Nov 07, 2024

Best High-Yield Savings Account for Your Emergency Fund

In this article:

You’ve heard it before, but it’s worth repeating: Building an emergency fund is one of the smartest moves you can make for financial stability. Whether it’s to cover unexpected car repairs, medical bills, or a sudden gap in income, an emergency fund gives you peace of mind and a safety net when life surprises you.

But where, exactly, should you stash away those emergency funds? Simply parking it in a standard savings account seems like a safe option, and it is. But other accounts, namely high-yield savings accounts, offer more, including a smarter way to grow your rainy day fund while keeping your money secure.

In a High-Yield Savings Account, your emergency fund has an opportunity to grow at a faster rate. This translates to more money in case of emergencies — and who couldn’t benefit from that? Read on to learn more about the best high-yield savings accounts for emergency funds and why making an informed decision about the account you choose can make all the difference.

What is a High-Yield Savings Account (HYSA)?

Before we dig into specifics, let's make sure everyone’s on the same page. A high-yield savings account (or HYSA) is just that — an account that earns a higher interest rate compared to traditional savings accounts. These accounts may look similar to their standard counterparts, but the key difference lies in the Annual Percentage Yield (APY), a figure that tells you how sharply your savings can grow over time.

Key Features of High-Yield Savings Accounts:

Competitive Interest Rates: With interest rates that can be 10 to 20 times higher than those of regular savings accounts, HYSAs empower your money to grow faster.

FDIC Insurance: Your funds are usually insured up to $250,000, making them a safe option for your emergency fund.

Accessibility: While some accounts might limit your monthly withdrawals, most HYSAs make it easy to dip into your savings when an urgent expense comes up.

Simply put, HYSAs are a no-brainer for saving — the security of a traditional savings account with growth potential that keeps your money working harder. If you’re concerned about how much of an emergency fund you can save up, a HYSA can help tip the scale.s

Why a High-Yield Savings Account Is the Right Pick for Your Emergency Fund

When it comes to emergency funds, liquidity, safety, and growth are your top priorities. You want to be able to save more, be able to access that money easily, and allow your money to passively grow with little risk so you can go on living your life. Here are three main benefits of using a high-yield savings account for your emergency fund:

Earn More, Save Smarter

With a traditional savings account offering interest rates as low as 0.01%, your money barely grows over time. Meanwhile, HYSAs typically offer APYs between 3% and 5%, allowing you to build your cushion faster without taking investment risks. It’s a bit of a no-brainer in terms of securing your financial future.

Always Accessible

Emergencies can’t wait, and with the right HYSA, your funds won’t need to. Many accounts allow penalty-free withdrawals, meaning you can access that dough without being penalized. When your car suddenly needs a major repair or an unexpected medical bill enters your world, you’ll be glad for this.

Zero Market Risk

Unlike investments that fluctuate with the market, your funds in an HYSA stay consistent. This is ideal for keeping your emergency fund both secure and stress-free.

5 Things to Consider When Choosing a High-Yield Savings Account

Finding the best high yield savings account for an emergency fund isn’t complicated, but you will need to do a little research before signing up for any account. Here are the essentials:

1. Interest Rate (APY)

The higher the APY, the faster your money will grow. Compare current rates and keep an eye on any promotional offers. For example, some banks offer introductory rates to get you started. Read the fine print to learn about the bank’s changing rates (rates change often) and aim high.

2. Minimum Deposit and Balance Requirements

Look for accounts that align with your budget. Some HYSAs require a minimum deposit to open or a minimum balance to avoid fees. Make sure you can maintain these minimums (oftentimes, you’ll move the money from your traditional savings account to your new HYSA, so check your history to see if maintaining such a balance is feasible for you). Otherwise, look for an option with low or no minimums.

3. Fees

No one likes hidden costs. Opt for accounts with no monthly maintenance fees, transfer fees, or withdrawal penalties. You’ll want to make the most of your account to amplify your savings — not waste your hard earned dollars on needless costs.

4. Accessibility

Can you manage your account online or with an app? Does the bank offer a seamless way to access funds if you need them? You’ll want an account that offers easy access and transfers — emergencies typically fail to wait three to five business days.

5. Reputation

Survey your family, friends, and colleagues about their preferred account services. You’ll want to stick with institutions known for their reliability, transparency, and customer service. Read reviews, Reddit threads, and beyond to ensure you’re not missing any red flags associated with the company.

How to Start Saving with Stash

Setting up a high-yield savings account with Stash is quick and easy. Follow these steps to get started:

1- Sign Up

Head to Stash.com and create your free account. (It takes less than 5 minutes!)

2- Add Your Savings Goal

Specify that you’re building an emergency fund. Stash’s tools will help track your progress.

