Nov 06, 2024

The Top Banks Offering High-Yield Savings Accounts in 2025

In this article:

- Why high-yield savings accounts matter in 2025

- Considerations for choosing a high-yield savings account

- Top banks offering high-yield savings accounts in 2025

- Tips to maximize high-yield savings growth

- Trends to watch in high-yield savings accounts

- Supercharge your savings with a high-yield savings account

The Top Banks Offering High-Yield Savings Accounts in 2025

A smart savings strategy can help you achieve your financial goals. But where you store your money matters; high-yield savings accounts can make your money work harder for you and boost the impact of your savings habit. Offering much higher interest rates than traditional savings accounts, high-yield savings accounts are designed to help your money grow faster while keeping funds easily accessible.

But with so many options out there for 2025, which banks provide the top high-yield savings accounts? This guide will walk you through the essentials, comparing top banks and their offerings, and help you make an informed decision to maximize your financial growth.

Why high-yield savings accounts matter in 2025

High-yield savings accounts have become particularly attractive as interest rates have climbed in recent years. If you're putting away money for an emergency fund or saving for a milestone like buying a home, these accounts can offer significant benefits over their traditional savings account counterparts.

Key benefits of a high-yield savings account:

Higher interest rates: High-yield savings accounts typically offer much better interest rates, often up to ten times higher than traditional savings accounts.

Low risk: Most accounts are federally insured by the FDIC or NCUA, making the risk of losing money incredibly small.

Easy access: Unlike certificates of deposit (CDs) or long-term investments, funds in a high-yield savings account remain readily available when you need them.

With increasing financial uncertainty in global markets, 2025 could be the ideal time to take advantage of a high-yield savings account to build a secure safety net or simply grow your cash reserves faster.

Considerations for choosing a high-yield savings account

Choosing the right account isn't as straightforward as looking at the highest APY (annual percentage yield). Every account comes with different terms and rules, and the details can make a big difference. When comparing high-yield savings accounts, keep these considerations in mind:

Opening balance requirements: You might need to deposit a certain amount up front to open a high-yield savings account. Check each account you’re considering to see if there’s an opening balance requirement and, if so, whether you have enough money to meet the minimum.

Balance minimums: Some banks require you to maintain a certain minimum balance to earn the maximum APY or avoid paying monthly maintenance fees. Think through your savings plan to be sure you can keep enough money in the account to avoid penalties.

Fees: You may find that a high-yield savings account comes with a monthly maintenance fee or charges other fees that could eat into your returns. Understand all the potential fees before settling on an account.

Withdrawal restrictions: Some banks place a limit on the number of withdrawals you can make from your high-yield savings account each month. If you expect to make frequent withdrawals, an account with restrictions might not fit your needs.

Compounding frequency: Compound interest is when your balance earns interest, that interest is added to your account balance, and then that interest starts earning interest. Compounding frequency is how often that interest is added to your account; the more frequent, the faster your savings can grow.

Now that you know what to look for, here’s a dive into some of 2025’s top-rated high-yield savings accounts.

Top banks offering high-yield savings accounts in 2025

1. EverBank

EverBank Performance Savings

Current APY: 4.75%

Key features:

No minimum opening deposit

No minimum balance

No monthly maintenance fee

EverBank allows you to calculate your potential interest earnings online before opening an account, so you have a better understanding of how your money can grow. With no minimum opening deposit, no minimum balance, and no monthly maintenance fees, this account offers flexibility without extra costs eating into your savings. It’s also easy to set up and maintain an account online or via the EverBank app. If you’re in California or Florida, you can visit 11 different brick and mortar locations, and no-fee ATM locations are available throughout the U.S.

2. Western Alliance Bank

Western Alliance Bank High-Yield Savings Premier

Current APY: 4.46%

Key features:

No fees

$500 minimum opening deposit

$0.01 minimum balance

Western Bank Alliance promises enhanced security and the ability to open your account online in five minutes or less. Additionally, you can link one external bank account, making it quick and easy to fund your new high-yield savings account. While brick and mortar locations under the Western Alliance Bank umbrella are generally limited to Arizona, Nevada, and California, online and mobile access make account maintenance simple for account holders across the U.S. A relatively low $500 minimum opening deposit can get you started, and a $0.01 minimum balance is required to keep earning the APY.

3. CIT Bank

CIT Bank Platinum Savings

Current APY: 4.55%

Key features:

No monthly fees

Convenient mobile app

$100 minimum opening deposit

Opening a CIT Bank Platinum Savings account takes about five minutes and a low minimum deposit of $100. Online and mobile app access make it simple to maintain your account. In fact, it’s the only way to maintain your account, as CIT Bank doesn’t have any physical locations. This account does require a $5,000 minimum balance to get the highest APY, so it may be better suited to savers who have the means to maintain that balance consistently.

Tips to maximize high-yield savings growth

Once you’ve chosen a high-yield savings account, the next step is making the most of it. Here are some smart savings strategies to accelerate your financial growth:

Automate monthly contributions: Set up automatic deposits from your checking account to ensure consistent savings growth.

