from January 1, 2022 through December 31, 2022.

Frequently asked questions

How does banking with Stash work?

Your online banking account with Stash is designed to help you achieve greater financial freedom through smart money management.

The Stock-Back® Card.1

Use our debit card to shop at well-known brands, and we’ll reward you with pieces of matching stock. Instead of points that might expire, we want to give you stock that can actually grow in value over time.

No hidden fees.2

We want you to save and grow your money, not worry about hidden fees—so we don’t charge any. The digital banking account has no overdraft fees, no minimum balance fees, no monthly maintenance fees, and no set-up fees. You also have access to over 55k fee-free ATMs worldwide, as well as fast cash deposits with no extra fee at participating retailers like CVS Pharmacy, Walgreens, and Walmart. (Limits may apply. Money should be available about 10 minutes after you complete deposit.)

Instant transfers.6

Transfers within Stash between your investment portfolio cash and your Stash banking account are instant, eliminating the wait times that can come with external bank account transfers. So you can make your money moves—faster.

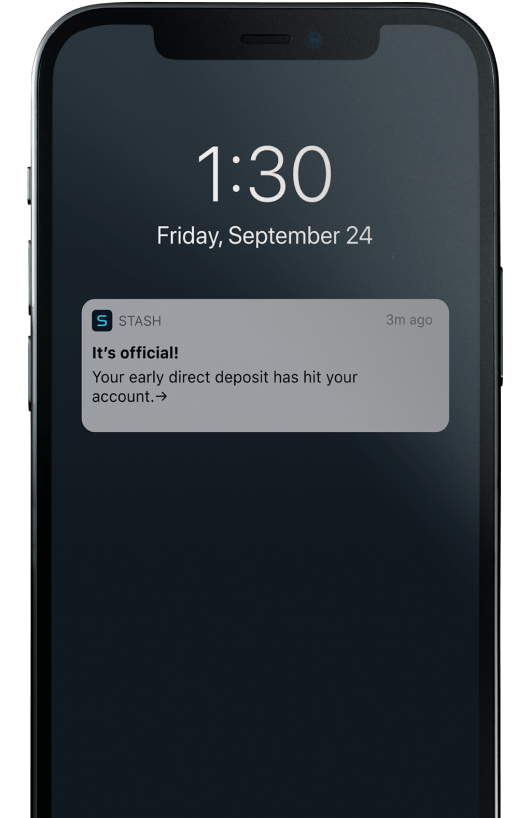

Early payday.3

Direct deposit users could get their paychecks up to 2 days early. It’s incredibly easy to set up direct deposit with Stash—you can even start by allocating a percentage of your paycheck to Stash and increasing from there.

App-friendly features.

Our banking and investing app features include: mobile check deposit, debit card lock and unlock, virtual card, real-time transaction alerts, recurring transfers, and digital wallet compatibility for both Apple Pay and Google Pay.

How does Stash help me budget and save?

Stash is a personal finance app that comes with saving, investing, and budgeting tools that you can use to better manage your money.

Save for goals.

Our goals feature lets you separate the cash in your online bank account into spaces for designated purposes. You can use this feature as a budget planner for rent, bills, groceries, an emergency fund, or your next vacation—it’s all customizable. You can even set a target date and dollar amount for each goal, and we’ll send you reminders to keep you on track.

Stay on top of spending.

We track your transactions in real-time and sort your spending into categories, such as ‘Food & Drink’, ‘Shopping’, and ‘Bills’. We also offer helpful insights into where your money is going.

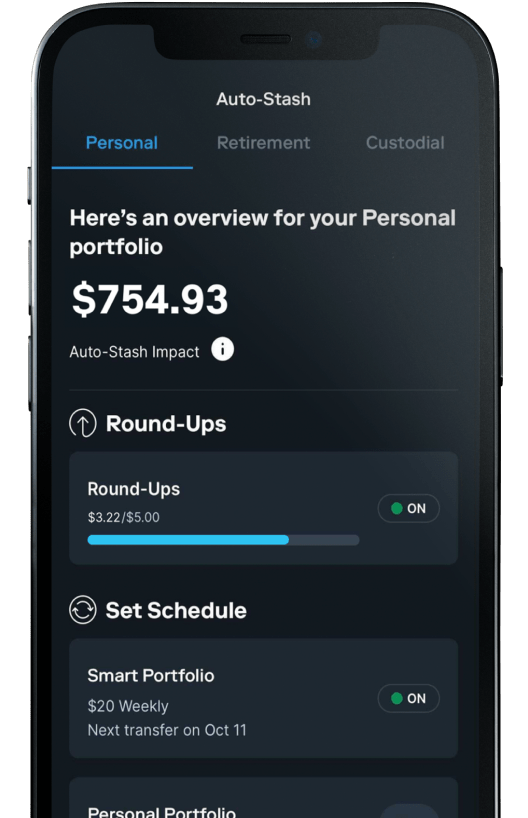

Save with automatic tools.

We offer automated saving and investing tools like Stock Round-Ups*, which automatically invests the spare change from your purchases for you.

*The Stock Round-Up program is subject to terms and conditions. In order to participate, a user must comply with all eligibility requirements and make a qualifying purchase with their Stock-Back® Card. All funds used for this Program will be taken from your Stash Banking account.

What is Stash?

Stash is a personal finance app that can help anyone improve their financial life.

From budgeting to saving for retirement, Stash features banking, investing, and advice all in one app. We’ve helped millions of Americans reach their financial goals–all for one low monthly price.

How does Stash work?

Stash can give you everything you need to build wealth for the long-term. Here’s how Stash works.

Answer a few questions.

When you first join Stash, we’ll get to know you by asking some questions. These help us understand your financial goals and provide useful, specific advice for things like investing and budgeting.Pick a plan.

Then, you’ll choose your subscription plan, starting at just $3/month. †

With Stash, you'll have access to a personal brokerage account, a retirement account, and a Smart Portfolio. You’ll also receive the Stock-Back® Card that lets you earn stock when you spend. And there’s even more benefits depending on the plan you choose, like budgeting and saving tools, advice and education and more.Add money to Stash.

You can add money to Stash automatically or manually. It only takes 5 minutes to set up direct deposit to send either all or a part of your paycheck straight to Stash. You can even receive your paycheck up to 2 days early.3Budget, save, and create goals

Use our automatic budgeting and saving tools to organize your cash and track your spending.Invest your way.

You’ve got options. Choose to invest in fractional shares with $5 or less—you can pick from thousands of stocks and ETFs. You can also shop and earn stock with the Stock-Back® Card.1Stash is built for long-term investing, not day-trading, so all of our market transactions execute during four trading windows each weekday. (Note: Availability of trading windows is dependent on market conditions and may be subject to limitations.)

Is Stash safe?

Stash is 100 percent legit. From investments made to cash set aside, you can feel confident in the security of your money.

- Stash uses cutting-edge security features.

- Stash is a registered investment advisor with the US Securities and Exchange Commission (SEC).

While such registration does not imply a certain level of skill, it does require us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client.

- Stash offers access to FDIC-insured banking accounts through Stride Bank N.A., member FDIC.1