Aug 25, 2025

Why Stash+?

Level up your investing with extra rewards and support.

The Stash+ plan is designed for those looking to build long term wealth, particularly for individuals focused on saving for retirement, those with families, or those who want to maximize their rewards.

This premium subscription offers all the benefits of the Starter plan, plus the following additional features and benefits:

3% match on retirement contributions: Planning for your future can feel like a big task, but every little bit helps. On Stash+, you can supercharge your retirement savings with a 3% match on net monthly retirement contributions to your Roth or Traditional IRA. The match is given on top of your contributions, but the IRS annual contribution limits still apply and your total contributions cannot exceed these limits. Terms and conditions apply.1

Priority customer servicing: Get your servicing questions answered faster with premium servicing benefits on Stash+. When you contact Stash customer service via email or phone, your request will be prioritized ahead of non-Stash+ members in the servicing queue.

Greater Stock-Back® Rewards value: The Stash+ tier significantly increases the percentage of rewards you receive from using the Stock-Back® Card. Earn up to 3% of your qualifying purchases back in stock. For example, if you spend $200 a month on utilities with your Stock-Back® Card, you could earn $120 in stocks and ETFs in a year.1

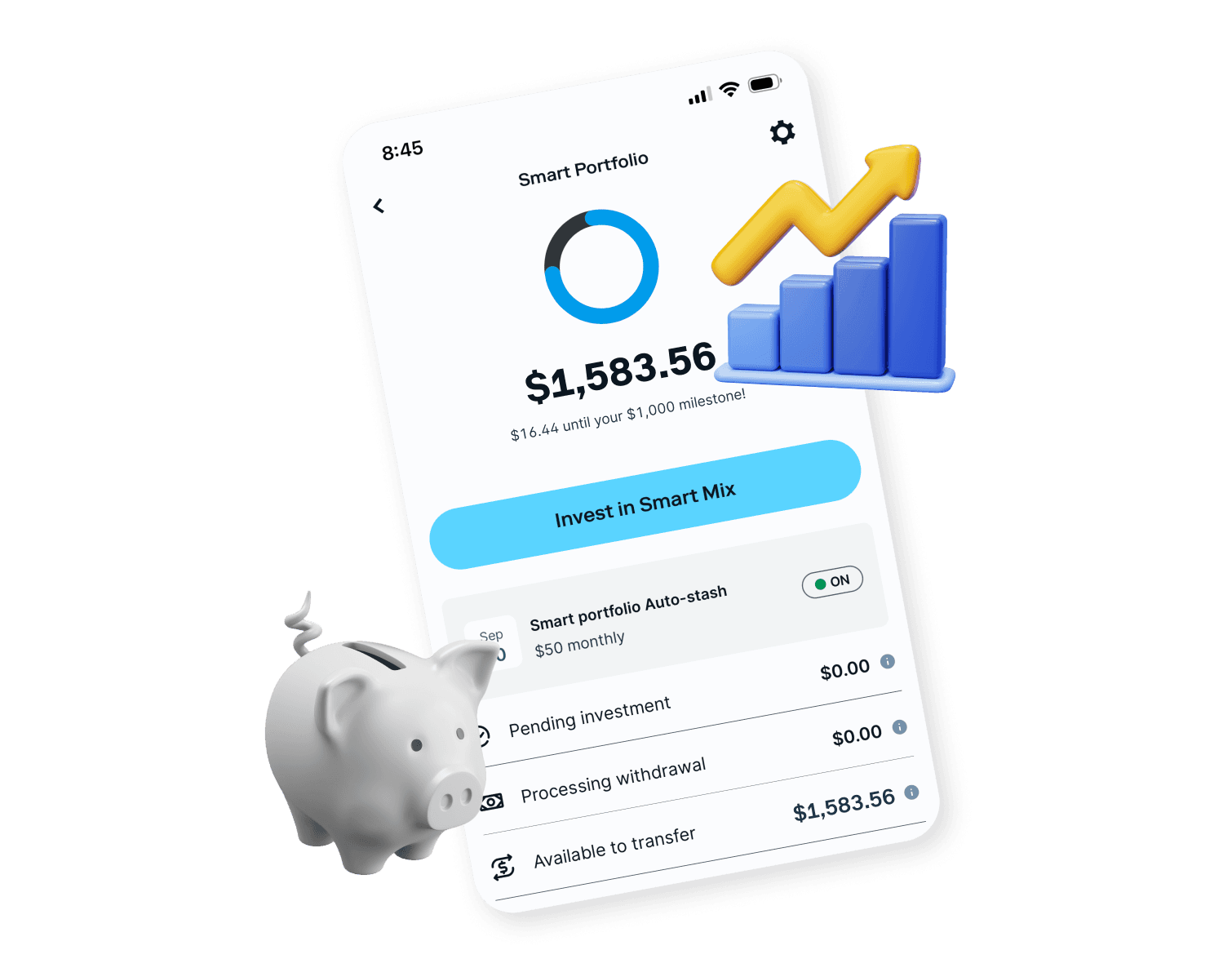

Personal, Retirement, and Kids Portfolios: Cover all of your investing needs with access to a Self-Directed Investing Portfolio, a Smart Managed Portfolio, a Retirement Portfolio (Roth or Traditional IRA), and Custodial Portfolios for the children in your life – all designed to help you invest for every stage of life.

Enhanced Financial Advice: Stash+ provides a higher level of advice and market insights compared to the Starter plan, including guidance for family finances, to help you make more informed decisions.

$10k life insurance offered by Avibra: The Stash+ plan provides added protection and peace of mind for you and your family for up to $10k, through our partner, Avibra.‡

Stash+ FAQs

How does the 3% retirement match work?

Stash+ includes a 3% match on net monthly contributions to a Roth or Traditional IRA held within Stash.1 You’ll receive the match monthly. Please note: the match is subject to terms and conditions, including IRS annual contribution limits. To be eligible, you must maintain a retirement account with Stash+ and actively contribute.

When will I get my retirement match?

Stash+ members will get their 3% match on net contributions to a Roth or Traditional IRA monthly, after the calendar month of contributions has passed.

What kind of support comes with Stash+?

Stash+ members receive priority customer servicing, meaning your support inquiries are placed ahead of Starter-tier requests. This can lead to faster response times when contacting our customer service team by phone or email.

How can the Stock-Back® Card rewards add up?

With Stash+, you earn 1% back in stock on all qualifying purchases and up to 3% in select bonus categories such as utilities and streaming services.1 For example, if you spend $200 a month on utilities with your Stock-Back® Card, you could earn $120 in stocks and ETFs in a year.Actual results may vary. Stock-Back® and Bonus terms apply.

What are Custodial Portfolios, and how do they work?

Stash+ gives you access to Custodial Portfolios that allow you to invest on behalf of the kids in your life. These portfolios can be used to start saving early for their future goals. Account control remains with the adult custodian until the child reaches the age of majority, at which point control may transfer to the child.

Related articles

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.