We make it easy to start your investing journey

Join over 1 million customers and reach your financial goals faster with Stash’s personalized advice, stock picks, and simple investing platform.

“Best No B.S. Investing App” - Popsugar 2024

As reviewed by

Harness the power of investing

Stash helps you invest on a schedule and, with Smart Portfolio, build a diversified portfolio. Diversified portfolios have historically delivered average annual returns of 5-10%.1

Stash gives you advice so investing doesn’t feel like gambling

Professionally managed portfolio.

Invest using Stash’s award-winning Smart Portfolio.

Fractional Shares for 1,000's of Stocks

Invest in some of the biggest companies in the world, regardless of price.

Personalized advice on what to buy

No investing experience required.

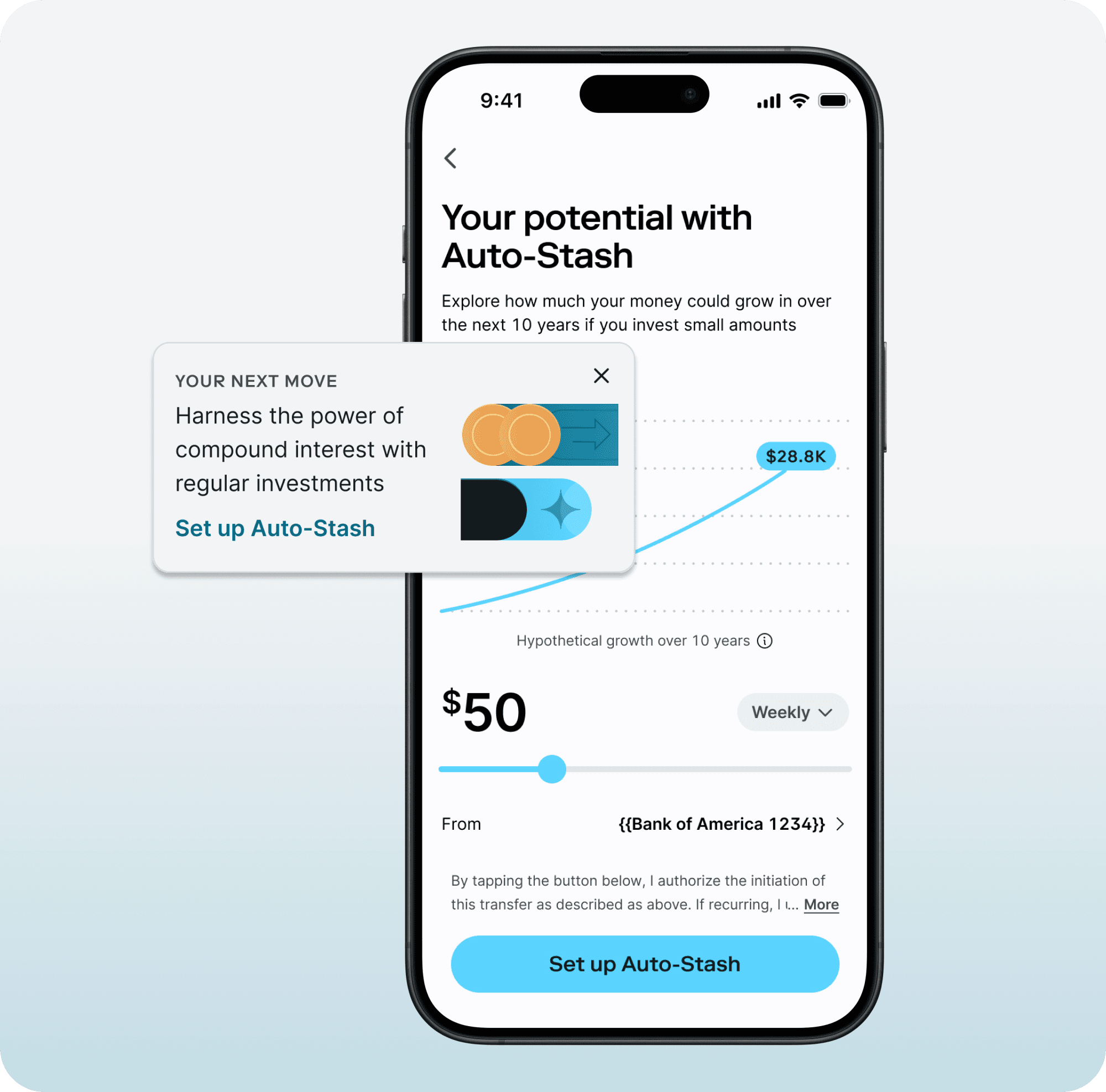

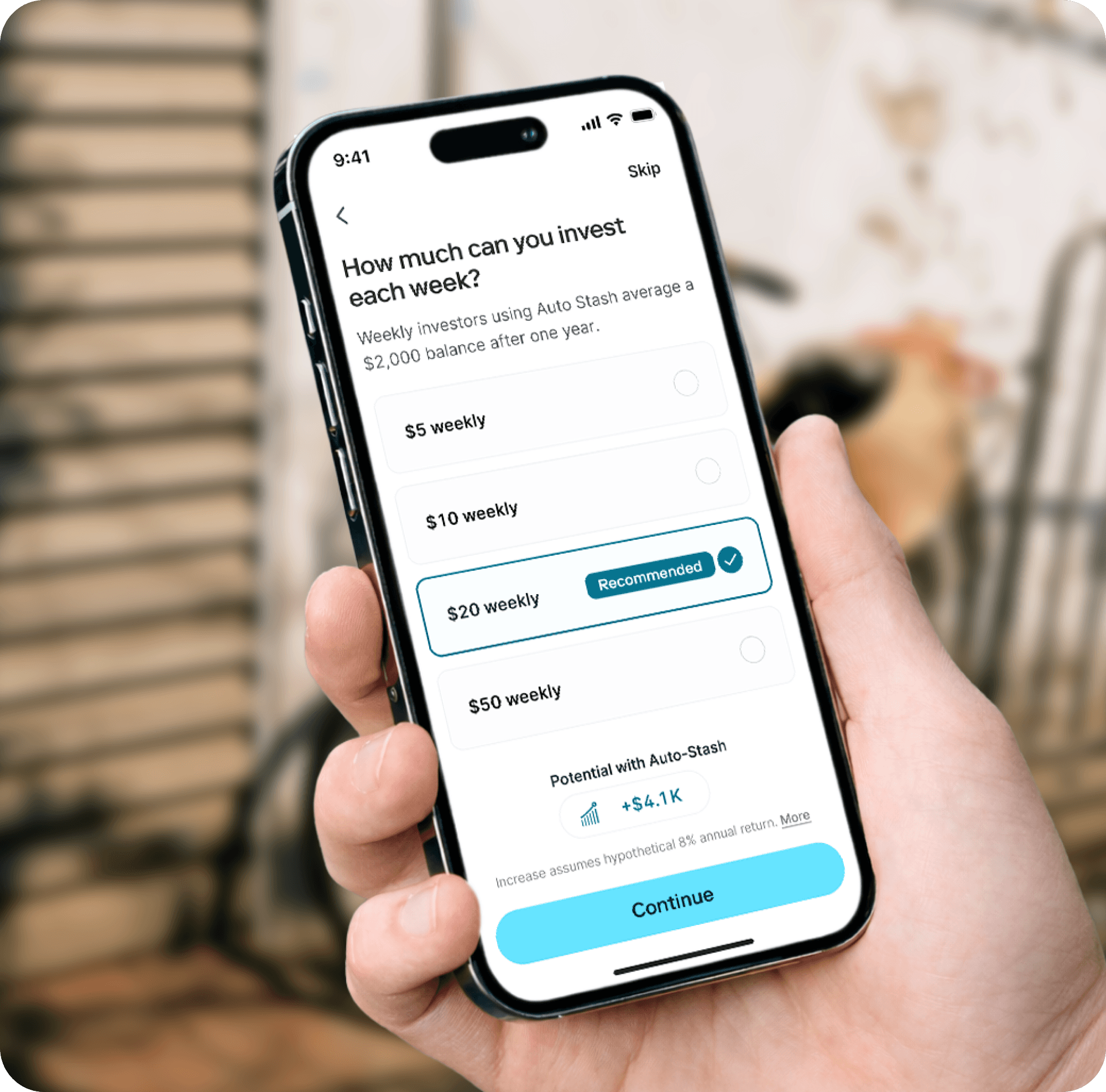

Invest on a consistent schedule

Contributions of any size can add up.

Instantly gain a better approach to investing

Set up a daily, weekly, or monthly recurring investments to start building no matter how small you start.

