Feb 15, 2024

What is compounding? An explanation of compound interest

The sooner you start putting money away, the more it can work in your favor.

In this article:

- What is compound interest and how does it work?

- Why is compounding important?

- How to calculate compound interest

- The power of starting early

- How to maximize the impact of compound interest

- What is compound interest? Your savings superpower

- How compounding works in different financial products

- Compounding FAQs

What does compounded mean? Compounding Definition: Compounding is the returns earned from interest on an existing principal amount, as well as on interest already paid means that, over time, you earn interest not only on your original investment (the principal) but also on the interest that has already been added to the principal. |

|---|

Ever heard the phrase “make your money work for you”? That's exactly what compound interest does. It’s like having a little financial helper pushing your money to grow faster over time. Whether you’re just starting your personal finance journey or are looking to improve your savings strategy, understanding compound interest can change the way you think about building your financial future.

In this guide, we’ll break down what compound interest is, how it works, and how you can harness its power for your goals.

What is compound interest and how does it work?

Compound interest is what happens when the interest you earn starts earning interest itself. Unlike simple interest, which only earns interest on the initial principal (the money you start with), compound interest allows the interest you’ve already earned to generate even more interest. Here’s a quick example to illustrate the difference between simple and compound interest:

Simple interest: A $1,000 deposit earning 5% simple interest annually would grow by $50 each year. So after five years, you would have $1,250, because every year you earn interest only on your initial $1,000 deposit.

Compound interest: The same $1,000 deposit earning 5% compound interest annually would grow to $1,276 after five years. That’s because each year, interest is calculated on both the original deposit and the interest already earned.

Over time, the effect of compounding can lead to exponential growth in your savings. Here’s another example that shows how compounding works in more detail.

Imagine that you deposited $100 in a savings account that accrues 10% interest annually. After one year, you’d have $110 in that savings account. After two years, though, your interest would have compounded, and you’d have $121.

That’s because you’re not just earning 10% interest on your initial deposit ($100)—you’re earning interest based on your new total earnings ($110). So after two years, you’ll earn your 10% interest based on your new total of $110. Here’s a breakdown of how those earnings could compound over time:

Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

Starting balance | $100 | $110 | $121 |

+ 10% interest | $10 | $11 | $12.10 |

Ending balance | $110 | $121 | $133.10 |

Initial deposit: $100

Year 1: $100 + (100 x 10%) = $110

Year 2: $110 + (110 x 10%) = $121

Year 3: $121 + (121 x 10%) = $133

And after 10 years of compounding at a rate of 10%, your $100 deposit would grow to $259.37. That’s the power of compounding in action.

Why is compounding important?

The beauty of compound interest lies in its ability to multiply your money over time. Even if you don’t constantly add to your savings, your money can grow. And when you do contribute more to your savings over time, you amplify the power of compounding. It’s the secret sauce behind long-term financial growth!

When it comes to your overall financial stability, there’s also a flip side to compounding interest: it affects debts as well as savings. Compounding can either work for you or against you, depending on whether it’s for an asset (like your savings) or a liability (such as loans and credit card balances). For instance, if you owe money on a credit card, the interest you rack up over time compounds the same way it does in the examples of saving above. The compounding interest means the amount you owe increases (compounds) over time. Compounding money when it comes to accounts with debt is something you want to avoid.

Real-life examples of compound interest in action

To appreciate why compounding is an important component of a future-focused financial plan, let’s take a look at some real-life scenarios.

Building an emergency fund

Ty is a 23-year-old just getting established in their career. They wanted to build an emergency fund so they’d have a safety net in case their car broke down or they got laid off. Ty deposited $500 into a high-yield savings account that earned 5% interest, compounded monthly. They also set up their direct deposit at work to automatically put $100 of their monthly paycheck into the savings account. After just three years, Ty’s emergency fund was nearly $4,500—and over $350 of that was compound interest earnings.

