Aug 01, 2024

How to pay yourself first

In the realm of personal finance, the concept of “pay yourself first” stands out as a powerful strategy for becoming financially stable and achieving success. This approach involves prioritizing savings and investments before addressing other expenses.

By setting aside a portion of your income for savings right from the start, you ensure that you meet your financial goals and reduce the likelihood of overspending on less critical expenses. This article will help you understand the essence of paying yourself first, its benefits, and how to implement it effectively, all of which will benefit your financial literacy.

What does pay yourself first mean?

The concept of paying yourself first refers to the practice of automatically saving a portion of your income before spending it on anything else. This philosophy prioritizes savings and investments, ensuring that your financial future is secured before discretionary spending kicks in. Popularized by financial experts like David Bach in his book “The Automatic Millionaire,” the idea has evolved over time to become a fundamental principle in personal finance. By adopting this mindset, you shift the focus from reactive to proactive financial management, making long-term wealth building a priority.

Benefits of paying yourself first

Financial security

One of the primary benefits of the pay-yourself-first strategy is building a financial cushion. A robust savings account begets psychological advantages, like peace of mind and less financial anxiety. Knowing you have an emergency fund set aside can help you feel in control of your finances, which will contribute to your long-term stability and give you a greater feeling of security.

Reduced financial stress

Money doesn’t necessarily buy happiness, but having savings to fall back on can stress related to unexpected financial emergencies. For example, if your car suddenly needs repairs or you face an unexpected medical expense, that emergency fund can alleviate the financial burden and keep you safe. This preparedness means fewer sleepless nights worrying about unforeseen costs and a more relaxed approach to handling life’s unexpected challenges.

Long-term wealth building

Consistent savings contribute significantly to long-term wealth and financial goals. We can’t overstate the power of compound interest: by saving regularly, your money grows exponentially over time. This steady accumulation of wealth makes it easier to achieve significant financial milestones, like buying a home, funding children’s education, or enjoying a comfortable retirement.

How to pay yourself first

Assess your financial situation

The first step in paying yourself first is to assess your current financial situation. Review your income and expenses to better understand where your money is going. Identify areas of discretionary spending that you can reduce or eliminate to free up funds for savings. This assessment will provide you with a clear picture of your financial health and highlight opportunities for redirecting money toward your financial goals.

Set savings goals

Setting clear, achievable savings goals is crucial for motivation and direction. Define short-term goals like building an emergency fund, mid-term goals like saving for a vacation, and long-term goals like funding retirement. Having specific targets makes it easier to stay focused and measure progress. For instance, aim to save three to six months’ worth of living expenses for your emergency fund, and set a target amount for your retirement savings based on the lifestyle you want for yourself when the time comes.

Determine how much you should save

How much of your paycheck should you save? There’s not a single right answer, but a common recommendation is to set aside 10-20% of your income. Adjust this rate based on your personal financial situation and goals. If you’re new to saving, start small and gradually increase the amount as you become more comfortable. Overcoming the initial hurdle of starting to save is often the most challenging part, but once you begin, it becomes easier to maintain the habit.

Determine where you’ll keep your money

Choosing the right place to keep your savings depends on your financial goals.

Traditional savings account: A safe option for short-term savings with easy access and modest interest.

High-yield savings accounts: Offer higher interest rates than traditional savings accounts, making them suitable for medium-term goals.

Retirement accounts: Options like 401(k)s, IRAs, and Roth IRAs provide tax advantages for long-term retirement savings.

Investment accounts: Stocks, bonds, and mutual funds offer growth potential for long-term savings but come with varying levels of risk.

Automate your savings

Automating your savings is a key step in ensuring consistency, and it takes a lot of weight off your mental load. Set up automatic transfers from your checking account to your savings or investment accounts. Many employers also offer payroll deductions directly into retirement accounts. By automating the process, you remove the temptation to spend the money and make saving a seamless part of your financial routine.

Avoid lifestyle creep

Lifestyle creep, or lifestyle inflation, occurs when increased income leads to increased spending. To avoid this, keep your savings goals aligned with your income growth. Instead of upgrading your lifestyle with every raise or bonus, allocate a portion of the additional income to your savings. This discipline helps maintain your financial health and accelerates the achievement of your long-term goals.

