Jan 08, 2024

How Much Do I Need to Retire: A Guide for Retirement Saving [2025]

In this article:

- How much do I need to retire?

- How to estimate retirement saving goals

- How to calculate retirement savings

- Retirement investment accounts: Breakdowns, pros, and cons

- Tips for success

- Retirement savings considerations

- Your future starts today

- Frequently Asked Questions (FAQ)

- Why you should start saving now

How much do you need for retirement? Experts say the average individual will need $1.2 to $1.5 million to maintain their lifestyle with 80% of their annual pre-retirement income. |

|---|

Experts say the average individual will need $1.2 to $1.5 million to maintain their lifestyle with 80% of their annual pre-retirement income. However, the average American retires with $200,000 to $250,000 among various retirement savings accounts—over one million dollars shy of the recommended amount!

For some people, retirement can seem like an impossibility. Even retiring by the standard retirement age of 65 can seem out of reach. This explains why so many retirees return to work either part-time or full-time—34% of the American workforce is 65 or older, with almost 9% being 75 or older.

While we all have different ideas of what retirement can or should be, everyone eventually hopes to punch the clock one last time and enjoy life without work. But getting there takes a specific understanding of how much you’ll need in retirement savings and a focused effort on planning for retirement.

How much do I need to retire?

As previously mentioned, the most common recommendation to save for retirement is between $1.2 and $1.5 million. However, if you are hoping for an exact amount, there isn’t a one-size-fits-all number. Everyone has different retirement goals and methods of reaching them, though there are formulas to use as starting points to determine how much you’ll need in retirement. Here are some things to consider.

The 80% rule

The 80% rule can be a helpful place to start. This rule suggests that in retirement, you’ll need about 80% of your pre-retirement income to maintain your current lifestyle. This accounts for reduced expenses, such as commuting or work-related costs, but still budgets for basics like housing, utilities, and living comfortably.

Healthcare and living expenses

Bills don’t go away when you retire, so you need a plan for how you’ll pay living expenses like utilities, healthcare, and property taxes. According to Fidelity, the average 65-year-old couple retiring in 2025 will need approximately $315,000 for healthcare costs alone during retirement—and that doesn’t include long-term care. Building a buffer for these potential expenses is critical.

The impact of inflation

While 80% is a handy guideline, don’t forget about inflation. The cost of goods and services tends to rise every year—just compare the price of groceries or gas today to even a decade ago! If retirement age is several decades away for you, this can make a big difference in how much you’ll need to save. The best way to account for inflation in your retirement savings is to save for more than you’ll need if you can afford to. Experts typically recommend factoring in a 2%-3% annual inflation rate to your retirement planning.

Your retirement vision

Perhaps the biggest factors in figuring out how much you’ll need to retire are where and how you hope to live. Understanding how your cost of living might change will help you plan more effectively.

Do you plan on downsizing and moving into a smaller house? Selling your home for a smaller, cheaper one may provide additional money for your retirement savings. Do you want to move to a different country? A European villa will cost much more than a small house in Indiana or Ohio.

If you plan on moving away from friends and family, you could spend more on frequent trips to visit.

Another important question to ask yourself: “What do I want to do when I retire?” For example, if you hope to retire at 65 and spend your retirement golfing at the local country club, you’ll need far less than the person who wants to retire early and travel the world.

How to estimate retirement saving goals

Once you’ve roughly determined what your annual retirement income needs to look like, it’s time to calculate your total retirement savings goal.

The table below lists a 20- to 35-year retirement plan with access to 80% of pre-retirement salary. For example, to retire early at 50, an individual earning $50,000 a year should have $1.4 million in their retirement account to support a 35-year retirement. If that person were to retire at 60, they would need $1 million in retirement savings.

Two important considerations for early retirement:

Some retirement accounts penalize withdrawals before 59 ½. You can contribute more to account for the penalties or plan on how to pay for it.

Realistically, if an individual retires early, they don’t solely rely on their retirement funds. Setting up a steady stream of passive income is a common way retirees bring in money while enjoying retirement.

