Aug 25, 2025

Why Starter

In this article:

All the essentials to start investing.

Stash’s Starter plan is designed for investors who are focused on building personal wealth. It provides the essential tools to start investing for the long term and is a solid starting point for individuals looking to start their investing journey with a low-cost, all-in-one product.

The Starter plan includes all of the following features:

1,000s of Stocks & ETFs: Access a broad universe of investments so you can build a portfolio that matches your interests and goals.

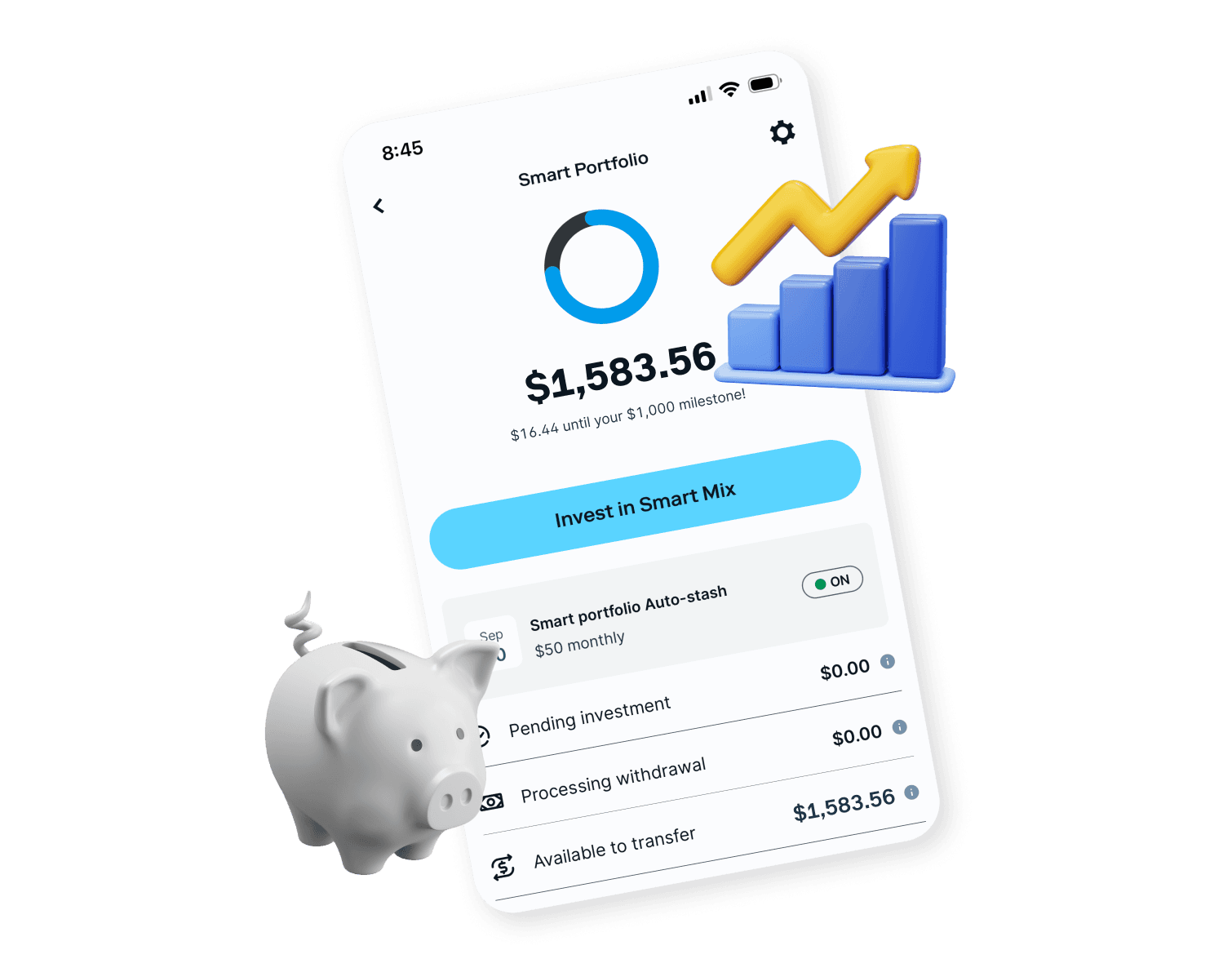

Personal and Smart Managed Portfolios: Choose and customize your own investments, or let Stash build and manage a diversified mix for you based on your risk level.7

AI Money Coach: Personalized insights and tips based on your activity to help you make informed money decisions.