Saving for a dream vacation

Blaise and Ryann had worked hard to save up $3,000 for their dream vacation, but they had to put their plans on hold when the 2020 pandemic hit. Instead of leaving that cash sitting idle, they put it into a four-year certificate of deposit (CD) that paid 5.25% interest. When the term was up, they’d earned $700 on their initial deposit. The extra money was enough to add an extra week to their trip, and they didn’t even lift a finger to earn it.

Buying a first home

When Dwayne got a $1,800 tax refund, it gave him the motivation to get serious about saving for a down payment on a house. He put that money into an account earning 4% interest with daily compounding. Then he cut extraneous spending from his budget so he could add $300 a month to his savings. Plus, he was able to use future tax returns to contribute an extra $1,300 each year. Just five years later, the dream of homeownership was in reach: Dwayne had nearly $30,000 saved, and compound interest accounted for over $3,000 of that total.

How to calculate compound interest

In order to see exactly how compound interest is calculated, you’ll need to understand the four key factors at play:

Principal: The starting amount of money you deposit

Interest rate: The percentage of your balance that you will earn every compounding period

Compounding frequency: How often your earned interest is added to your account balance. This could be daily, monthly, quarterly, or annually. The more frequently interest is compounded, the faster your money grows

Time: The amount of time you keep your money (both principal and earned interest) in the account. The longer your money is in the account, the more it can grow through compounding

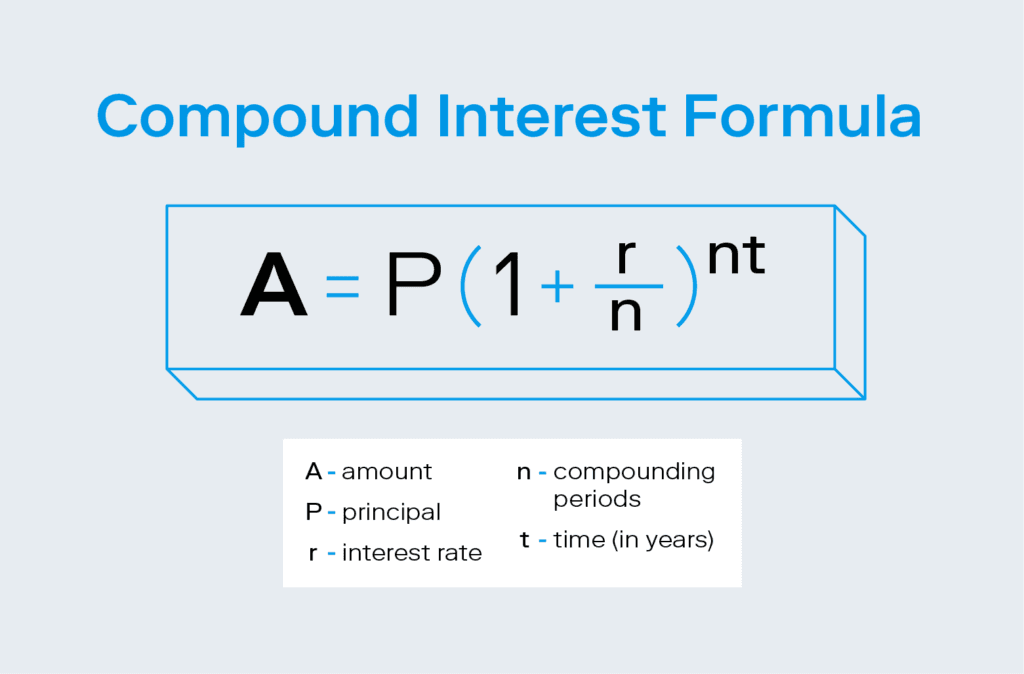

The compound interest formula

The formula to calculate compound interest is A=P(1+r/n)nt.