How Much Do You Need to Retire: By Income

Current income | Savings at Age 50 | Savings at Age 55 | Savings at Age 60 | Savings at Age 65 |

|---|---|---|---|---|

$50,000 | $1,400,000 | $1,200,000 | $1,000,000 | $800,000 |

$75,000 | $2,100,000 | $1,800,000 | $1,500,000 | $1,200,000 |

$100,000 | $2,800,000 | $2,400,000 | $2,000,000 | $1,600,000 |

$150,000 | $4,200,000 | $3,600,000 | $3,000,000 | $2,400,000 |

$200,000 | $5,600,000 | $4,800,000 | $4,000,000 | $3,200,000 |

$250,000 | $7,000,000 | $6,000,000 | $5,000,000 | $4,000,000 |

$300,000 | $8,400,000 | $7,200,000 | $6,000,000 | $4,800,000 |

How to calculate retirement savings

While the numbers above are a good benchmark for how much you’ll need in retirement by age, the exact amount varies on your specific situation. Many free tools can help you calculate exactly what you need.

Savings calculators can help you see how much money you need to set aside each month to reach your financial goals and retire by 65 or any other age. Check out Stash’s retirement calculator. Simply plug in your age, income, and current savings, and it can help you calculate how much you’ll need to save to reach your retirement goals.

How much do you need to retire?

Use our retirement calculator to find out.

Calculating retirement savings

While the numbers above are a good benchmark for how much you’ll need in retirement by age, the exact amount varies based on your specific situation. Retirement savings calculators can help you see how much money you need to set aside each month to reach your personal financial goals and retire by the age you want. Though realistically, if an individual retires before age 65, they seldom rely solely on their retirement funds. Setting up a steady stream of passive income is a common way retirees bring in money while enjoying retirement.

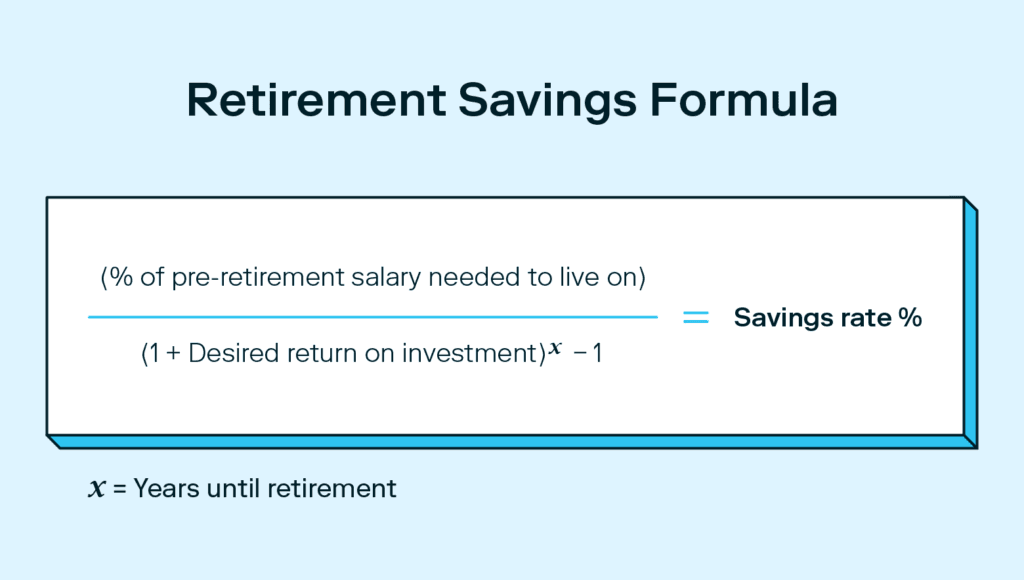

Retirement savings formula

If your salary isn’t in the table above or you are a couple looking for your combined retirement savings benchmark, use the following calculations.

High earners should consider contributing on the higher end of the scale to maintain their typical lifestyle while in retirement. For example, the retirement account of a Chief Financial Officer making $275,000 a year should hold about $2,200,000—eight times their salary—when they turn 55.

Retirement Savings Benchmark By Age

It may make more sense to consider retirement savings based on a series of benchmarks according to your age.

Age | Savings benchmarks |

|---|---|

30 | .5x to 1x annual salary |

35 | 1.5x to 2x annual salary |

40 | 2.5x to 3.5x annual salary |

45 | 3x to 4.5x annual salary |

50 | 5x to 6x annual salary |

55 | 7x to 8x annual salary |

60 | 9x to 11x annual salary |

65 | 10-15x annual salary |

Generational needs

Each generation faces unique challenges and opportunities when it comes to retirement planning.

Baby Boomers (born 1946-1964) who are either nearing retirement or may already be retired can optimize existing savings by making catch-up contributions to max out retirement accounts, waiting to claim Social Security until age 70, and downsizing to a smaller home to reduce expenses.

