Apr 10, 2025

Why Does Higher Credit Utilization Decrease Your Credit Score?

Managing your credit score might feel like an overwhelming task, especially with all the terminology and rules involved. If you've recently checked your credit score and noticed a dip, you might be wondering what caused it. One key factor could be your credit utilization.

But what exactly is credit utilization? More importantly, why does higher credit utilization decrease your credit score? This blog will take you through the answers, breaking down how credit utilization works, why it impacts your credit score, and what you can do to manage it effectively.

What Is Credit Utilization and Why Does It Matter?

Credit utilization, in simple terms, is the percentage of your available credit that you're currently using. It’s calculated by dividing your total credit card balances by your total credit limits and then multiplying by 100 to get a percentage. For example:

If you have a $5,000 credit limit and carry a $1,000 balance, your credit utilization rate is 20%.

Why does credit utilization matter?

Credit bureaus use this metric to gauge your borrowing habits. If you're using a high percentage of your available credit, it could signal that you're financially overextended. Conversely, a lower credit utilization rate shows that you're responsibly handling your credit.

Credit Utilization and Your Credit Score

Credit utilization is one of the most significant factors influencing your credit score. According to FICO, it accounts for 30% of your overall score. This makes it one of the most vital elements to consider when striving for a healthy credit profile.

How Credit Scores Are Calculated

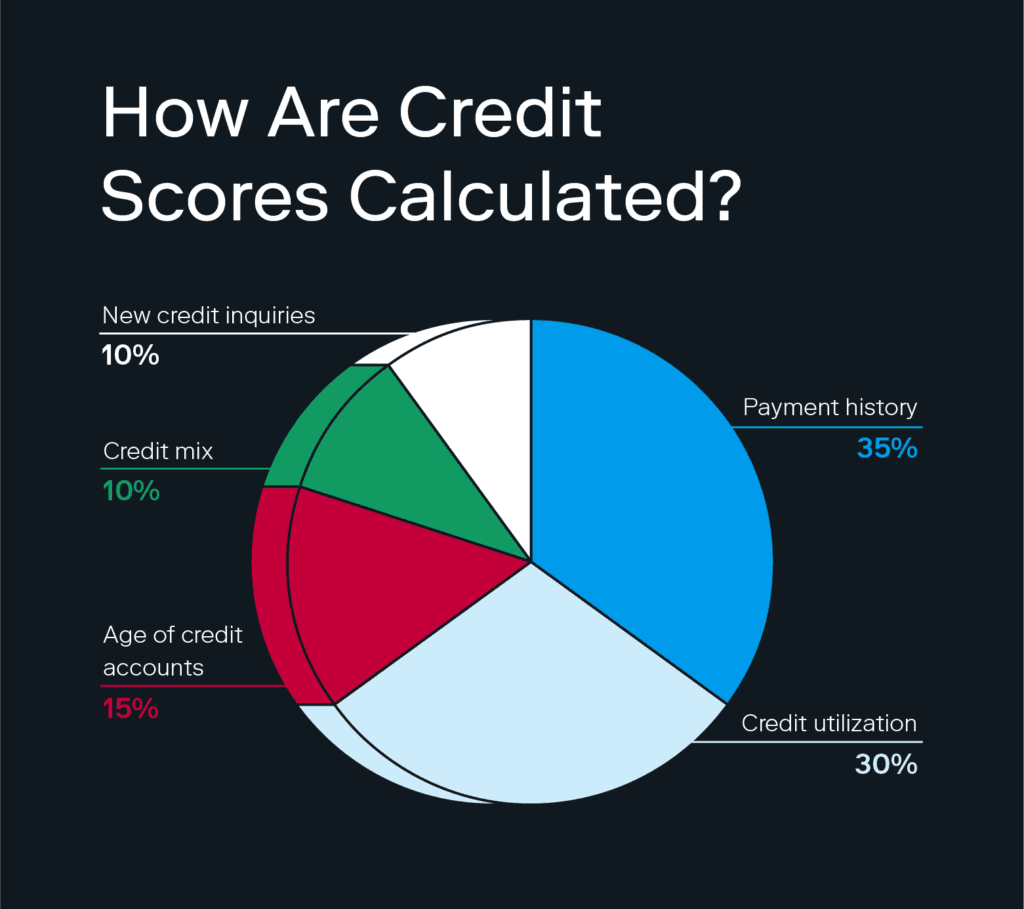

To understand the impact of credit utilization, it helps to know how credit scores are calculated. These scores are typically made up of five components:

Payment History (35%) - Whether you pay your bills on time.