A = the total amount of money accrued on your principal plus interest, after n years

P = principal (the initial investment or deposit)

r = interest rate (in decimal form)

n = number of compounding periods (how often the interest is compounded per year)

t = time in years (how long the principal remains invested/deposited)

Let’s put this formula into action with some concrete numbers. Say you deposit $500 into a savings account with a 5% interest rate that compounds monthly for 10 years. So:

P = $500

r = 0.05

n = 12

t = 10

Now let’s plug those numbers into the compound interest formula:

A = P (1 + [r / n]) ^ nt

A = $500 (1 + [0.05 / 12]) ^ (12 * 10)

A = $500 (1.00417) ^ (120)

A = $500 (1.64767)

A = $823.84

In 10 years, your new total is $823.84—your principal plus $323.84 in interest.

Compound interest calculators

The good news is that you don’t have to do all that math yourself to figure out how your savings can benefit from compound interest. Online compound interest calculators do the work for you, and you can easily test out various scenarios to see how different savings strategies may play out. Here are a few you might want to explore:

Stash compound interest calculator: Straightforward and easy to use, this calculator also lets you see how your balance grows with monthly contributions to your account.

Investor.gov compound interest calculator: This calculator has the additional capability of accounting for variations in interest rates over time.

Financial Mentor compound interest calculator: If you want to get even more detailed, you can use this calculator to account for increases in your contributions and the impact of inflation.

These calculators make it easy to plan your financial goals by showing exactly what compound interest can do for you.

The power of starting early

Timing is everything when it comes to compounding. The sooner you start earning compound interest, the more time your money has to grow. Even a small amount can add up to sizable returns thanks to the power of compounding.

To see how this can play out in real life, let’s compare two people who are saving for retirement. They both open an account that earns 7% interest annually, but they start their savings journeys at different times:

Avery starts saving $2,000 every year at age 35 and stops at 45. Over the course of those 10 years, those contributions total $20,000. Avery then leaves that money in the account until age 65 (20 years), without making any more contributions.

Taylor starts saving $2,000 every year at age 45 and continues until age 65. In that 20-year period, Taylor has contributed a total of $40,000.

At a 7% annual return, Avery’s investment will grow to approximately $215,000 by age 65, while Taylor’s will grow to just $198,000—even though Taylor contributed twice as much money! That’s the power of starting early.

How to maximize the impact of compound interest

Contribute regularly

Even though compounding interest helps your money grow all on its own, you’ll get the most benefit if you keep adding to your savings on a consistent basis. Set up automated contributions to your account every month to make it easy. Even modest, consistent deposits add up over time.

Choose accounts that compound frequently

The more often interest is added to your balance, the greater returns you can see from compound interest over time. Look for financial products that offer frequent compounding, like daily or monthly, for the best results.

Look at APY, not just interest rates

When you’re exploring savings options, you’ll encounter two different numbers: the interest rate and the annual percentage yield (APY). The interest rate is simply the percentage of interest you’ll earn on your balance. The APY, on the other hand, reflects the actual return you would earn with compound interest. APY provides a more accurate view of expected interest earnings; it takes into account both the interest rate and compounding frequency of a particular account.

Minimize fees

Many savings and investment vehicles come with fees that can eat into your returns, especially over the long term. Look for options with no or low fees. And when you’re calculating your expected return from compound interest, also add up any fees you’ll pay to make sure they won’t undermine your saving efforts.

Pay off debt

Since compounding works against you when you’re borrowing money, prioritize paying down high-interest debts to reduce the negative impact of compounding on your overall financial picture. Paying off credit cards may be especially important, as they usually have very high interest rates. If you’re trying to decide whether to put a chunk of money into savings versus paying off debt, compare how much compound interest that money could earn with how much interest you’d pay on the same amount of debt over the same period of time.

Focus on the long term

Time is on your side when it comes to compound interest. The longer your money is earning that interest, the more it can grow. Resist the temptation to dip into savings unless it’s truly necessary.

Reinvest your investment earnings

When you earn dividends on investments—whether individual stocks or shares in funds or a retirement account—reinvest those earnings instead of withdrawing them or letting the cash sit idle in your account. Reinvestment keeps the compounding momentum going.

