Invest in legal cannabis.

The legal marijuana industry is changing. You can invest in it with $5.

Get startedStash does not endorse the illegal use of narcotics. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.

The legal marijuana industry, 101.

Legal cannabis is now America’s 6th most valuable crop. (Forbes, 2022)

The U.S. cannabis industry is expected to reach $72 billion in annual sales by 2030. (Forbes, 2022)

The legal cannabis industry employs over 400K Americans. (NORML, 2022)

Start investingWhy invest with Stash?

Investing

Invest in fractional shares of thousands of stocks and ETFs.

Stock-Back® Card

Shop, and we’ll give you up to 1% in stock in well-known brands.1

Banking

Protect your money from overdraft and other hidden fees.2

Saving

Put saving into practice with tools like Stash Goals.6

Advice

We can guide you as you build wealth for the long-term.

Insurance

Stash includes complimentary life insurance offered by Avibra.‡

Learn more about investing in the legal marijuana industry.

A Beginner’s Guide to Investing in the Legal Cannabis Industry

Get all the details on investing in marijuana and the legal cannabis industry.

Learn more →

How to Invest, The Stash Way

We recommend an investment strategy called the Stash Way, which includes regular investing, diversification, and planning for the long term.

Learn more →

Frequently asked questions

What is the Marijuana industry?

The industry is composed of cultivators and packagers of cannabis plants, dispensaries for medical and recreational marijuana, plus companies that use cannabis byproducts called CBDs, which are non-psychoactive derivatives of cannabis and can be used for a variety of purposes such as inflammation, chronic pain, and depression.

It also includes the production of hemp, which can be used to make fabrics and textiles, as well as health food and body care products.

And it all makes for big business. The marijuana industry is expected to reach $72 billion by 2030, according to Forbes—that’s more than the GDP of Costa Rica in 2022.

How can I invest in the business of marijuana?

Investors in the U.S interested in adding cannabis to their portfolios have a few options. They can purchase shares of stock in cannabis-related companies that are publicly-traded on an exchange.

Another option is to purchase shares of a fund, which offers exposure to many companies leading the way in this growing sector.

Investing in Cannabis: Single stocks

A single stock is just that, a share of ownership of a company. For example, investors can purchase shares of stock in companies in the Legal Marijuana industry.

Investing in Legal Cannabis: Exchange-traded funds

Exchange-traded funds (ETFs) are a basket of investments bundled into a fund that's traded on an exchange like the Nasdaq or NYSE.

That fund owns the stocks within it and generally tracks an index – or group of investments that represent part of an industry or investment theme. For more info on ETFs, click here.

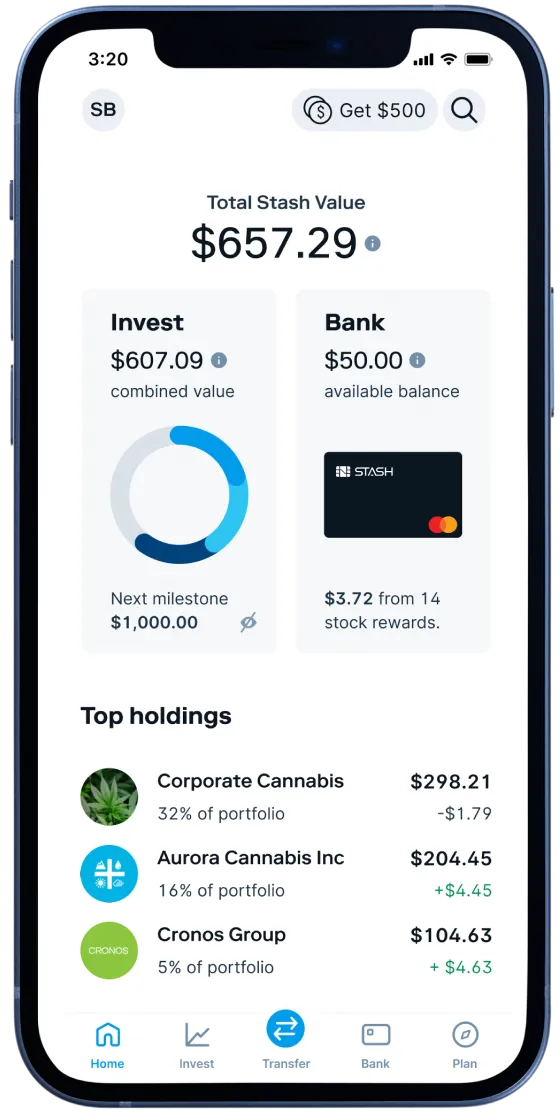

How does Stash work?

Stash can give you everything you need to build wealth for the long-term. Here’s how Stash works.

Answer a few questions.

When you first join Stash, we’ll get to know you by asking some questions. These help us understand your financial goals and provide useful, specific advice for things like investing and budgeting.Pick a plan.

Then, you’ll choose your subscription plan, starting at just $3/month. †

With Stash, you'll have access to a personal brokerage account, a retirement account, and a Smart Portfolio. You’ll also receive the Stock-Back® Card that lets you earn stock when you spend. And there’s even more benefits depending on the plan you choose, like budgeting and saving tools, advice and education and more.Add money to Stash.

You can add money to Stash automatically or manually. It only takes 5 minutes to set up direct deposit to send either all or a part of your paycheck straight to Stash. You can even receive your paycheck up to 2 days early.3Budget, save, and create goals

Use our automatic budgeting and saving tools to organize your cash and track your spending.Invest your way.

You’ve got options. Choose to invest in fractional shares with $5 or less—you can pick from thousands of stocks and ETFs. You can also shop and earn stock with the Stock-Back® Card.1Stash is built for long-term investing, not day-trading, so all of our market transactions execute during four trading windows each weekday. (Note: Availability of trading windows is dependent on market conditions and may be subject to limitations.)

Why should I start investing now?

Investing can be a critical part of building wealth. As time passes, inflation can eat away at the value of your saved cash—making it worth less over the years. On the other hand, the average annual return of the S&P 500 has been around 8%, historically. Even if it’s just $1 at a time, it’s important to start investing as soon as possible so you can maximize your money’s growth potential and take advantage of compound returns over the years.

Is Stash safe?

Stash is 100 percent legit. From investments made to cash set aside, you can feel confident in the security of your money.

- Stash uses cutting-edge security features.

- Stash is a registered investment advisor with the US Securities and Exchange Commission (SEC).

While such registration does not imply a certain level of skill, it does require us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client.

- Stash offers access to FDIC-insured banking accounts through Stride Bank N.A., member FDIC.1

What is Stash’s mission?

Stash is on a mission to empower everyday Americans to build wealth. We believe every financial decision can be an investment in your future—that’s why our tools and products are designed to help people achieve greater financial freedom.

Unlike a lot of other financial companies, we’re here to help build healthy financial habits, hit money goals, and remove long-standing barriers to building wealth.

By giving Stashers access to simple, affordable investing and unlimited financial education, we remove what we consider to be the two biggest barriers stopping everyday Americans from building wealth: inaccessibility and lack of financial literacy.

In their place, we’ve created a clear path to better financial futures for all Americans.

investor today.

By using this website you agree to our Terms of Use and Privacy Policy.To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.