Shop for competitive rates: Reassess your account’s APY periodically and be prepared to switch banks if you find a better rate.

Avoid frequent withdrawals: Maximize the power of compound interest by keeping your money in the account as long as possible.

Look for promotions: Many banks offer a sign-up bonus for their high-yield savings account or better rates if you also open a checking account.

With these strategies, you can not only boost your savings, but also create a habit of disciplined financial planning.

Trends to watch in high-yield savings accounts

The financial landscape continues to evolve, and so do savings account offerings. Taking advantage of these trends early can keep you ahead of the curve. Key trends for 2025 include:

Eco-friendly banking: Many banks now aim to incentivize paperless statements and green initiatives with higher APYs or rewards.

AI-powered financial tools: Expect smarter budgeting interfaces and AI-assisted growth insights as part of mobile app experiences.

Hybrid options: Accounts that blend high-yield savings benefits with checking account flexibility are gaining traction.

Supercharge your savings with a high-yield savings account

Choosing a high-yield savings account takes consideration, but it can be a simple and effective way to start growing your savings. Whether you prioritize high APYs, low fees, or low balance requirements, there’s an account out there tailored to your needs.

Explore your options, take control of your savings, and, most importantly, make choices that help you build financial stability for your future.

Related articles

saving

Nov 06, 2025

The 6 Main Types Of Car Insurance

saving

Apr 10, 2025

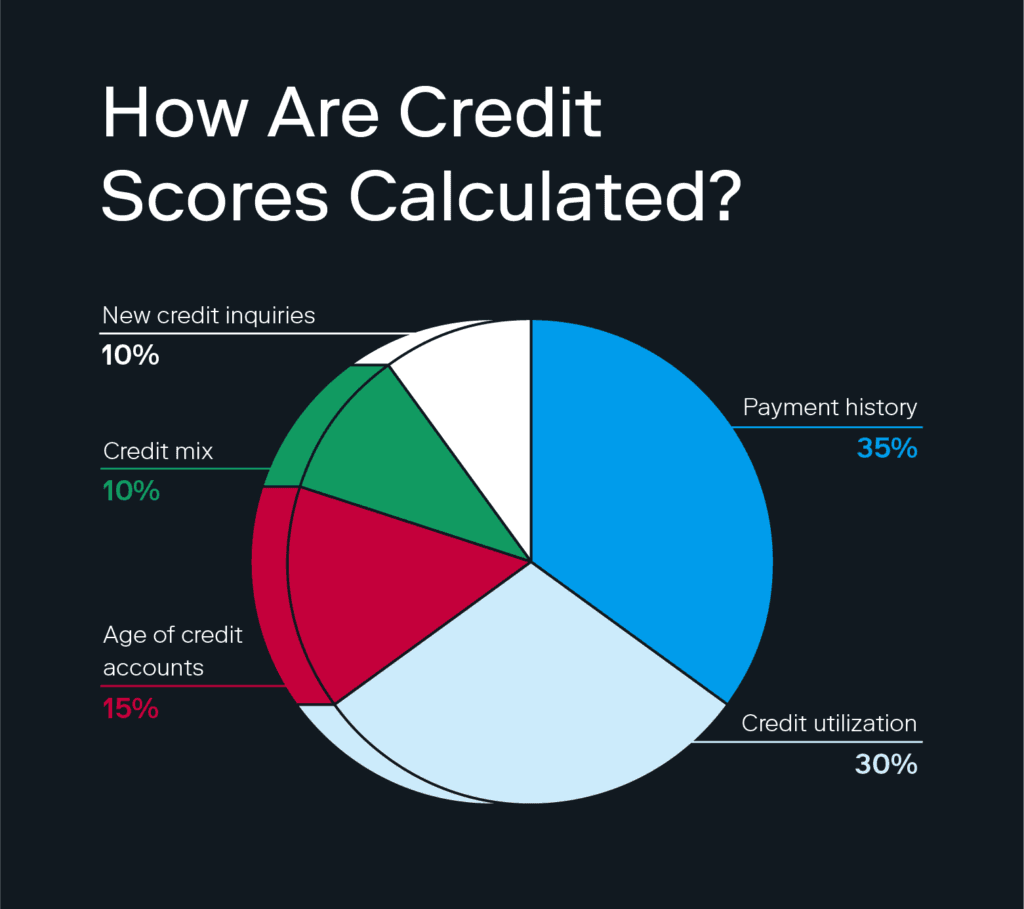

Why Does Higher Credit Utilization Decrease Your Credit Score?

saving

Jan 10, 2025

High-Yield Savings Accounts vs. Regular Savings Accounts

saving

Jan 09, 2025

How to Choose the Best High-Yield Savings Account

saving

Nov 14, 2024

Can You Lose Money with a High-Yield Savings Account?

saving

Nov 07, 2024

Best High-Yield Savings Account for Your Emergency Fund

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.