Credit Utilization (30%) - How much credit you’re using compared to your total limit.

Credit History Length (15%) - How long you've been using credit.

Credit Mix (10%) - The types of credit accounts you have (e.g., credit cards, loans).

New Credit (10%) - Recent inquiries or new accounts.

While all five components matter, credit utilization is second only to payment history in terms of importance. This is why keeping your utilization in check is crucial.

Why High Credit Utilization Lowers Your Credit Score

Using a large percentage of your available credit can hurt your credit score for several reasons:

1. You Appear Risky to Lenders

Creditors and lenders analyze your credit utilization to determine your financial stability. A high utilization rate may suggest that you rely heavily on credit to manage your expenses, raising concerns about your ability to repay debt if emergencies arise.

2. It Impacts Your Debt-to-Credit Ratio

Your debt-to-credit ratio (or utilization ratio) directly affects your credit score. Ideally, experts recommend keeping this number below 30%. For example, if your credit limit is $10,000, keeping your balances below $3,000 is ideal. Once you exceed that threshold, your score could start to dip.

3. It Signals Financial Strain

High credit utilization might reflect deeper financial challenges. Credit score algorithms can interpret carrying high balances as over-reliance on credit, which impacts your score—even if you always make payments on time.

4. Lower Available Credit Impacts Your Flexibility

Even if you're not maxing out your credit card, higher balances leave less room for unexpected expenses. This financial inflexibility can be another red flag for lenders.

Strategies to Lower Credit Utilization

If high credit utilization is negatively affecting your score, don’t worry. There are several steps you can take to lower it and improve your credit health. Here are some actionable strategies:

1. Pay Down Balances Regularly

The most straightforward way to reduce your credit utilization is by paying off your balances. Consider prioritizing high-interest cards first while making minimum payments on others. This method, often called the debt avalanche, can help reduce both your debt and utilization rate.

2. Ask for a Credit Limit Increase

Increasing your credit limit lowers your credit utilization ratio automatically, as long as you don’t increase your spending. For instance, if your limit rises from $5,000 to $10,000 while maintaining a $1,000 balance, your utilization rate drops from 20% to 10%.

3. Spread Out Spending on Multiple Cards

Using several credit cards for small amounts instead of a single card for large purchases can also lower your utilization. Just make sure you can manage multiple due dates to avoid late payments.

4. Make Payments Twice a Month

Most credit card issuers report your balance to credit bureaus monthly. If you pay down your balance before it’s reported, your utilization will appear lower. Making bi-weekly payments can help keep your utilization in check.

5. Monitor Your Spending Habits

Tracking your spending can help you avoid overusing credit. Budgeting tools and apps can give you a clear picture of where your money is going and help you make informed decisions.

Tools to Monitor and Maintain Healthy Credit Utilization

Staying on top of your credit usage doesn't have to be difficult. Several tools and resources can assist you in maintaining healthy credit utilization:

Credit Monitoring Services

Platforms like Credit Karma or Experian provide regular updates on your credit utilization and overall score.

Budgeting Apps

Apps like Mint or YNAB make it easy to track spending and ensure you're staying within your limits.

Alerts from Credit Card Issuers

Many credit card companies allow you to set up balance and usage alerts to help you avoid exceeding your preferred utilization rate.

Use a Calendar Reminder

Set alerts for payment due dates or reminders to pay off balances before issuers report to credit bureaus.

By monitoring your spending and using these tools, you’ll stay informed and in control of your utilization rate.

Managing Credit Utilization for a Better Score

Higher credit utilization can significantly decrease your credit score, but with proper management, you can avoid this pitfall. Remember, your credit score isn’t static. With thoughtful planning and disciplined behavior, it’s possible to rebuild your score and maintain long-term financial health.

By regularly paying down balances, requesting credit limit increases, or using helpful financial tracking tools, you’re not just improving your score. You’re building a stronger, more secure financial future.

Want to learn more about how to maintain excellent credit management? Bookmark this post, and share it with your friends who might need help understanding why higher credit utilization decreases your credit score!

Related articles

saving

Nov 06, 2025

The 6 Main Types Of Car Insurance

saving

Apr 10, 2025

Why Does Higher Credit Utilization Decrease Your Credit Score?

saving

Jan 10, 2025

High-Yield Savings Accounts vs. Regular Savings Accounts

saving

Jan 09, 2025

How to Choose the Best High-Yield Savings Account

saving

Nov 14, 2024

Can You Lose Money with a High-Yield Savings Account?

saving

Nov 07, 2024

Best High-Yield Savings Account for Your Emergency Fund

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.