Jan 31, 2024

How much should I be investing? A 2025 breakdown by income bracket

In this article:

- Understanding Your Personal Finance Goals

- How much should you invest? It mainly depends on your income.

- 3 Considerations That Influence How Much You Should Invest

- 3 steps to determine how much you should be investing

- Investment Options and Allocation

- Setting Investment Goals: Be ‘SMART’

- Strategies to Increase Your Investment Amount

- Investing for Your Future: Final Thoughts

- How much should I be investing FAQs

How much should I be investing? Generally, experts recommend investing around 10-20% of your income. But the more realistic answer might be whatever amount you can afford. |

|---|

Investing your money is a tried-and-true way to build long-term financial security and achieve your money goals. But you may be wondering: How much should I be investing? It’s a great question, and the answer depends largely on your personal circumstances, goals, and financial strategies.

This guide will walk you through the key factors that influence how much you should invest, explore the investment options available, and provide clear strategies to make the most of your money. They say knowledge is power, and it’s true: Understanding how to tailor your investment approach can make all the difference. So let’s begin

Understanding Your Personal Finance Goals

Before you figure out how much to invest, it’s important to understand why you’re investing. At its core, investing allows you to grow your wealth over time, make your money work for you, and achieve your financial goals. Your goals — or reasons for investing — may differ from your friends’. But for the most part, these goals often fall into two categories:

Short-Term Goals:

Short-term financial goals might include saving for a vacation, creating an emergency fund, or making a down payment on a car. Typically, you’ll aim to reach these goals in a few months to a few years, so riskier investments (like stocks) may not be ideal.

Long-Term Goals:

Long-term goals, such as retirement savings, buying property, or saving for your children’s education, are often several decades into the future. In cases like these, investing in vehicles that offer compound growth potential, like stocks and mutual funds, can help amplify your returns.

The first step is identifying your goals. Knowing why you’re investing will help you figure out how much you should invest.

How much should you invest? It mainly depends on your income.

The exact number of how much to invest depends on your current financial situation and your net income level. Calculate your net income (after tax withholding and withheld expenses) and see if it’s feasible to consistently invest 10%-20% of that amount. For reference, here’s how that might shake out across different income levels:

Income | 10% | 15% | 20% |

|---|---|---|---|

$25,000 | $2,500 | $3,750 | $5,000 |

$35,000 | $3,500 | $5,250 | $7,000 |

$45,000 | $4,500 | $6,750 | $9,000 |

$55,000 | $5,500 | $8,250 | $11,000 |

$65,000 | $6,500 | $9,750 | $13,000 |

$75,000 | $7,500 | $11,250 | $15,000 |

$85,000 | $8,500 | $12,750 | $17,000 |

$95,000 | $9,500 | $14,250 | $19,000 |

$125,000 | $12,500 | $18,750 | $25,000 |

Experts also recommend that financially literate investors factor their contributions into their expected expenses and never invest more than they are willing to lose.

3 Considerations That Influence How Much You Should Invest

There’s no one-size-fits-all answer to how much you should invest — it depends on your unique financial situation and goals. That said, there are a few factors to consider that can help you figure out how much of your wealth you want to put into investing. Here are three of the big ones:

1. Income and Expenses

Start by looking at your monthly income and expenses. To calculate how much you can reasonably spend on investments, use this simple formula:

Income - Essential Expenses (rent, bills, groceries) - Savings = Potential Investment Amount

If you’re wondering, “How much should I be investing each month?” use this equation to calculate a realistic starting point. Financial experts often recommend investing 15-20% of your income. However, even if you can only set aside 5-10%, it’s better to start small than not at all.

2. Risk Tolerance

How comfortable are you with fluctuating investments? Risk tolerance plays a major role in deciding where and how much to invest. Younger investors with long-term goals might be comfortable taking on more risk by investing in the stock market. On the other hand, conservative investors or those nearing retirement may prefer less volatile options, such as bonds or index funds.

Take the time to evaluate your personal comfort level with risk — it will guide your choices and give you peace of mind.