Conclusion

The pay-yourself-first strategy is a powerful tool for achieving financial stability and building long-term wealth. By prioritizing savings and automating the process, you create a financial cushion that brings peace of mind and reduces stress.

Remember, persistence and proactive management of your finances are key to success. Start implementing the pay-yourself-first strategy today, and continually seek ways to improve your financial literacy and stability. Your future self will thank you!

Investing made easy.

Start today with any dollar amount.

Related articles

saving

Nov 06, 2025

The 6 Main Types Of Car Insurance

saving

Apr 10, 2025

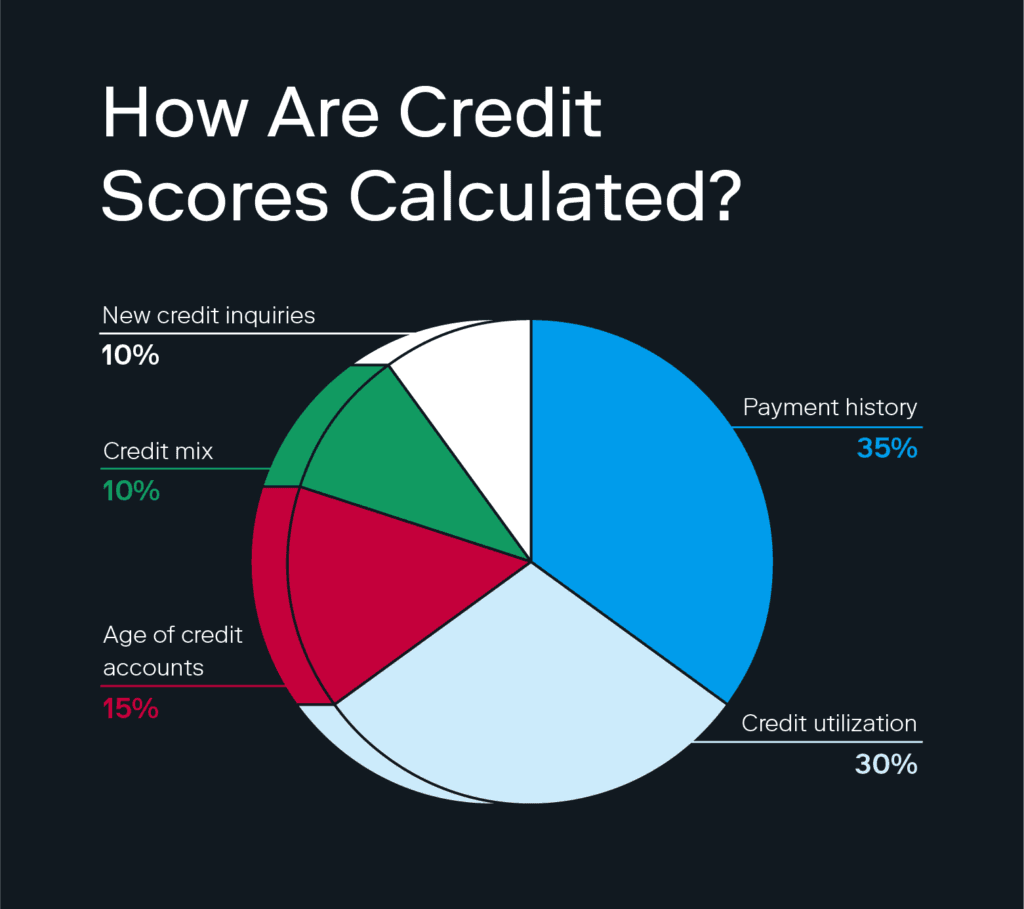

Why Does Higher Credit Utilization Decrease Your Credit Score?

saving

Jan 10, 2025

High-Yield Savings Accounts vs. Regular Savings Accounts

saving

Jan 09, 2025

How to Choose the Best High-Yield Savings Account

saving

Nov 14, 2024

Can You Lose Money with a High-Yield Savings Account?

saving

Nov 07, 2024

Best High-Yield Savings Account for Your Emergency Fund

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.