Invest in

fractional shares.

Buy fractional shares (pieces of stock) at any dollar amount —without having to purchase a whole share.

Get more out

of investing.

A whole share can be hundreds of dollars and can cost you if the market turns.

With fractional shares, you can invest—at any amount—in multiple companies, which can help with ups and downs in the market. You have options.

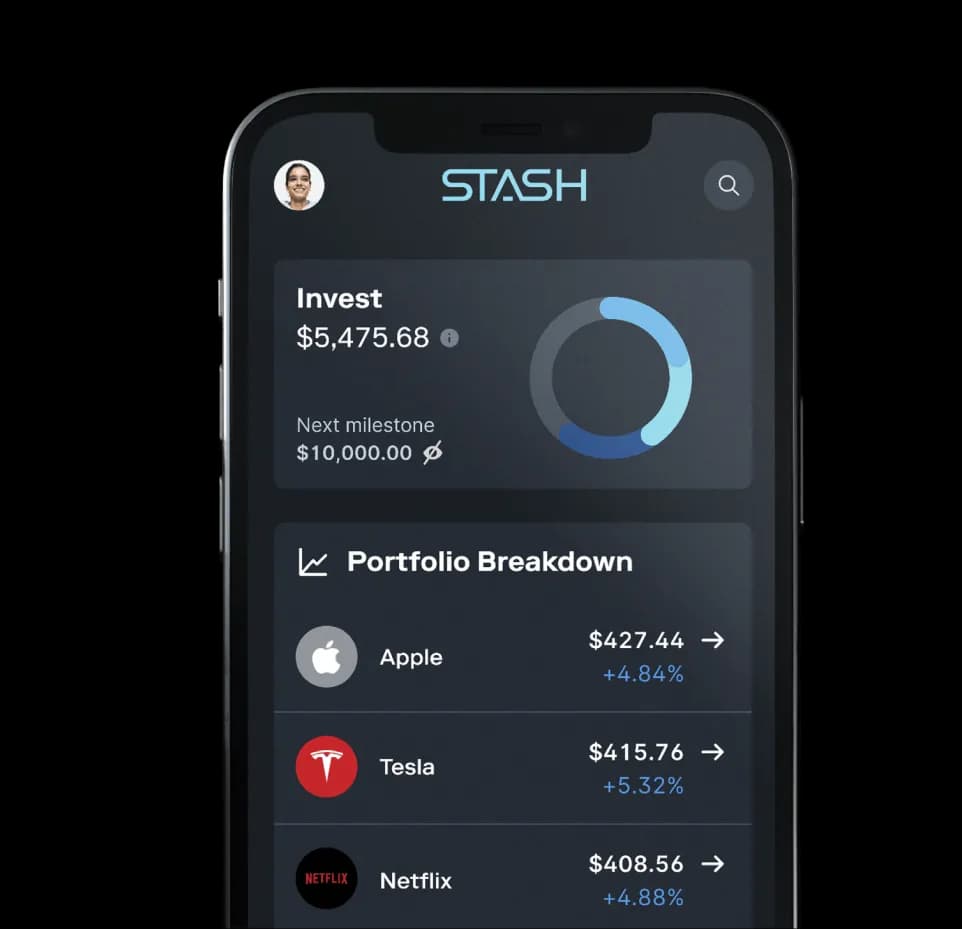

Diversify your

portfolio.

Use fractional shares to invest in a variety of companies at an amount that works for you. Choose from over 3,800 stocks and ETFs— there’s no limit to the amount you can buy.

Browse investments →

No add-on commission fees.

Avoid hidden fees when you buy or sell fractional shares with Stash—that means more money to build your wealth.†

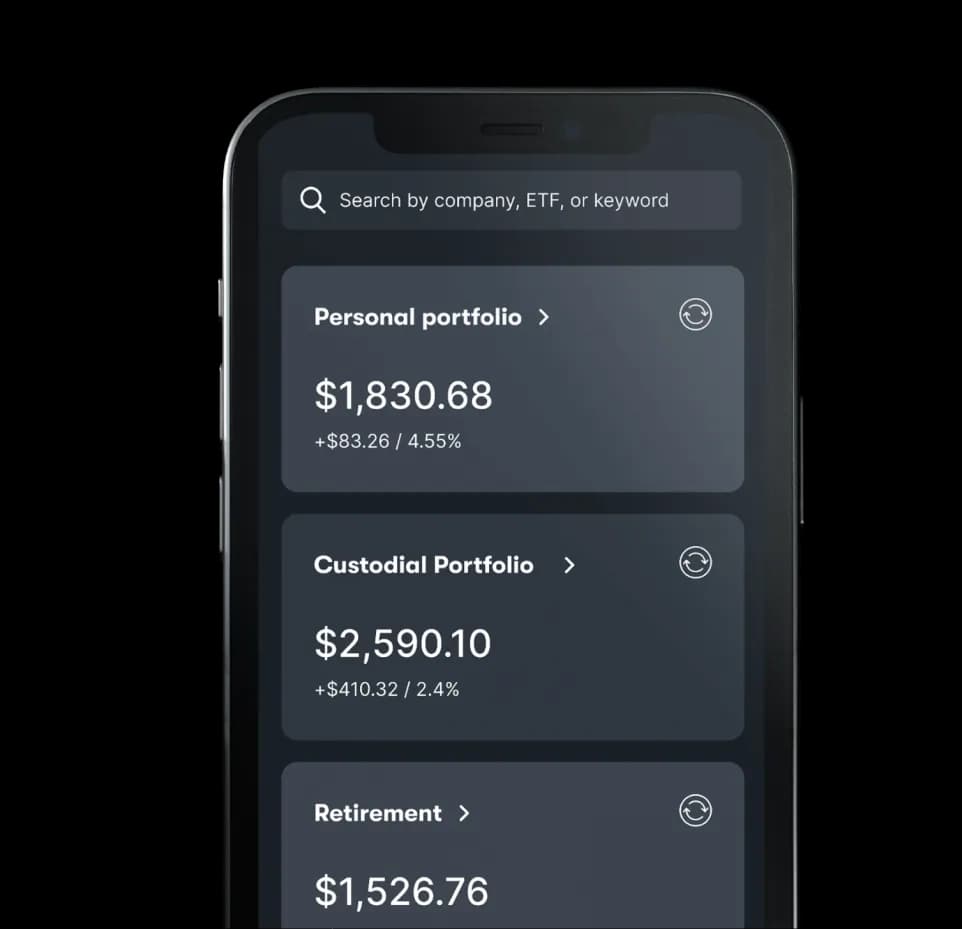

Give yourself options.

When you buy fractional shares with Stash, you can choose your own stocks, set up automated recurring investments, or contribute to a retirement account.

It’s easy to get started investing in fractional shares.

Sign up for Stash.

Choose your first investment.

And you’re set!