly money-saving challenge is a popular savings challenge because many people get paid every other week. Aligning your savings cadence with your paychecks can make it easier to set aside money, because you know exactly how much you’re going to take out of each paycheck to fund your savings goal.

A step-by-step guide to the biweekly money-saving challenge

1. Set your savings goal

Before you begin, you’ll want to determine what you’re aiming for. Start by setting a specific savings goal for your challenge. Your goal can be anything that reflects your financial priorities. Common goals include:

Filling a sinking fund for a specific short-term goal

Building up a bigger emergency fund

Saving enough for a down payment on a house

Putting away money for your retirement plans

Determine how much money you’ll need to save in order to reach your specific goal: that dollar amount is your savings target.

2. Divide your savings target by 26

To determine how much to save biweekly, divide your savings target by 26. There are 26 biweekly periods in a year, so this calculation will tell you how much to save each period. For instance, if your goal is to save $1,300 in a year, you’ll need to save $50 every two weeks.

3. Build your savings biweekly

Once you have your biweekly savings amount, it’s time to start saving. Try these methods to make the process smoother:

Set up a dedicated savings account for the challenge: This can help you keep the saved money separate from your everyday spending so you don’t accidentally dip into it. Consider storing your money in a high-yield savings account or money market account so it earns interest to increase the impact of your saving efforts.

Automate your savings: Set up automatic transfers from your checking account to your savings account every two weeks. If you get paid biweekly, you could even adjust your direct deposit to put a certain amount of your paycheck straight into your savings account. Automation ensures that you don’t forget and helps maintain consistency.

Use money envelopes: If you prefer a more tangible approach, withdraw cash and use physical envelopes to store your biweekly savings. Label each envelope with the date and amount to stay organized.

4. Track your biweekly challenge progress

Monitoring your progress frequently can help you stay motivated. Regularly update a savings tracker or spreadsheet to see how much you’ve saved and how close you are to your goal. Celebrate small milestones along the way to keep yourself encouraged. Visual tools like charts or graphs can also help you visualize your progress and maintain momentum.

Biweekly money-saving challenge tips for success

Stay consistent and motivated

Consistency is key to the success of the biweekly money-saving challenge. Here are some strategies to help you stay motivated:

Stick to a budget: If you’re not already budgeting regularly, now may be a good time to make a budget. This allows you to plan your spending and saving intentionally to ensure you can stick with your biweekly money-saving challenge.

Monitor your spending: Spending more than you planned can derail your ability to stay on track with your biweekly money-saving challenge. Curb impulse buying and be sure your discretionary spending isn’t taking away from your savings plans.

Maintain motivation: Keep a visual reminder of your savings goal to increase your motivation. You might want to create a vision board or set an inspiring photo as your phone’s lock screen to keep your big-picture aspiration at the front of your mind.

Stay accountable: Share your progress with friends or family, or join a savings group. Being part of a community can provide additional encouragement and support. You might want to practice loud budgeting as a way of building accountability and community.

Remain flexible

A biweekly money-saving challenge breaks down goals that can seem overwhelming into manageable chunks. But you don’t have to rigidly follow a program; feel free to adjust the challenge to fit your specific circumstances. For instance, if you can’t afford to set aside enough money every other week to reach your goal in a year, extend the timeline for your challenge. And if you get paid on a different cadence, such as weekly or monthly, you can set aside money on that schedule instead of biweekly.

If you can’t stick with your biweekly money-saving challenge every single period, don’t get discouraged. Sometimes unexpected expenses come up that interfere with your plans. When that happens, you might save a little less during one period and make it up later when you can. If you’re struggling to meet your biweekly target, consider looking for practical ways to save money so you can prioritize your savings efforts.

Benefits of the biweekly money-saving challenge

There are many reasons that it can be hard to save money. Participating in money-saving challenges is one way to overcome the hurdles. A biweekly money-saving challenge can offer several benefits, including improved financial discipline and the ability to achieve both short-term and long-term financial goals. With biweekly saving, you can gradually accumulate enough money to reach your goal without feeling overwhelmed.

Build a regular saving habit: The challenge reinforces the habit of saving regularly, which can lead to better long-term financial stability.

Make saving more approachable: Breaking down your savings into manageable biweekly increments makes the process less daunting and more achievable.

Grow your confidence: Seeing your savings grow can provide a sense of accomplishment, increase your confidence with money, and reinforce positive financial choices.

Work toward your goals: A biweekly money-saving challenge can help you set specific goals and make consistent progress toward achieving them.

