Nov 06, 2025

The 6 Main Types Of Car Insurance

The six main types of car insurance are liability, collision, comprehensive, uninsured motorist, personal injury protection and medical payments. Together, they keep you from paying thousands out of pocket when something goes wrong on the road.

Jerry has helped over 500,000 people get the right coverage this year, with policies that include the main types of car insurance. Here's what each one does and whether you actually need it.

Coverage type | What it covers | Do you need it? |

|---|---|---|

Others' medical bills and property damage when you're at fault. | ✅ Required by law, except in New Hampshire. | |

Your car repairs after hitting another vehicle or object. | ✅ Required if financing/leasing. Recommended for cars worth more than $5,000. | |

Damage to your car from theft, vandalism, weather and accidents with animals. | ✅ Required if financing/leasing. Recommended for cars worth more than $5,000. | |

Your costs when hit by uninsured or underinsured drivers. | ✅ Required in some states. Strongly recommended everywhere. | |

Medical bills, lost wages, childcare after an accident. | ✅ Required in no-fault states. | |

Medical payments (MedPay) | Medical expenses only after an accident. | Optional, but may be worthwhile if you don’t have health insurance. |

Compare insurance, fast.

Jerry pulls quotes from over 50 insurance companies in as fast as 2 minutes.

What you'll pay for coverage

Full coverage (liability + collision + comprehensive) typically costs between $168 to $370 per month. Individual coverages vary based on your deductible and limits.

Coverage type | Typical monthly cost |

|---|---|

State minimum liability | $73 - $161 |

Full coverage | $168 - $370 |

Uninsured motorist | $3 - $12 |

PIP | $20 - $70 |

MedPay | $5 - $10 |

Your actual cost depends on where you live, your driving record and what you drive. Rates for the same coverage can vary by hundreds of dollars between insurers.

💡 Tip: Insurance companies price coverage differently. One might charge $250/month while another charges $380 for identical coverage. You can compare quotes on the Jerry app to find the coverage that’s best for you.

Compare coverage options through Jerry

When you shop for car insurance, compare rates for different coverage types and add-ons to see how they affect your total price. Jerry shows you quotes from 50+ carriers side-by-side so you can see exactly what each insurer charges for the coverage you need.

If your rates go up at renewal, you can use the Jerry app to check what you'd pay with other carriers. You might find the same coverage for significantly less.

Compare quotes from 50+ companies.

Drivers who switch with Jerry save an average of $54/mo on car insurance.

Deep dive: Types of car insurance

Liability insurance (Required by law)

Liability covers damage you cause to others in an accident. It has two parts:

Bodily injury liability: Pays for other people's medical costs, lost wages and legal fees when you're at fault.

Property damage liability: Pays to fix or replace other people's vehicles and property when you're at fault.

Nearly every state requires liability insurance. New Hampshire is the only exception.

Understanding liability limits

Liability limits are typically written in the format of “100/300/100”. Here’s what it means:

$100,000 bodily injury liability, per person, or the maximum amount covered for one person’s injuries.

$300,000 bodily injury, per accident, or the maximum amount covered for all injuries combined.

$100,000 property damage liability, per accident, or the maximum amount covered for property damage you cause in a crash.

⚠️ Tip: State minimum coverage limits are often too low to cover the cost of a serious accident — the average severe crash costs over $160,000, according to the National Safety Council. Jerry recommends drivers to consider at least 100/300/100 in liability coverage to lower the risk of becoming financially responsible for costs that go beyond your policy limits.

Learn more: Liability insurance vs. full coverage

Collision and comprehensive coverage

Collision and comprehensive coverage, when combined with liability insurance, make up "full coverage" insurance. Lenders require both if you're financing or leasing your car.

Here’s what each covers:

Collision insurance: Pays to repair your car after hitting another vehicle or object, regardless of who's at fault.

Comprehensive insurance: Pays for damage from everything except collisions, including theft, vandalism, weather events, animal strikes, fire and falling objects.