3- Automate Your Savings

Link your debit card or bank account, and set automatic deposits so you can grow your fund effortlessly.

4- Kick Back and Watch It Grow

With high APYs and no fees eating away at your money, all that’s left to do is relax and repeat.

Real People, Real Success

Countless savers have already discovered the peace of mind that comes with Stash’s high-yield savings features. Here’s what they’re saying:

“Stash made saving for emergencies so much easier. The ability to set it and forget it was a lifesaver!” – Maria T.

“I’ve got my first $1,000 saved! The APY blew me away, especially compared to my last bank.” – James K.

“The Stash app makes managing finances fun and easy—not something I expected from a savings account!” – Laura D.

Start Growing Your Emergency Fund With an HYSA Today

Don’t leave your savings sitting idle or stuck in a low-interest account. By switching to a high-yield savings account, your money is going to work harder for you.

What are you waiting for? Take the first step toward financial security today. Sign up with Stash, and start building the best emergency fund you’ve ever had.

Related articles

saving

Nov 06, 2025

The 6 Main Types Of Car Insurance

saving

Apr 10, 2025

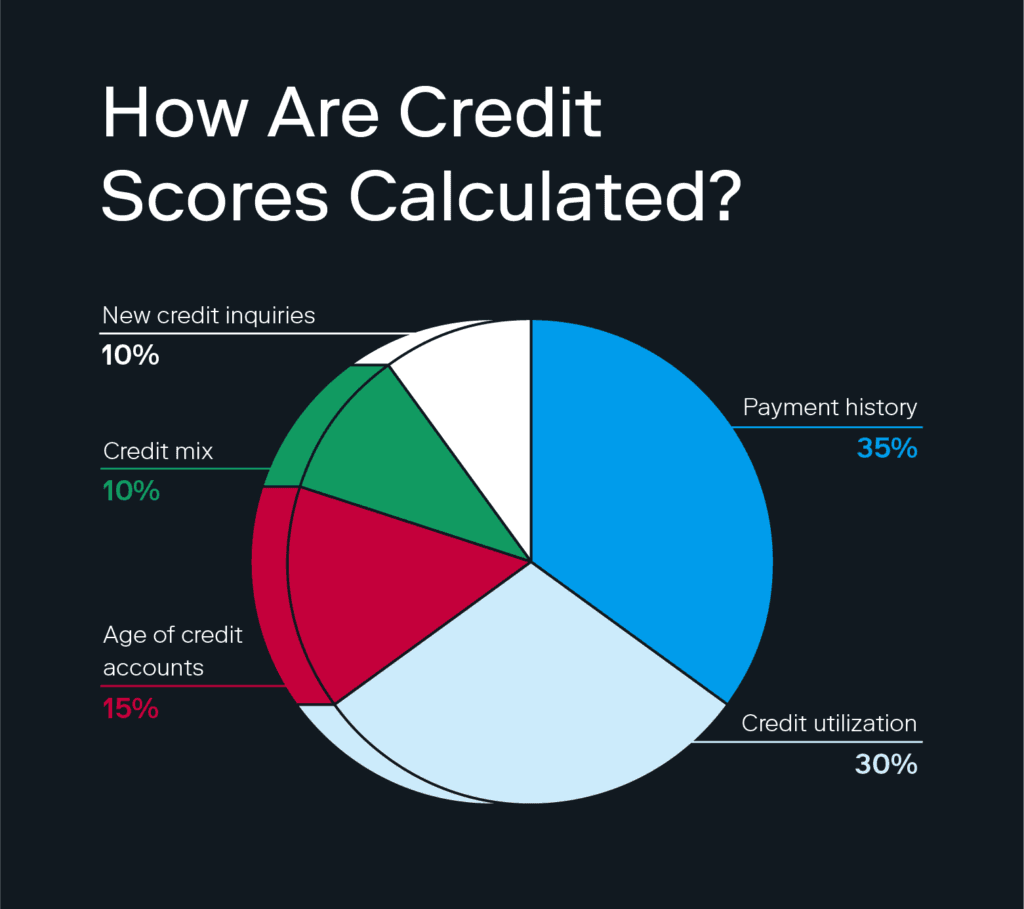

Why Does Higher Credit Utilization Decrease Your Credit Score?

saving

Jan 10, 2025

High-Yield Savings Accounts vs. Regular Savings Accounts

saving

Jan 09, 2025

How to Choose the Best High-Yield Savings Account

saving

Nov 14, 2024

Can You Lose Money with a High-Yield Savings Account?

saving

Nov 07, 2024

Best High-Yield Savings Account for Your Emergency Fund

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.