Start your biweekly money-saving challenge

If saving money feels overwhelming, the biweekly money-saving challenge can be a useful way to say “bring it on” and start working toward your goals. Whether you’re saving for a vacation, building an emergency fund, or planning a large purchase, this challenge can help you set your sights on your financial priorities, stay on track, and build a long-lasting savings habit that will serve you well in the future.

Learn about more money saving challenges like:

Investing made easy.

Start today with any dollar amount.

Biweekly money-saving challenge FAQs

How to save money on a biweekly paycheck?

Saving money on a biweekly paycheck involves setting aside a portion of each paycheck in a dedicated savings account. Automate the process to ensure consistency and adjust your budget to accommodate your savings goal.

What is the savings challenge for biweekly pay?

The savings challenge for biweekly pay involves saving a predetermined amount of money every two weeks, at the same time you get your paycheck. This method helps build a consistent saving habit and allows you to accumulate significant savings over time, tailored to your financial goals.

Related articles

saving

Nov 06, 2025

The 6 Main Types Of Car Insurance

saving

Apr 10, 2025

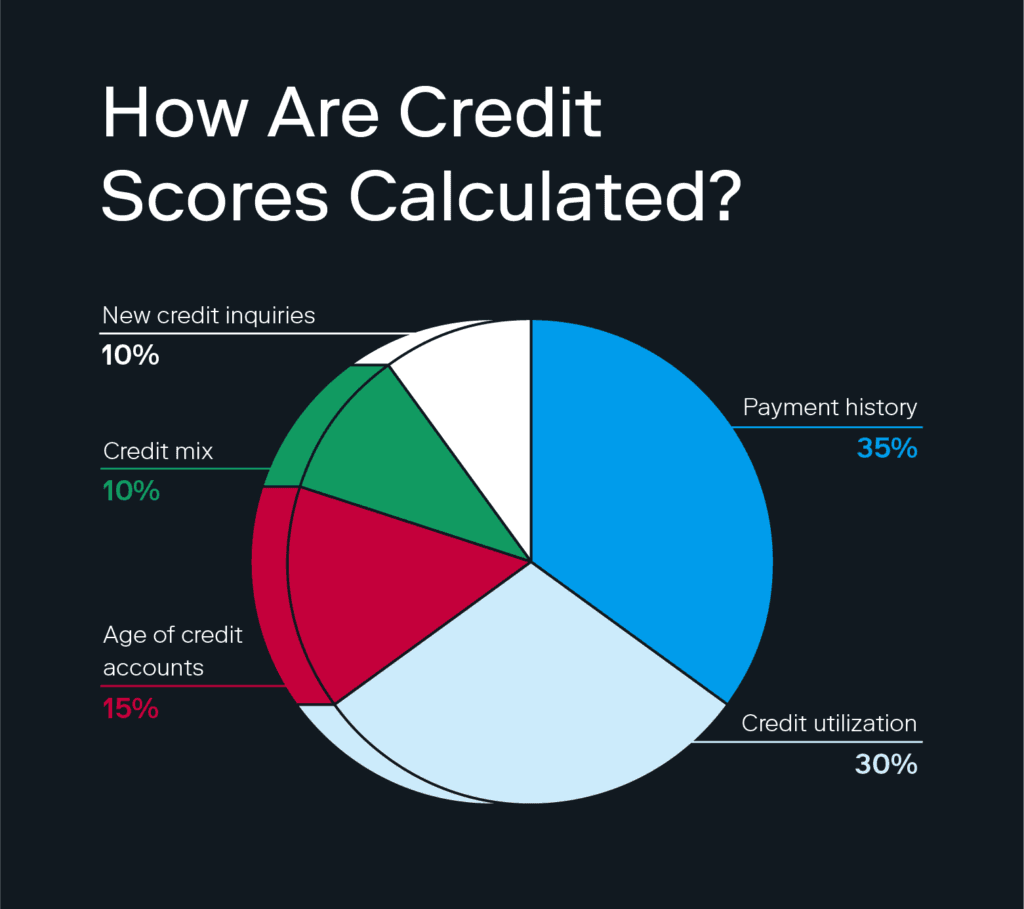

Why Does Higher Credit Utilization Decrease Your Credit Score?

saving

Jan 10, 2025

High-Yield Savings Accounts vs. Regular Savings Accounts

saving

Jan 09, 2025

How to Choose the Best High-Yield Savings Account

saving

Nov 14, 2024

Can You Lose Money with a High-Yield Savings Account?

saving

Nov 07, 2024

Best High-Yield Savings Account for Your Emergency Fund

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.