Jun 03, 2025

Sustainable Investing Stocks to go after in 2025

Sustainable investing is more than just a trend—it’s a movement reshaping the world of finance. By prioritizing environmental, social, and governance (ESG) factors, sustainable investing can allow you to build your wealth while making a positive impact on the planet and society. Whether it’s tackling climate change, promoting social equality, or encouraging ethical business practices, sustainable investing aligns your portfolio with your values.

This surge reflects growing consumer demand for ethical investment options and increased corporate accountability. Consider joining this movement and building a portfolio that supports your financial goals and the greater good.

Ready to start investing sustainably? Download the Stash app today and create a portfolio that aligns with your values.

Start Investing with Stash

Invest with Smart Portfolio.

Try Smart Portfolio and see how it can help your portfolio.

What Is Sustainable Investing?

Sustainable investing involves selecting investments based on their commitment to sustainability and ethical practices. This approach evaluates companies through the lens of ESG factors:

Environmental: How a company manages its environmental impact, including carbon emissions, renewable energy use, and water conservation.

Social: A company’s dedication to social issues, such as diversity, equity, and community engagement.

Governance: Ethical business practices, including transparent leadership, board diversity, and responsible executive compensation.

Sustainable investing aims to generate long-term financial returns while addressing critical global challenges.

Why Invest Sustainably?

Sustainable investing offers a unique opportunity to combine your portfolio with positive impact. Here’s why it’s gaining traction among investors:

1. Strong Financial History

Contrary to the myth that sustainability sacrifices returns, many sustainable investments can be strong inclusions in a diversified portfolio. Companies with strong ESG practices can be more resilient to risks like regulatory changes and reputational damage.

Key Stats:

A 2024 study by MSCI found that companies with high ESG scores outperformed their peers by an average of 2.5% annually over the past decade. Source

2. Align Your Investments With Your Values

Sustainable investing allows you to support causes you care about. From renewable energy to social equity, these investments enable you to make a difference while achieving your financial goals.

Examples of Values-Driven Investments:

