Oct 07, 2024

How to Use Compound Interest to Achieve Financial Freedom

Financial stability doesn’t necessarily sound sexy, but it is a dream many of us share. There are a host of practices that can help you achieve such a dream, and one of the more powerful ones is to use compound interest to your advantage.

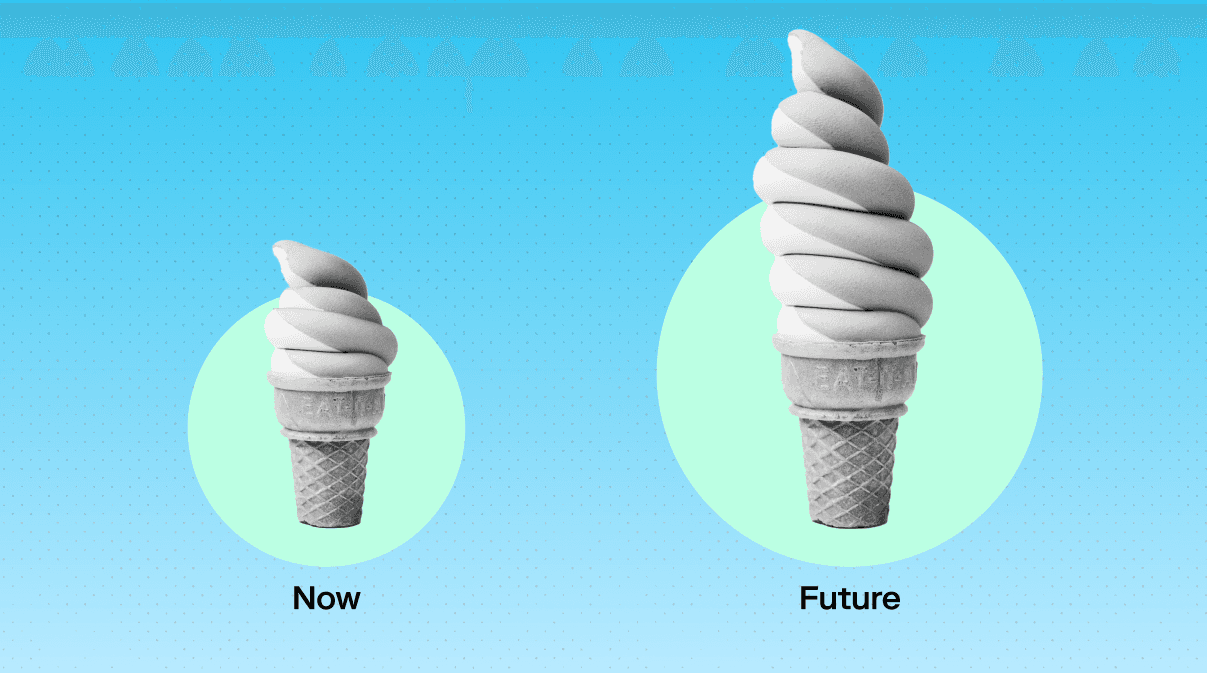

The seemingly magical financial principle of compounding can accelerate your path to financial freedom, turning small investments into substantial sums over time. Read on to explore the power of compound interest,understand how it works, and learn some practical tips to help you harness its potential in your financial planning.

What Is Compound Interest?

Compound interest is the interest on a loan or deposit that is calculated based on both the initial principal and the accumulated interest from previous periods. This means that, unlike simple interest, which is only calculated on the original amount, compound interest allows your money to grow exponentially as it builds upon itself over time.

Still a little fuzzy on what compound interest really means? Let us explain it to you with a simple example:

Imagine you have $10, and you put it in a special bank account. Each year, the bank gives you a little extra money as a "thank you" for keeping it there — let’s say they add $1. This is simple interest.

But with compound interest, the next year, the bank doesn’t just add money to the original $10; they add it to the whole amount you have now, which includes the extra $1. So now you earn money on $11, then $12.10 the next year, and so on. Over time, your money keeps growing faster because you're earning interest on the interest you already got!

The Basics of Compound Interest

The formula for compound interest is straightforward but powerful. It's typically expressed as A = P(1 + r/n)^(nt), where:

A is the amount of money accumulated after n years, including interest.