3. Age and Investment Horizon

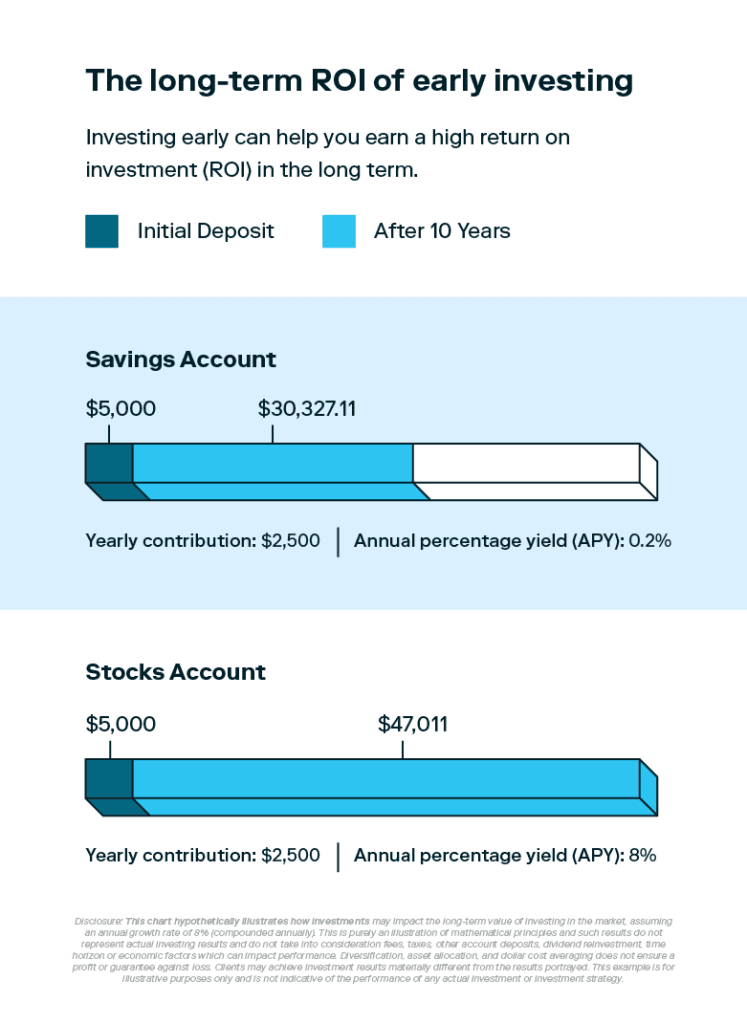

Age impacts how aggressively — or conservatively — you should approach investing. The earlier you start, the more time you have to benefit from compound interest, allowing your investments to grow exponentially. For example, investing $200/month starting at age 25 versus age 35 could result in hundreds of thousands of dollars more by retirement.

If you’re starting later, don’t panic! You can still grow wealth by increasing your contributions or exploring higher-return investment options.There’s no better time to start investing than right now, so don’t let thoughts of being “too late” get in the way of growing your wealth.

3 steps to determine how much you should be investing

So, how much of your income should you invest? Generally, the sooner you can start to invest the better, because your investments will have a long time to grow and increase your return on investment, or ROI. See the example below. However, investing a lot right away may not be the best course for everyone given other factors of their financial life. Ultimately how much you should invest will depend on your risk profile and lifestyle. You can follow these three steps to help assess what number is in your comfort zone.

1. Understand your current financial situation

Having a firm grasp on your personal finances will help you understand how much of your income you should invest.

The following factors of your financial profile should be reviewed and addressed before accruing investments:

The following factors of your financial profile must be addressed before accruing investments:

Taxed income: record the most recent taxed income from your latest Form W2. This will be the basis of your financial plan.

Debt (if any): if you still have debt, it’s time to strategize apayment plan. Without debt, you’ll have more disposable income to invest.

Emergency funds: save enough money to cover around three to six months’ worth of basic living expenses.

Rainy day funds: save enough money to cover major financial events like an unexpected medical bill or your car breaking down.

Before adding funds into an investment account, you should prioritize paying off your high interest debt and credit card balances.

After you pay off your high interest debt and create savings funds, subtract your living expenses from your taxed income. Any remaining money is what you can potentially begin to invest with.

If you sell your investments frequently because you’re short on cash or in debt, you risk lowering or losing your ROI (return on investment) and prolonging the time it takes to achieve your investment goals.

The key to achieving a healthy long-term investing strategy is setting attainable investment goals aimed at building a diverse portfolio of assets.

>> Learn how to invest with any amount of money:

