Oct 29, 2024

How Does Compound Interest Work? Grow Your Savings Account

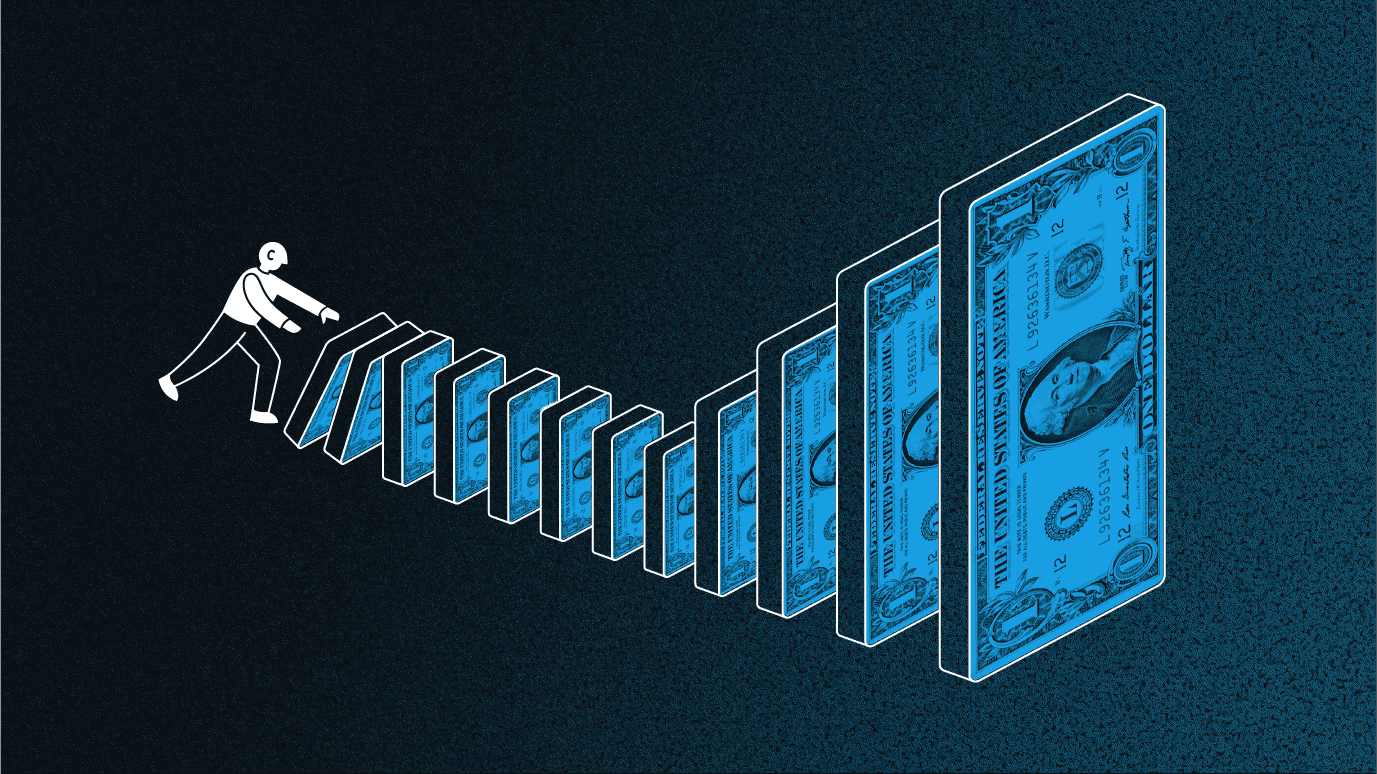

Imagine your money working for you while you sleep, growing quietly in the background. That’s not a fairy tale: it's the power of compound interest. For savvy savers, understanding how compound interest works in a savings account may be key to stepping up your personal finance game.

This guide will break down the concept of compound interest into simple terms and offer practical tips to maximize your savings. Whether you're just starting your financial journey or looking to enhance your strategy, you'll discover how compound interest can be the catalyst for growing your savings faster over time.

The basics of compound interest

To grasp how compound interest works in a savings account, let's start with the basics. Compound interest is interest that accrues on interest that you’ve already earned. It's calculated based on the initial principal plus the accumulated interest from previous periods.

For example, if you deposit $1,000 in a savings account with a 5% interest rate compounded annually, you'll earn $50 in the first year. In the second year, you'll earn interest not just on the original $1,000 deposit, but on the $1,050 total (your initial deposit plus the first year’s interest). This cycle continues year after year, and that's the magic of compounding.

Compounding frequency

Notice in that example that the interest is added to the account balance once a year. How often interest is added to your balance is called compounding frequency, and it’s a crucial element in understanding how compound interest works in a savings account. Different banks and accounts have different compounding frequencies: it could be annually, semi-annually, quarterly, monthly, or even daily. The more frequently interest is compounded, the more quickly it starts earning additional interest, and the faster your savings can grow.

