Oct 30, 2024

How to Make the Most Money with Your High-Yield Savings Accounts

Whether it’s for an emergency fund, a dream vacation, or retirement, having money set aside makes life’s uncertainties a little less uncertain (and a lot less scary).

Saving money is important, but how you choose to save it can make all the difference. Traditional savings accounts are fine enough, until you realize they offer interest rates that barely outpace inflation. High-yield savings accounts, on the other hand, can help you level up and make more from your savings, turning the little bits you stash away into real financial growth. Let's explore how to maximize your interest earnings and take your savings to the next level.

What Is a High-Yield Savings Account?

Let’s start with the basics: A high-yield savings account (HYSA) is a type of savings account that offers significantly higher interest rates compared to traditional savings accounts. While a typical savings account might offer an interest rate of around 0.01% to 0.05% (pennies!), high-yield savings accounts can offer rates upward of 1.00%, and sometimes even higher. These accounts are typically offered by online banks or credit unions and are designed to help you grow your savings more quickly.

The allure of high-yield savings accounts lies in their simplicity and benefits. Unlike other investment options that may require a deep understanding of market dynamics, high-yield accounts are straightforward. You deposit your money, and it earns interest. It’s as simple as that. They are also federally insured up to $250,000, so your principal is safe, just like with traditional savings accounts.

Another key difference between high-yield savings accounts and traditional savings accounts is accessibility. While traditional banks might offer physical locations to visit, high-yield accounts are often managed entirely online. This might seem like a downside for those who prefer face-to-face interactions, but the convenience of accessing your account from anywhere often outweighs this for many.

The Benefits of High-Yield Savings Accounts

The primary benefit of a high-yield savings account is the higher interest rate. This elevated rate allows your money to grow faster than it would in a traditional savings account. For example, if you have $10,000 in a high-yield savings account earning 1%, you’d earn about $100 in interest over a year, compared to just $1 in a standard account with a 0.01% rate.

Compound interest is another major advantage of high-yield savings accounts. Compounding means you earn interest on your initial deposit and on the interest that accumulates over time. The more often the interest is compounded, the faster your savings will grow.

High-yield savings accounts also offer easy access to your funds. While they usually don’t come with ATM cards, you can typically transfer funds to your checking account within a few business days. This balance between accessibility and earning potential makes high-yield savings accounts an attractive option for those looking to maximize their savings.

How to Pick the Right High-Yield Savings Account for You

When selecting a high-yield savings account, there are several factors to consider to make sure you’re getting the most out of your savings. One of the most important factors is the Annual Percentage Yield (APY). The APY reflects the real rate of return on your savings over a year, taking into account the effect of compounding interest.

Fees are something else to consider. Some high-yield savings accounts may charge monthly maintenance fees, which can eat into your interest earnings. Look for accounts that offer no-fee options or have straightforward criteria for waiving fees, like maintaining a minimum balance.

Customer service is another element worth considering when picking the right account. Since most high-yield savings accounts are offered by online banks, it’s important to choose one with a reputation for excellent customer support. Being able to quickly resolve any issues that may arise with your account can save you time and frustration.

How to Maximize Interest Earnings

To make the most of your high-yield savings account, there are a few strategies you’ll want to implement.

First, set up automatic deposits. Regularly contributing to your savings increases your principal, which in turn earns more interest. Automating this process ensures you consistently invest in your financial future. This way, you don’t even have to think about making money — it’ll just happen behind the scenes!

Next, compare rates regularly. Interest rates can fluctuate, and what was once the best option may no longer be as competitive. Keep an eye on the market and be prepared to switch accounts if a better rate presents itself.

Finally, avoid the common pitfalls that can impact your savings. Be mindful of withdrawal limits, as exceeding them can result in fees or account restrictions. Additionally, make sure you maintain the minimum balance required by your account to avoid unnecessary fees.

The Future of High-Yield Savings Accounts

With the rise of digital banking, more institutions are offering competitive rates and innovative features to attract customers. This trend is expected to continue, providing savers with even more options to grow their money.

Additionally, as technology advances, we may see improvements in how these accounts operate. For example, AI-driven insights could help account holders optimize their savings strategies, while improved security measures could further protect their funds.

Overall, high-yield savings accounts are poised to remain a vital component of financial planning. By understanding their benefits and staying informed about industry developments, you can make informed decisions that support your financial well-being.