Gen Xers (born 1965-1980) can balance retirement savings with other priorities by creating clear and intentional budgets, refinancing or paying off debt early, or opening a Health Savings Account (HSA) to help save for future healthcare costs while offering tax advantages.

Millennials (born 1981-1996) have the advantage of time and the magic of compound interest when it comes to retirement planning. Even modest savings grow over time with consistent contributions. For example, investing $200 a month starting at age 25 could grow to nearly $500,000 by age 65 (assuming a 7% return).

Retirement investment accounts: Breakdowns, pros, and cons

There are numerous ways you can start saving for retirement. If you’re looking to build your wealth by investing for retirement, the most common retirement investment accounts are 401(k)s, Roth IRAs, and traditional IRAs. Stay with us as we break each one down.

Overview: common retirement accounts

Traditional 401(k) | Roth 401(k) | Traditional IRA | Roth IRA | |

|---|---|---|---|---|

Income eligibility | None | None | None | Must have an annual salary less than $161,000 (single filers) or $240,000 (combined for joint filers). Other limits based on filing status. |

Annual contribution limit | $23,000, or $30,500 if you’re 50+ (between all 401(k) accounts) | $23,000, or $30,500 if you’re 50+ (between all 401(k) accounts) | $7,000, or $8,000 if you’re 50+ (between all IRA accounts) | $7,000, or $8,000 if you’re 50+ (between all IRA accounts). |

Taxation | Taxed at withdrawal | Taxed at contribution | Taxed at withdrawal | Taxed at contribution |

Distribution | Required | Effective 2024, distributions will no longer be required | Required | No requirements |

Average fees | Moderate to high | Moderate to high | Low | Low |

Investment types | Primarily mutual funds. Limited by plan provider and employer. | Primarily mutual funds. Limited by plan provider and employer. | Mutual funds, bonds, stocks, certificates of deposit (CDs), and real estate. | Mutual funds, bonds, stocks, certificates of deposit (CDs), and real estate. |

Employer match | Eligible | Eligible, although employer contributions are treated as pre-tax and taxed at withdrawal | Ineligible | Ineligible |

Maintained by | Employer | Employer | Self | Self |

401(k) plans (traditional and Roth)

A 401(k) plan is an employer-sponsored retirement plan offered to employees. Contributions are invested and grow over time. However, the employer and plan provider determine what investment options are available.

401(k)s can be either traditional or Roth—about 88% of 401(k) plans offer a Roth version. The main difference between the two is how they’re funded. Those enrolled in traditional 401(k)s contribute pre-tax dollars, whereas Roth 401(k)s use after-tax dollars.

One primary benefit of a 401(k) is that your employer may match a portion of your contributions, adding more money to your retirement account. Approximately half of all employers offer some degree of matching. Taking advantage of this benefit is a smart way to boost your retirement savings. Note that any employer contributions will be deposited as traditional 401(k) funds, even if you have a Roth 401(k).

Pros | Cons |

|---|---|

Potential free money from employer matching | Fewer investment opportunities |

High contribution limits | Penalties for early withdrawal |

Traditional contributions reduce taxable income in the same tax year | High administrative fees |

Traditional IRAs

A traditional IRA is a tax-advantaged retirement account where investors contribute pre-tax dollars into investment types like stocks, bonds, and mutual funds. Balances grow tax-deferred, meaning investments accumulate tax-free until withdrawn. If you expect to be in a lower tax bracket after retirement, a traditional IRA might be right for you.

Roth IRAs

A Roth IRA is another type of investment retirement account, but unlike traditional IRAs, Roth IRAs are funded by after-tax dollars. After contributing, investments continue to grow tax-free and do not face further taxes when withdrawn.

Roth IRAs are appealing due to their high-growth nature. If you started maxing out your Roth IRA in your twenties, you could retire as a millionaire in your sixties.

However, Roth IRAs have high-income eligibility limits meant to prohibit those earning over $161,000 from profiting from Roth tax benefits. That said, high earners can get around this stipulation by converting a traditional IRA to a backdoor Roth IRA.

Pros | Cons |

|---|---|

Tax-free growth | Contributions aren’t tax deductible |

Tax-free withdrawals | Penalties for withdrawing from earnings early |

Withdraw from contributions penalty-free | Lower annual contribution limit |

No RMDs (unless it’s passed on to a beneficiary) | Income threshold reduces eligibility for high earners |

Tips for success

No matter where you are in your retirement planning process, these tips can help steer you clear of common missteps and make the most of your retirement saving efforts.