Start saving today

In the examples above, you’ve seen how starting early can lead to better long-term gains. Even if you don’t have much money to put aside right now, it can pay to begin your savings journey as soon as possible. That principal will start earning compound interest instead of languishing. And you can add to it bit by bit over time, increasing your contributions as you’re able. You may be pleasantly surprised at how much your balance grows.

Investing made easy.

Start today with any dollar amount.

What is compound interest? Your savings superpower

Compound interest is like a secret weapon in your financial toolkit—it gets stronger the earlier you start and the longer you use it. Whether you’re saving for a home, your child’s education, or retirement, mastering the ins and outs of compound interest can make a big difference.

When you understand the power of compounding, it can get you excited about the possibilities and motivated to start making your money work for you. Small, consistent steps today can lead to significant rewards tomorrow. There’s no better time than the present to get started!

How compounding works in different financial products

So far, we’ve covered how compound interest works. But the answer to “what is compounding” is incomplete until we also understand the element of compound returns. It’s easy to conflate the idea of compound interest and compound returns, but there are important differences.

Compound interest is a promised, steady amount that you earn in a financial account. It applies to financial products that pay interest on your balance.

The most familiar interest-earning products are deposit accounts at a bank or credit union, such as high-yield savings accounts, money market accounts, and certificates of deposit (CDs).

Some investment vehicles also pay interest., and the most common option may be bonds. A bond is a type of security issued by governments and corporations. Basically, your investment in a bond is like a loan you give to the bond issuer for a set period of time, and at the end of that term you get back your initial investment plus interest.

Compound returns are usually discussed when you’re talking about investment vehicles. These financial products don’t generally pay interest, but you can still harness the power of compounding when investing in the market.

Dividend-paying stocks are one of the primary ways to take advantage of compound returns when investing in the stock market. These stocks periodically pay investors a portion of the company’s earnings. If you reinvest the dividends to buy more shares of the company’s stock, you can take advantage of compound returns.

Exchange-traded funds (ETFs) and mutual funds can also provide opportunities for compounding. Funds hold a collection of multiple securities. Investing in a fund that includes dividend stocks, bonds, or interest-paying securities can allow you to reinvest dividends and/or earn compound interest.

Retirement accounts like IRAs and 401(k)s usually hold a variety of different securities, which might include dividend stocks, bonds, and even interest-bearing deposit accounts. Depending on the assets in your account, you might be able to earn compound returns.

Compounding FAQs

Have more questions along the lines of “what is compounding?” We have answers.

What is the rule of 72?

The Rule of 72 is a calculation that estimates how long it would take for an investment to double in value as a result of compound interest. Here’s the formula:

Years to double = 72 / rate of return on investment (the interest rate)

In other words, you can find the number of years it would take to double an investment by dividing 72 by the interest rate.

How can investors receive compounding returns?

Investors can receive compound returns through dividend payments. If you’re investing in stocks and the value of a stock grows over time, you can earn compound interest by reinvesting your profits.

If payouts are made in cash, they will need to be manually reinvested in order to potentially earn additional compounding returns. Mutual funds, on the other hand, often offer automatic dividend reinvestments in order to earn compound returns.

What type of average is best suited for compounding?

For investments that have compounding, the time-weighted rate of return (TWR)—also known as the geometric average—is best suited for calculating average returns. It’s able to provide a more accurate estimate of returns by isolating returns that were affected by cash flow changes, balancing out the distortion of these growth rates.

Related articles

investing

Feb 09, 2026

Trump Accounts: Invest Early

investing

Jan 13, 2026

FAQ: Personal Portfolio

investing

Jan 05, 2026

Why did the price I bought or sold my investments at change? What are Trading Windows?

investing

Dec 11, 2025

How to Invest through the Holidays—Without the Stress

investing

Oct 23, 2025

Why Millions Are Canceling Disney+ and Hulu and What It Means for Investors

investing

Sep 30, 2025

Securities Lending

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.