P is the principal amount (the initial sum of money).

r is the annual interest rate (decimal).

n is the number of times that interest is compounded per year.

t is the number of years the money is invested for.

This formula illustrates how compound interest can multiply your investments, turning modest savings into sizable nest eggs over the long term.

Consider another example of compound interest:

Imagine you invest $1,000 at an annual interest rate of 5% compounded annually. After 10 years, your investment will grow to approximately $1,628.89. If you leave it for 30 years, the same investment will balloon to $4,321.94. The longer your money is left to compound, the more pronounced the growth becomes. This is why you’ll so often hear advice to take advantage of compound interest as early on as you can.

Factors That Impact Compound Interest

There are several factors that influence the growth of your investment when compounding.

Frequency of Compounding

Interest can be compounded at various frequencies, such as annually, semi-annually, quarterly, monthly, or even daily. The more frequent the compounding, the greater the amount of interest accumulation.

Time Span

Time is a critical factor in maximizing compound interest. The longer you leave your money in an account or investment, the more time it has to grow. This is why starting early in your financial planning is crucial.

Interest Rates

Higher interest rates lead to more significant growth through compound interest. While you may not always have control over interest rates, choosing investments or accounts with competitive rates can enhance your returns.

3 Ways to Maximize Compound Interest and Make More Money

To make the most of compound interest, consider these practical tips:

Start Early

The earlier you start investing, the more time your money has to compound. Even small amounts can grow into considerable sums given enough time. Even if you start with just $5, growing your savings now with the additional benefit of compound interest will have great significance to you in the future.

Contribute Regularly

Consistent contributions can dramatically increase the potential of compound interest. Setting up automatic transfers to your investment or savings account can help you stay disciplined and take advantage of dollar-cost averaging. Consider taking a portion of every paycheck and investing it with compound interest.

Choose the Right Investments

Selecting investments with favorable compounding frequencies and competitive interest rates can amplify your returns. While riskier investments may offer higher potential returns, you’ll want to do your research to make sure you balance growth and risk.

Compound vs. Simple Interest

When comparing compound interest to simple interest, the difference in growth potential is stunning. Simple interest is calculated only on the principal amount, while compound interest accounts for accumulated interest. This makes compound interest vastly more powerful for long-term growth. Choosing simple interest instead of compound interest is sort of like leaving money on the table.

Common Misconceptions About Compound Interest

There are several misconceptions about compound interest that can lead people to make mistakes or not make the most of this powerful tool.

For one, some believe it's only relevant for large sums. This is not the case. As we’ve discussed, starting small is better than not starting at all.

Some think the concept is too complex for them to understand and take advantage of. It’s not. In the simplest of terms, compound interest is a tool to make more money. Anyone can use the tool, and it’d be a shame to miss out on it.

Finally, some people think they should be more focused on how to save money. Here’s the thing: Using compound interest is saving money. It’s simply a way to build those savings faster and achieve your financial goals.

The bottom line? Compound interest benefits anyone willing to invest time and consistent effort, regardless of the initial amount.

Compound Interest Is a Powerful Money Making Tool: A Final Word

Compound interest is a powerful tool that can accelerate your path to financial freedom. By understanding its principles and implementing practical strategies, you can harness its potential to grow your wealth and achieve your financial goals.

At Stash, we believe in empowering individuals with financial knowledge that is accessible and actionable. We're here to help you confidently navigate your financial journey, whether you're just starting or looking to optimize your existing investments. Remember, the key to success is consistency, patience, and the willingness to learn.

Ready to take the next step? Sign up for our newsletter for more valuable insights into personal finance and investing. Together, let's build a brighter financial future — one compound interest calculation at a time.

Related articles

investing

Feb 09, 2026

Trump Accounts: Invest Early

investing

Jan 13, 2026

FAQ: Personal Portfolio

investing

Jan 05, 2026

Why did the price I bought or sold my investments at change? What are Trading Windows?

investing

Dec 11, 2025

How to Invest through the Holidays—Without the Stress

investing

Oct 23, 2025

Why Millions Are Canceling Disney+ and Hulu and What It Means for Investors

investing

Sep 30, 2025

Securities Lending

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.