Don’t underestimate your needs: Remember that factors like inflation and healthcare will drive up costs. In addition, you may have new expenses after retirement based on how your lifestyle changes, such as different travel plans, living in a retirement community, or long0term care needs. Having a financial cushion never hurts.

Update your plan regularly: Life changes—so should your retirement strategy. Review your goals, lifestyle, and financial situation annually to make necessary adjustments. Be particularly aware of how income increases could affect your Roth IRA contribution limits.

Avoid relying too heavily on social security: Social Security is a nice supplement, but few people find it sufficient to cover all their expenses in retirement. Calculate your estimated social security benefits and plan accordingly.

Max out retirement contributions when possible: The more money you can put into your retirement accounts, the more you can benefit from compounding and tax advantages. Whenever possible, max out your retirement contributions each year.

Start as early as possible: Saving up enough money to retire takes a lot of time, so the sooner you start, the better. Even if retirement seems a long way off, it’s wise to start planning now, even if you can’t save much at the moment. Analyze your financial standings and create a budget to determine how much you can contribute to your retirement savings. Remember, some retirement savings is better than none.

Retirement savings considerations

Think ahead, and consider the costs related to your future retirement plans. Bills don’t go away when you retire, so you need a plan for how you’ll pay living expenses like healthcare and property taxes. There are also factors beyond your control that impact your retirement savings, like where you live and inflation.

1. How much can you contribute?

You shouldn’t put yourself in financial trouble now to save for retirement. But that doesn’t equate to skipping out on saving for retirement altogether. Analyze your financial standings and create a budget to determine how much you can contribute to your retirement savings. Remember, some retirement savings is better than none.

2. Where do you want to retire?

Perhaps the biggest factor in figuring out how much you’ll need to retire is where you hope to live. Ask yourself:

Do I plan on downsizing and moving into a smaller house? Selling your home for a smaller, cheaper one may provide additional extra money for your retirement savings.

Will I move to a different country? A European villa will cost much more than a small house in Indiana or Ohio.

If I don’t plan on moving, will my maintenance costs, property taxes, and home improvements rise with time?

Think about where and how you want to live to understand how your cost of living might change. Also, if you plan on moving away from friends and family, you could spend more on frequent trips to visit—just one more thing to consider.

3. What do you envision retirement to be?

Another important question to ask yourself: “What do I want to do when I retire?”

For example, if you hope to retire at 65 and spend your retirement golfing at the local country club, you’ll need far less than the person who retires at 50 and travels the world.

Read more: How to calculate opportunity costs

4. How can you account for inflation?

It’s impossible to know how much the prices of goods will increase over time, making it difficult to plan for inflation in retirement savings. You could look at historical inflation rates, but even that might not be a completely accurate prediction of the future. For example, the COVID-19 pandemic, which led to inflation spikes in 2022, couldn’t have been predicted.

The best way to account for inflation in your retirement savings is to save for more than you’ll need if you can afford to. Additionally, Social Security increases with inflation, though this shouldn’t be your primary source of income in retirement.

Your future starts today

Retirement planning isn’t just about setting money aside for the future—it’s about creating a vision for the life you want. While calculating and saving for retirement can seem overwhelming, breaking it down into simple steps can make all the difference.

Whether you’re months away from retirement or decades into the planning process, remember—it’s never too late or too early to take control of your financial future. Even if your current contributions are small, compounding can help them add up by the time you reach 65.

Take the next step today by using a "How Much Do I Need to Retire Calculator" to assess your needs and map out a strategy. The earlier you get started, the more prepared you’ll be to live your best life after you leave the workforce.

Frequently Asked Questions (FAQ)

Still have questions about how much you’ll need in retirement? Let us help!

How much does a couple need to retire?

On average, couples should have about eight to 10 times their combined pre-retirement salaries saved for retirement. For high earners, that amount should be closer to 15 times their combined salaries.

Can I retire with $1.5 million comfortably?

Yes, it’s possible to retire with $1.5 million and live a comfortable life if you retire at a typical retirement age. However, this is only true for those used to living with a salary of less than $100,000.

Can I retire at 60 with $500,000?

It’s not impossible to retire at 60 with $500,000 if you live a frugal lifestyle. This savings amount would provide a $16,000 to $25,000 annual salary. But people retire with much less. The average American has less than half this amount in their 401(k) accounts.