Both have deductibles (what you pay before insurance kicks in). Common deductibles are $250, $500, or $1,000. The higher your deductible, the lower your premium is.

💡 Tip: If your car is worth less than $2,000–$3,000, collision and comprehensive might cost more than the car is worth. In that case, dropping them and pocketing the savings can makes sense.

Learn more: What does full coverage car insurance cover?

Uninsured/underinsured motorist coverage

This protects you when you're hit by someone who either has no insurance or doesn't have enough to cover the damage they caused.

About 15% of drivers in the U.S. don't have car insurance. That's roughly 1 in 7 drivers on the road with you.

Uninsured motorist (UM): Covers accidents with drivers who have no insurance.

Underinsured motorist (UIM): Covers accidents when the at-fault driver's limits are too low to pay for your expenses.

💡 Tip: Even if your state doesn't require UM/UIM coverage, Jerry recommends adding it. If you get into an accident, there's a decent chance the person who hits you won't have adequate coverage to pay your bills.

Personal injury protection (PIP)

PIP covers your medical expenses after an accident. It pays regardless of who caused the crash.

Depending on your state, PIP also covers:

Lost income if you can't work.

Ambulance services.

Childcare expenses while you recover.

Funeral costs.

PIP is required in 12 no-fault states: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah.

🔍 Tip: PIP is expensive in no-fault states because it pays out regardless of fault. If you live in Michigan or New Jersey (two of the most expensive states for car insurance), PIP is a big reason why.

Medical payments coverage (MedPay)

MedPay is similar to PIP, but it only pays for medical costs, nothing else.

MedPay pays for you and your passengers after any accident, whether you're at fault or not. It also pays if you're hit as a pedestrian or injured in someone else's vehicle.

💡 Tip: MedPay can cover your health insurance deductible. If you have a $3,000 health insurance deductible and $5,000 in MedPay, your car insurance covers that gap. Even with good health coverage, MedPay fills holes your health insurance won't.

Other coverage types worth knowing about

These aren't part of the "six main types," but you'll see them when shopping for insurance.

Gap insurance: Pays the difference between your car's value and your loan balance if it's totaled or stolen. Critical if you owe more than your car is worth.

New car replacement: Covers the cost of a brand new vehicle of the same make and model after a total loss (instead of your car's depreciated value).

Rental car reimbursement: Pays for a rental while your car is being repaired after a covered loss.

Roadside assistance: Provides towing, jump-starts, flat tire changes, and locksmith services.

⚠️ Tip: "Full coverage" doesn't include roadside assistance or rental reimbursement. Those are add-ons you pay extra for. If you assumed your full coverage policy included a rental car after an accident, check your policy to confirm you actually do have the coverage.

Learn more: How much car insurance do I need?

FAQs

✅ Is car insurance required by law? Yes, in every state except New Hampshire. Most states require liability insurance at minimum. Some also require uninsured motorist coverage, PIP, or MedPay.

🚗 What's the difference between collision and comprehensive? Collision covers damage from crashes with other vehicles or objects. Comprehensive covers non-collision damage like theft, vandalism, weather and hitting animals.

💰Do I need full coverage if my car is paid off? Depends on your car's value and whether you can afford to replace it. If your car is worth $8,000 and you don't have $8,000 in savings, keep full coverage. If your car is worth $1,500, you’ll likely save money by dropping it.

⚠️ What happens if I don't have enough liability coverage? You're personally responsible for costs that exceed your limits. That includes medical bills, legal fees, and property damage. This can mean tens or hundreds of thousands of dollars out of pocket after a bad crash.

🎯 How much uninsured motorist coverage do I need? Consider limits similar to your liability coverage. If you carry 100/300/100 liability, get the same for uninsured motorist coverage.

📋 What's the difference between PIP and MedPay? PIP covers medical expenses plus lost wages, childcare, and other costs. MedPay only covers medical expenses. PIP costs more but provides broader coverage.