A Final Word on High-Yield Savings Accounts

In summary, high-yield savings accounts offer an excellent opportunity to maximize your interest earnings and achieve your financial goals. With higher interest rates, the power of compounding, and easy accessibility, these accounts provide a simple yet effective way to grow your savings.

By considering factors such as APY, fees, and customer service, and implementing strategies like automatic deposits and rate comparisons, you can make the most of your high-yield savings account.

We encourage you to explore high-yield savings accounts as part of your financial strategy. With a little research and planning, you can take advantage of these powerful tools to enhance your financial future. For more tips and information on how to manage your money effectively, continue exploring Stash’s resources.

Related articles

saving

Nov 06, 2025

The 6 Main Types Of Car Insurance

saving

Apr 10, 2025

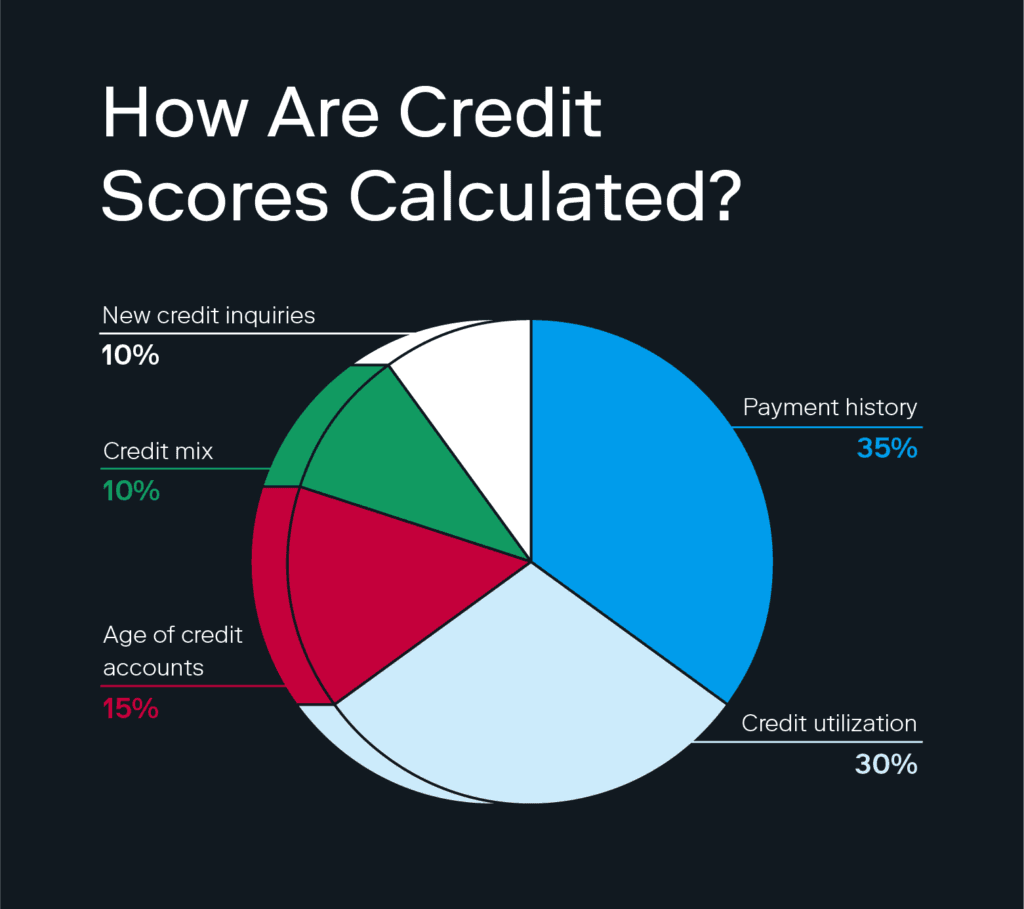

Why Does Higher Credit Utilization Decrease Your Credit Score?

saving

Jan 10, 2025

High-Yield Savings Accounts vs. Regular Savings Accounts

saving

Jan 09, 2025

How to Choose the Best High-Yield Savings Account

saving

Nov 14, 2024

Can You Lose Money with a High-Yield Savings Account?

saving

Nov 07, 2024

Best High-Yield Savings Account for Your Emergency Fund

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.