However, if you want to truly retire and not pick up a part-time job, you would need much more savings. Or, you may consider putting passive income streams in place to supplement your retirement savings.

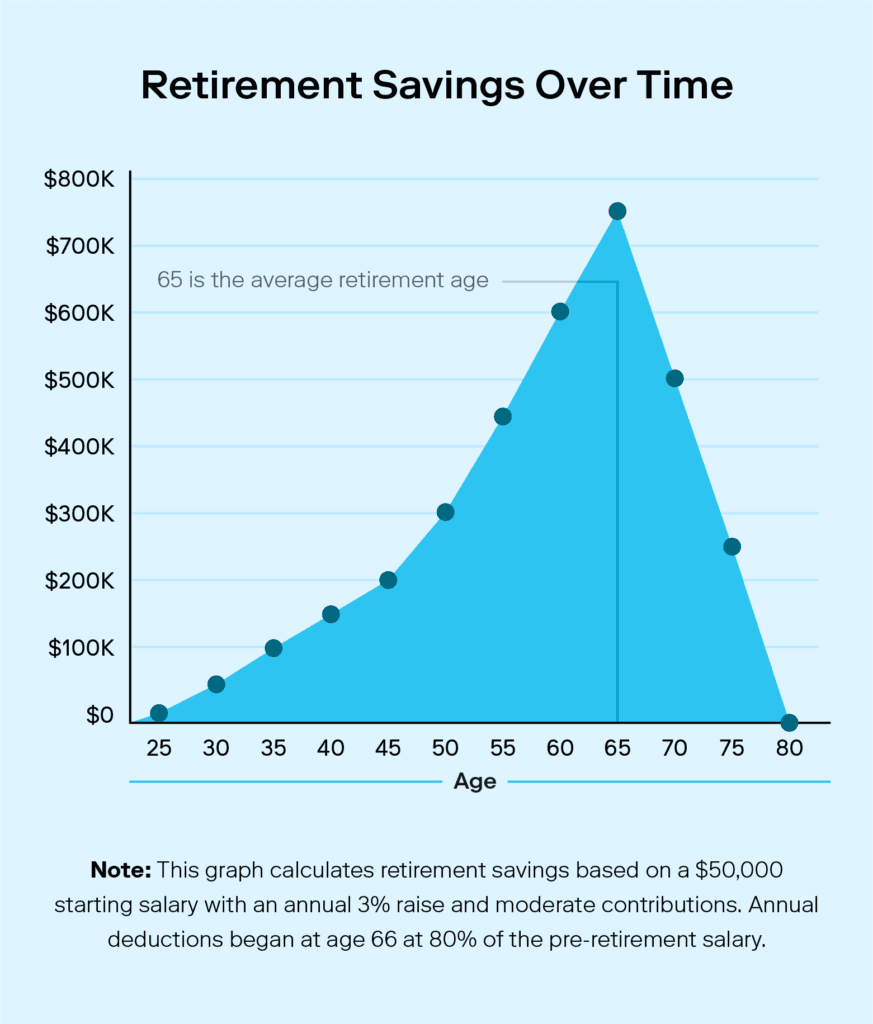

Why you should start saving now

Now that you’ve calculated how much you’ll need in retirement to live comfortably, it’s time to get started saving. Compound interest can heavily impact long-term retirement savings, which is why it’s important to start saving early to reach your goals.

The earlier you start saving, the more time your money has to compound and the more interest or returns you could earn. Even if your current contributions are small, compounding can help them add up by the time you reach 65.

The sooner you start, the better. Saving small amounts over longer periods is typically easier than scrambling to save several thousands of dollars per year in your 50s and 60s. Starting to save at a young age could give you a huge head start.

You can start saving for retirement now on Stash.

Related articles

taxes-and-retirement

Dec 15, 2025

FAQ: Retirement Portfolio

taxes-and-retirement

Jan 06, 2025

Best Financial Products To Buy With Your Tax Refund

taxes-and-retirement

Nov 19, 2024

How to Use Your Tax Refund for a Down Payment on a Home

taxes-and-retirement

Nov 18, 2024

Should You Save or Spend Your Tax Refund?

taxes-and-retirement

Nov 18, 2024

Tax Refund Delay: What You Need to Know

taxes-and-retirement

Nov 18, 2024

How to Get Your Tax Refund Fast

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.