2. Set attainable investment goals

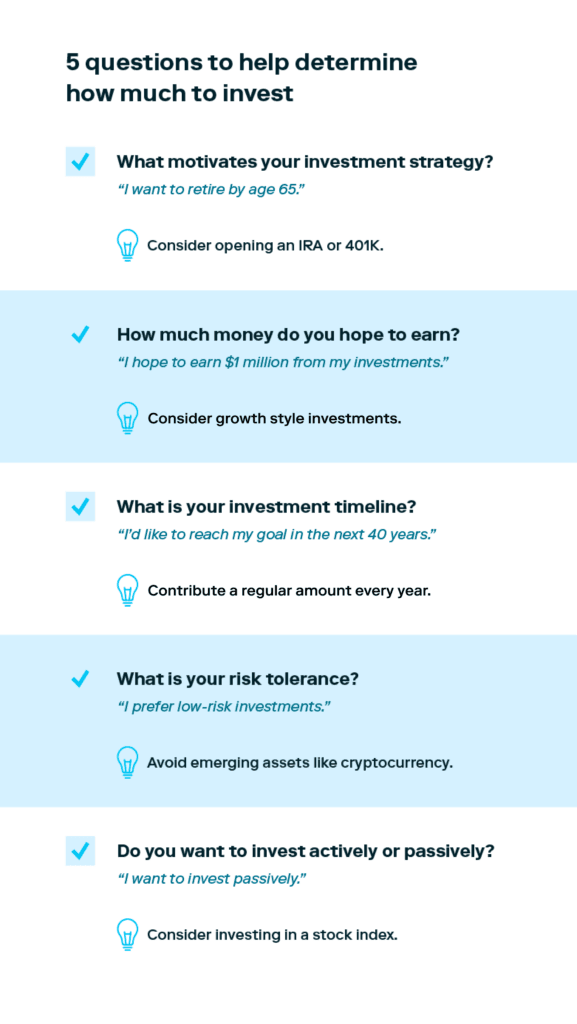

Before exploring the different types of investments and their associated costs, ask yourself the following questions to determine why you’re investing in the first place:

What motivates your investment strategy? Think about why you want to start investing. Knowing your end goal can help narrow down which investing platforms and tools you’ll use.

Is there an amount of money you hope to earn from investing? if you are saving for retirement, for example, then calculate the investment balance you’re interested in reaching by the time you are ready to retire.

What is your investment timeline? Consider when you would like to reach your investment goal. Understanding your timeline will help you decide which assets are the best fit for your schedule.

What is your risk tolerance? Every asset type has a different level of associated risks. Market volatility plays a big role in the health of an investment market so carefully consider which asset classes you want to add to your investment portfolio.

Do you want to actively or passively invest? Active investment examples can include day trading with stock market assets. Passive investing enables investors to take a hands-off approach to their investing strategy by funding accounts that don’t require a consistent effort to maintain.

Now that you have a firm grasp of your financial situation and what motivates your investments, it’s time to start setting attainable goals. Here are a few investment goals to consider:

Buying a home: money earned from an investment account can help you pay for the down payment of a new home or supplement the mortgage cost.

Having a child: it’s never too early to begin saving for your child’s future. You can start a college investment fund or simply save for another mouth to feed.

Retiring: the sooner you start saving for retirement, the more time you have to add to your retirement nest egg.

Earning passive income: simply adding funds into an investment account can potentially earn you passive income every year.

Living comfortably: investment income can enhance your lifestyle or allow for high-quality experiences, like regular travel or a car upgrade.

Answering these questions and setting attainable investment goals will help you understand what is realistic when formulating long-term investing strategies.

3. Create a realistic spending plan

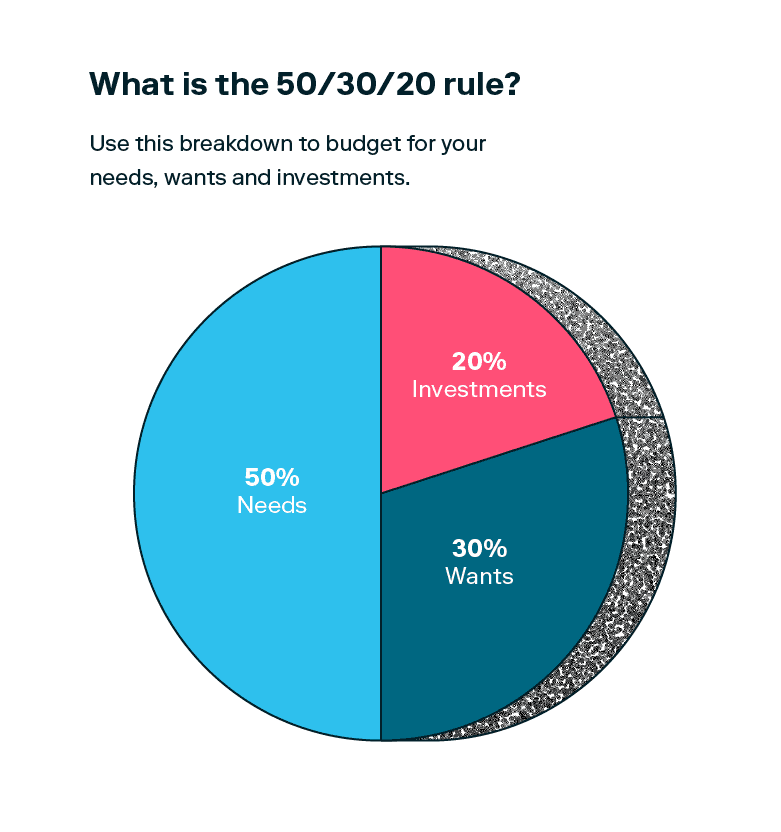

When it comes to determining where your money should go, the 50/30/20 rule is a popular model. You can use it to craft financially sound investing and spending plans.