Real-life examples of compound interest

Let's put this concept into real-life terms with examples to illuminate how compound interest can transform savings goals into reality. The more interest you earn over time, the more your money can grow, creating a snowball effect that accelerates your path to financial milestones.

Imagine you're saving for a vacation. You start with $2,000 in a savings account that offers a 4% interest rate, compounded quarterly. After five years, your savings will have grown to approximately $2,430. That's $430 earned just by letting your money sit in a savings account!

Now, think bigger. What if you plan to save for retirement? Starting with $10,000 at age 30, with a 6% interest rate compounded annually, you'd have over $76,000 by age 65. That's the impact of compound interest over time—it accelerates your savings the longer you leave your money untouched.

Those examples show how compound interest works in a savings account without any additional deposits—just your money earning money. But if you develop a regular savings habit, you can amplify the power of compound interest even more. Let’s take the same retirement savings scenario, but say you add just $50 per month to your account. After 35 years, you’d have more than $143k saved up, including your contributions and compounded interest.

Tips to maximize compound interest in savings accounts

Now you know the answer to “How does compound interest work in a savings account?” But there’s more to explore when you’re deciding how to put your money to work for you. These tips can help you get the most out of your savings efforts and maximize your money’s growth.

Start early

The earlier you start saving, the more time your money has to grow. And because compound interest involves earning interest on previously earned interest, you’ll earn more the longer your money stays in the account. Even if you don’t have a lot of money to start with, you can take advantage of compound interest and increase your savings over time.

Contribute regularly

Consistent deposits enhance the effects of compounding. And even small contributions can lead to significant growth over the long haul. For example, say you open a savings account with $100, earning 5% interest compounded daily. After 15 years, you’d have about $211 with no additional contributions. But if you deposited just $10 a month into the account, you’d end up with about $2,900 in total contributions and compound interest!

To make your savings habit easier, set up automatic transfers into your savings account to ensure you're contributing regularly, even if it's a small amount.

Understand fixed vs. variable interest rates

When you’re evaluating how compound interest works in a savings account, keep in mind that the interest rate for most savings accounts is variable, meaning that it changes over time. Variable interest rates fluctuate based on economic conditions, and could go up or down at any time. You can use a compound interest calculator to estimate how much you might earn in your savings account, but be aware that the projections can’t account for how variable rates will change.

Fixed interest rates remain the same over time, usually for a predetermined period, but savings accounts rarely offer this kind of interest rate.

Choose the right account

Not all savings accounts are created equal. Standard savings accounts usually come with a pretty low interest rate, but high-yield savings accounts and money market accounts typically offer much higher rates. While these types of savings accounts might sometimes come with more fees or higher minimum balance requirements than traditional savings accounts, there are many options with low to no fees or balance thresholds. Online banks often offer competitive rates and lower fees compared to traditional brick-and-mortar institutions.

Avoid withdrawals

Keeping your money in your savings account allows it to compound continuously. Frequent withdrawals can interrupt the compounding process and slow down your savings growth. When you set your financial goals, you’ll want to establish a timeline for achieving them--but if you take unplanned withdrawals, you’ll derail that timeline.

Comparing compound interest across investment vehicles

Compound interest isn't exclusive to savings accounts. Other investment vehicles also utilize compounding to grow your money. Here's how they compare:

Savings accounts: Traditional accounts typically offer lower interest rates, though high-yield savings accounts and money market accounts provide more competitive rates. On the plus side, savings accounts are safe and liquid: they’re FDIC insured and you can easily withdraw your money with few, if any, restrictions.

Certificates of deposit (CDs): These FDIC-insured deposit vehicles offer a higher, fixed interest rate in exchange for keeping your money in the account for a set length of time (the term). The downside is that you’ll usually incur a penalty if you withdraw your money before the term ends.

Bonds: These interest-paying investment vehicles are like a loan the investor makes to a government entity or corporation for a set term. At the end of the term, you receive back your principal plus interest. While they're more risky than bank deposit accounts, they’re generally considered a fairly stable investment. Some bonds, like savings bonds, pay compound interest, while others pay simple interest.

Common misconceptions about compound interest

If you started out by asking “How does compound interest work in a savings account?” you might have some other thoughts knocking around--but some of them may actually be misconceptions. Many people who are looking to save money have worries about the process, but addressing some common myths can help you overcome your concerns.

“I don't have enough to start”: Many people believe they need a substantial amount to benefit from compound interest. In reality, even a small sum of money can grow significantly over time.

“It's only for long-term savings”: While compound interest shines in long-term scenarios, it's still effective for short-term goals. The key is finding an account with a short compounding frequency, like daily or monthly.