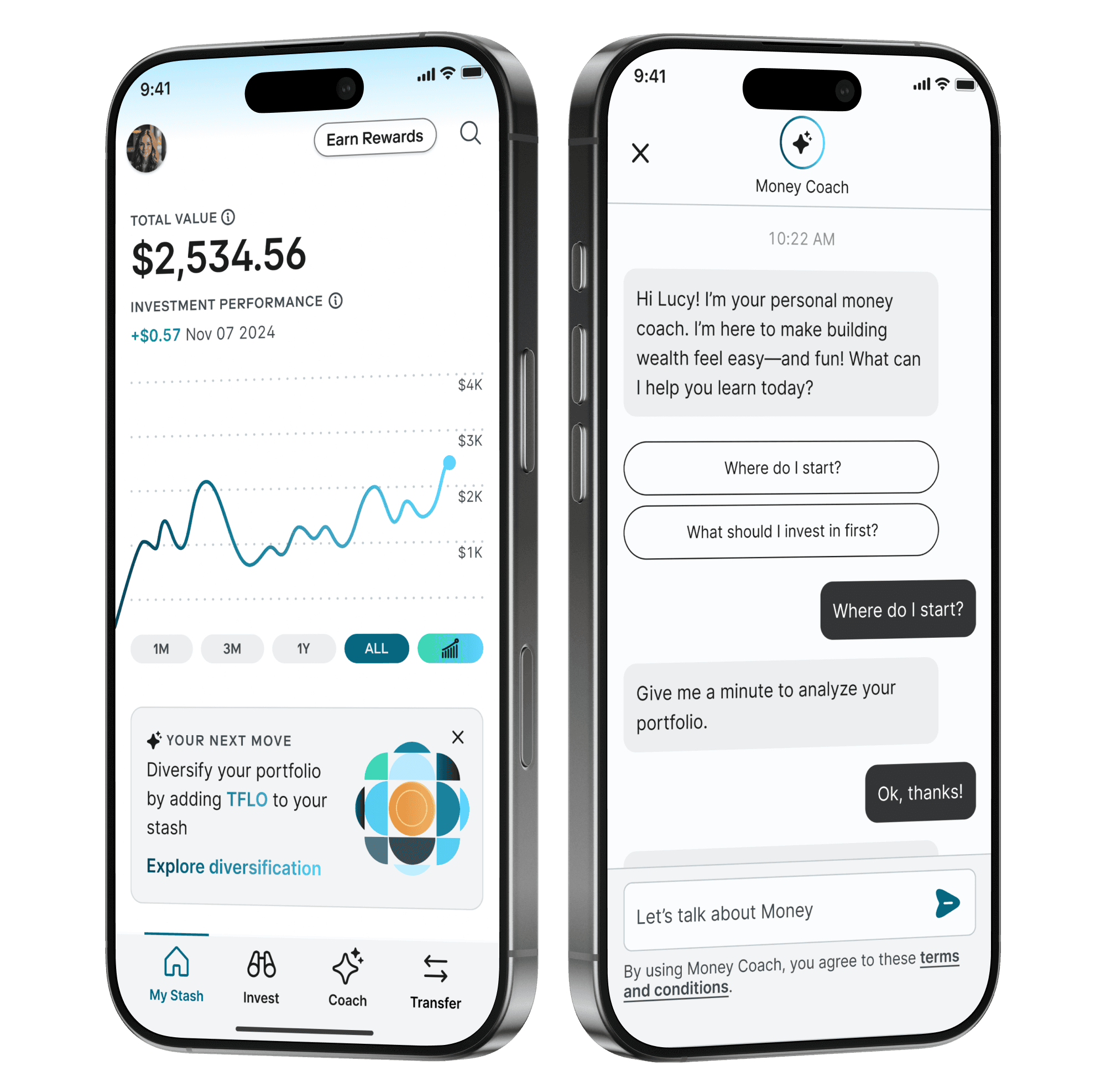

Get personalized advice on what stocks to buy

Buy shares of the stocks you know and love and get real-time advice on how to maintain a balanced portfolio.

Or, let our experts pick stocks for you

Stash’s Smart Portfolio is an award winning, expert-managed portfolio that picks stocks so you don’t have to.

Join the StockParty

Stock Parties are a way for Stashers to get bonus shares of new stock every other week. The pot grows when you invite more people to party.