Here’s how the 50/30/20 rule works:

Save 50% of your income for your needs, like rent, food, gas, insurance, etc.

Spend 30% of your income on wants, like date nights and streaming subscriptions.

Invest 20% of your income for long-term goals like retirement.

So when it comes to how much you should invest, according to this rule, you should aim to invest 20% of your income. If your income level doesn’t allow for big lump sum contributions to your investment accounts, consider employing a micro-investing strategy. For instance, routinely investing the same amount of money throughout the year—or dollar-cost averaging (DCA)—can help build a strong investment strategy from even the smallest contributions.

Investment Options and Allocation

Now that you have a sense of how much you can invest, it’s time to explore where to put your money. Diversification — spreading your money across different investment vehicles — helps reduce risk and optimize returns. Here are some popular options:

1. Stocks

Stocks, or shares in a company, are great for long-term growth. While they’re higher risk, they historically offer strong returns over time.

2. Bonds

Bonds are loans you give to a company or government in exchange for interest payments. They’re lower risk and ideal for more conservative investors.

3. Mutual Funds & ETFs

These funds allow you to invest in a mix of stocks, bonds, or other assets. They offer diversification and are professionally managed.

4. Real Estate

Investing in real estate — whether through property purchases or Real Estate Investment Trusts (REITs) — is another popular way to grow wealth.

5. Other Investment Options

Consider alternative investments like gold, cryptocurrencies, or venture capital, but only if they align with your risk tolerance and financial strategy. Finding out if they do will require some reading and research. You might also consider speaking with a financial advisor who can take your goals and risk tolerance into account and guide you in the right direction.

Setting Investment Goals: Be ‘SMART’

To stay on track and measure your progress, set specific investment goals using the SMART framework:

Specific: Define clear objectives (e.g., “Save $100,000 for retirement in 25 years”).

Measurable: Track progress toward your goals.

Achievable: Be realistic given your current financial situation.

Relevant: Align goals with your personal values and circumstances.

Time-Bound: Set deadlines to keep yourself accountable.

For example, your SMART goal might be, “Invest 15% of my annual income into diversified assets to retire in 35 years with $500,000 saved.”

Review your goals periodically to make adjustments based on life changes or financial priorities.

Strategies to Increase Your Investment Amount

If you’re looking to invest more without overhauling your lifestyle, try these strategies:

1. Pay Yourself First

Treat investing as a non-negotiable expense, like rent or electricity. Automating contributions ensures you consistently invest without temptation to spend the money elsewhere.

2. Cut Down on Non-Essential Spending

Identify areas where you can save, like dining out less often or canceling unused subscriptions (they can add up fast). Redirect that money toward investing.

3. Increase Income

Consider side hustles, freelance work, or part-time gigs to generate extra income specifically for investing.

4. Take Advantage of Employer Plans

If your employer offers a 401(k) or similar program with matching contributions, take full advantage of it — it’s essentially free money.

Investing for Your Future: Final Thoughts

The answer to the question “How much should I be investing?” boils down to understanding your financial situation, goals, and resources. Whether you’re putting away $50 or $500 per month, the key is consistency. Start where you can, and as your income grows, increase your contributions.

Remember, the best time to start investing was yesterday. The second-best time? Today.

And remember, when you start your investment journey, you’re not alone—there are financial experts and even robo-advisors to help.

Investing made easy.

Start today with any dollar amount.

How much should I be investing FAQs

Have more questions about how much money you should invest in 2024?” We’ve got the answers.

How much should I invest at my age?

How much you should invest depends less on age and more on income level. However, if you are closer to retirement age and want to save a large sum of money soon, consider investing as soon as possible.

Is it worth investing a small amount?

Yes—no amount is too small to begin investing. The sooner you invest, the sooner you can begin earning potential profits from your assets. It’s important to remember that all investments come with risk, however a longer horizon for investing can help smooth out investment performance.

What are the advantages of dollar-cost averaging?

When you utilize the dollar-cost averaging method, you become a stable force within a volatile market. This strategy can help you weather turbulent markets and avoid tempting, yet risky market trends.

What else can I do to maximize how much I invest?

You can open specialized investing accounts like a traditional IRA or Roth IRA that come with special perks like tax incentives.

Related articles

investing

Feb 09, 2026

Trump Accounts: Invest Early

investing

Jan 13, 2026

FAQ: Personal Portfolio

investing

Jan 05, 2026

Why did the price I bought or sold my investments at change? What are Trading Windows?

investing

Dec 11, 2025

How to Invest through the Holidays—Without the Stress

investing

Oct 23, 2025

Why Millions Are Canceling Disney+ and Hulu and What It Means for Investors

investing

Sep 30, 2025

Securities Lending

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.