“Interest rates are too low to matter”: Even in low-interest environments, compound interest still works its magic. Over time, the compounding effect magnifies your returns, regardless of the rate. And remember that variable rates change; low interest rates now may well become higher rates in the future.

By debunking these myths, you'll be better equipped to harness the true potential of compound interest. It's a versatile tool that can be tailored to various savings goals and time horizons.

Starting your compound interest journey

The power of compound interest has the potential to revolutionize how you save and grow your money. Whether you're building an emergency fund, planning for retirement, or working toward a big goal like buying a house, compound interest can be your ally.

To begin, assess your financial goals and choose the right savings vehicle. Use compound interest calculators to visualize potential growth and refine your strategy. With patience and consistency, you can watch your savings grow, making your financial dreams achievable.

In closing, remember that compound interest is a tool, not a magic wand. While it accelerates growth, your actions—saving consistently, choosing the right accounts, and avoiding unnecessary withdrawals—are the driving force. Take control of your financial future by leveraging the power of compound interest, and enjoy watching your savings flourish over time.

Related articles

saving

Nov 06, 2025

The 6 Main Types Of Car Insurance

saving

Apr 10, 2025

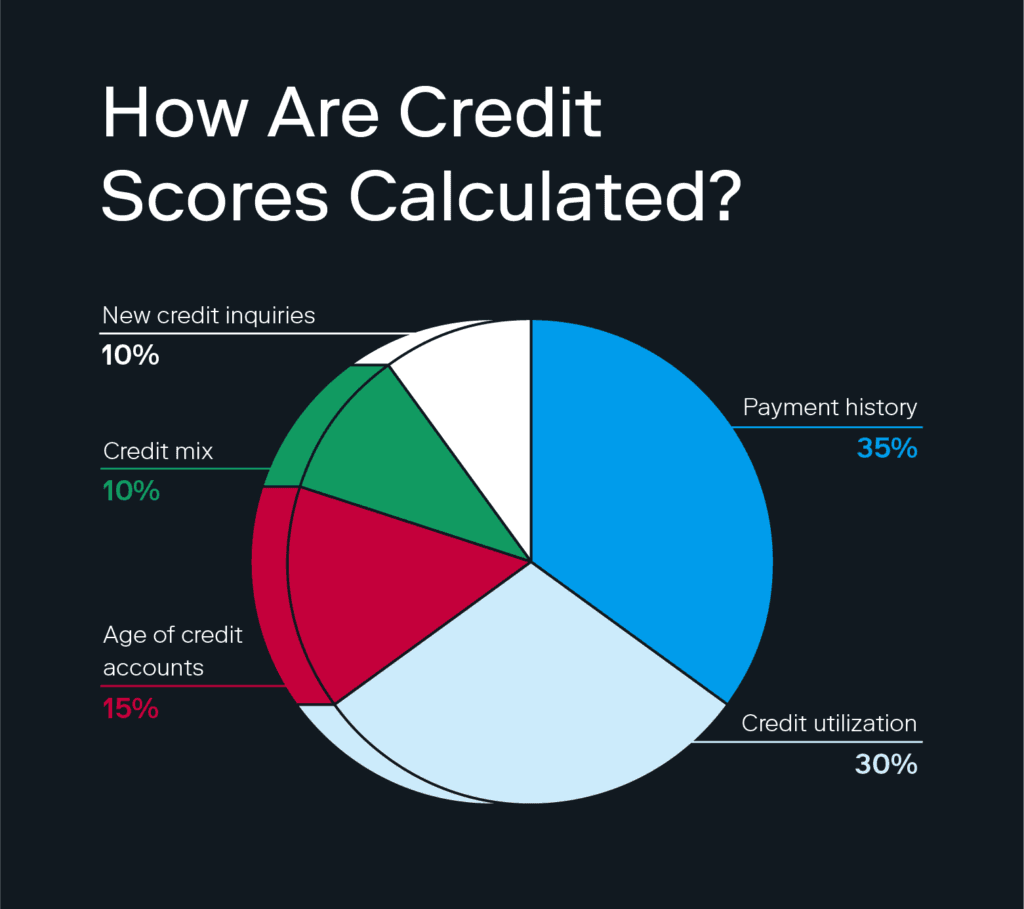

Why Does Higher Credit Utilization Decrease Your Credit Score?

saving

Jan 10, 2025

High-Yield Savings Accounts vs. Regular Savings Accounts

saving

Jan 09, 2025

How to Choose the Best High-Yield Savings Account

saving

Nov 14, 2024

Can You Lose Money with a High-Yield Savings Account?

saving

Nov 07, 2024

Best High-Yield Savings Account for Your Emergency Fund

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.