Banking Account1 with 2-day early pay: Access your paycheck up to two days earlier when you set up direct deposit.3

Stock-Back® rewards: Earn up to 3% of your qualifying utility purchases back in stock. For example, if you spend $300 a month on utilities with your Stock-Back® Card, you could earn $108 in stocks and ETFs in a year.1

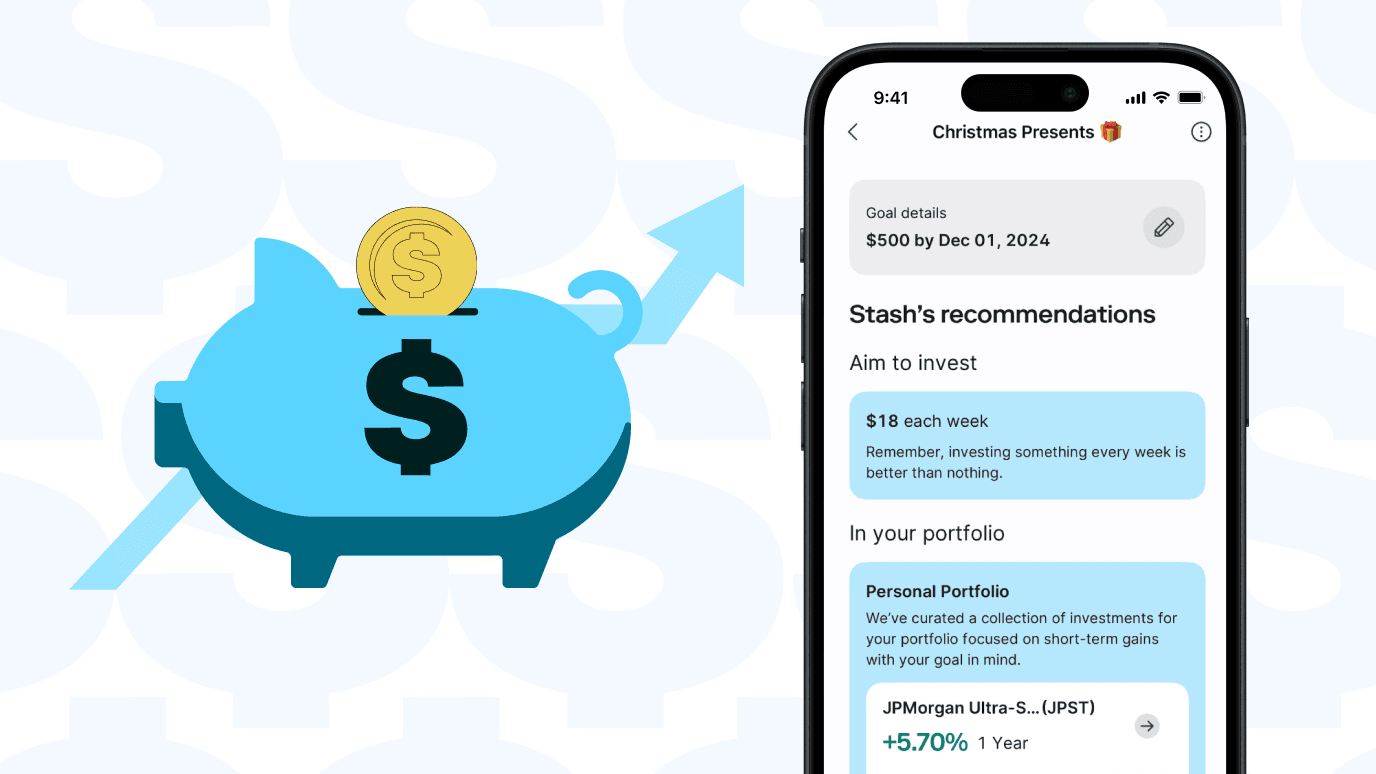

Advice and portfolio guidance: Get clear, actionable tips for investing and personal finances, plus see how balanced your portfolio is with a Diversification Score and suggestions to help manage risk.11

Automated investing tools: Set recurring contributions to invest or save automatically, helping you stay consistent.

Related articles

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.