Methodology

Quotes data included in this analysis comes from policies that Jerry has quoted within the last 6 months for drivers with a clean record and that have full coverage, unless stated otherwise. Jerry services 48 states and offers a range of insurance companies to choose from.

Related articles

saving

Nov 06, 2025

The 6 Main Types Of Car Insurance

saving

Apr 10, 2025

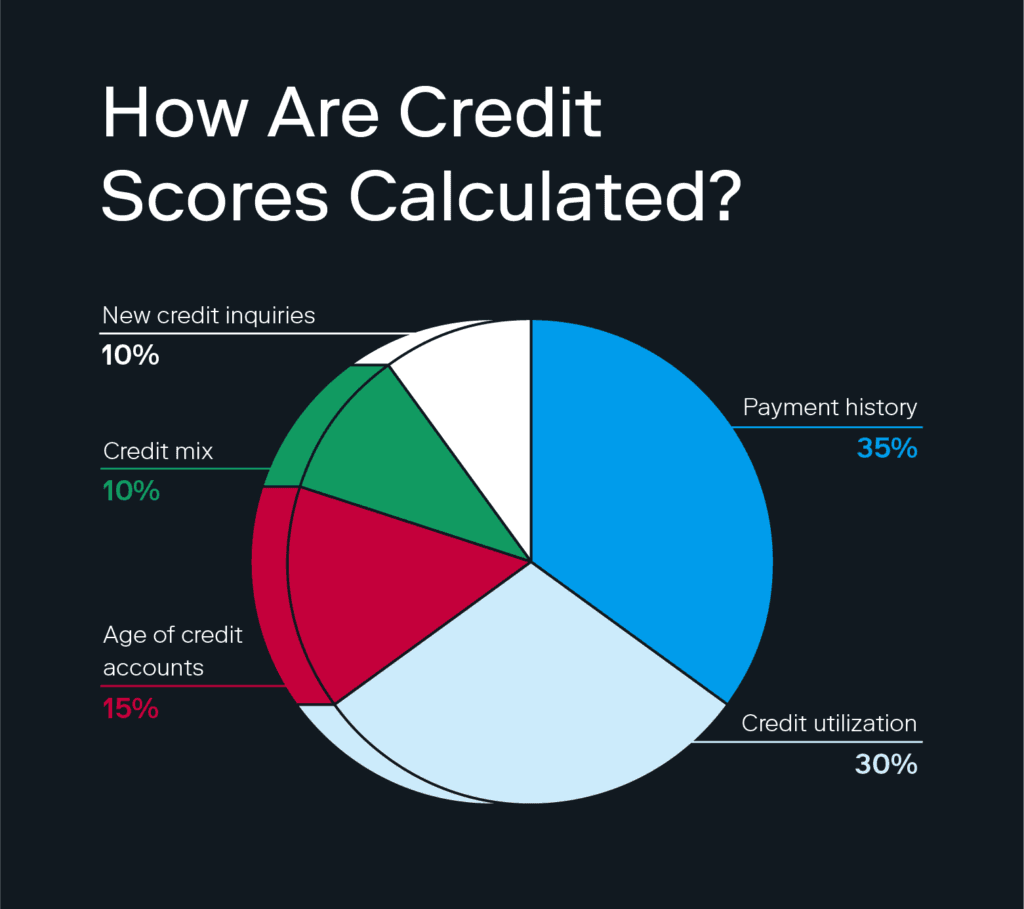

Why Does Higher Credit Utilization Decrease Your Credit Score?

saving

Jan 10, 2025

High-Yield Savings Accounts vs. Regular Savings Accounts

saving

Jan 09, 2025

How to Choose the Best High-Yield Savings Account

saving

Nov 14, 2024

Can You Lose Money with a High-Yield Savings Account?

saving

Nov 07, 2024

Best High-Yield Savings Account for Your Emergency Fund

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.