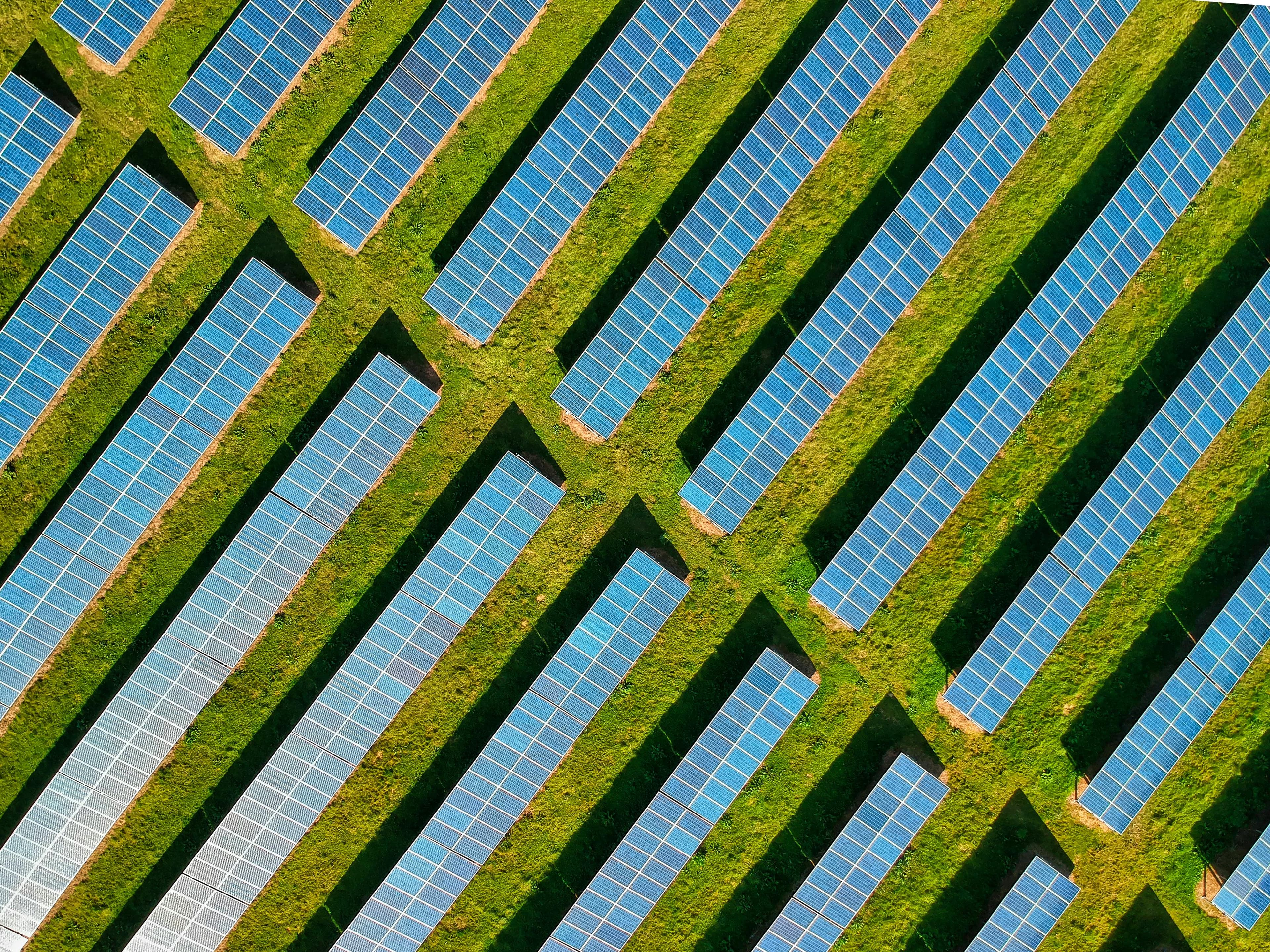

Clean Energy: Support solar, wind, and battery storage technologies.

Gender Equality: Invest in companies with diverse leadership teams.

Social Impact: Back businesses improving access to education, healthcare, or affordable housing.

3. Positive Impact on the World

Every dollar you invest sustainably can contribute to solving global challenges like climate change, inequality, and resource depletion. By supporting companies that prioritize sustainability, you’re helping create a better future for generations to come.

Key Impact Areas:

Reducing carbon emissions by investing in green technologies.

Promoting fair labor practices through socially responsible businesses.

Encouraging corporate accountability by choosing governance-focused investments.

4. Risk Mitigation and Resilience

Companies with strong ESG practices can often be better equipped to manage risks like environmental regulations, resource shortages, and consumer preferences. This can make sustainable investing a valuable strategy for building a resilient portfolio.

Popular Strategies for Sustainable Investing

Here are some common approaches to sustainable investing:

ESG Investing: Evaluates companies based on environmental, social, and governance factors.

Thematic Investing: Focuses on specific sustainability themes, such as clean energy, water conservation, or gender equality.

Impact Investing: Targets measurable social or environmental outcomes alongside financial returns.

Green Bonds: Fixed-income investments used to fund environmentally friendly projects like renewable energy installations.

Why Trust Stash for Sustainable Investing?

Stash simplifies investing, offering curated portfolios that align with your values. Whether you’re new to investing or a seasoned pro, Stash makes it easy to build a portfolio that supports your financial goals and the causes you care about.

Why Choose Stash?

Affordable Entry: Start investing with as little as $5.

Real-Time Insights: Track your investments’ impact and financial performance.

By investing through Stash, you can build your wealth responsibly while contributing to a more sustainable future.

How to Get Started with Stash

Here’s how to start your sustainable investing journey with Stash:

Download the Stash App: Available on iOS and Android devices.

Set Up Your Account: Begin your investment journey in just minutes.

Explore Sustainable Options: Browse ESG funds, impact investments, and green bonds curated by Stash.

Invest Your Way: Start small and scale up as you grow more comfortable with your portfolio.

Start investing now.

Invest in TFLO and make your idle cash work for you.

FAQs About Sustainable Investing

What’s the difference between ESG and sustainable investing?

While ESG investing focuses on evaluating companies based on Environmental, Social, and Governance factors, sustainable investing encompasses a broader approach that includes thematic and impact investing.

Can sustainable investing deliver strong returns?

Like all investments, many sustainable investments will experience both gains and losses. Based on historic trends, however, they also have the potential to be a valuable addition to your portfolio. Companies prioritizing sustainability are often more innovative, resilient, and aligned with future market trends.

How do I start sustainable investing with Stash?

Download the app, create an account, and explore curated sustainable investment options that align with your values.

Related articles

investing

Feb 09, 2026

Trump Accounts: Invest Early

investing

Jan 13, 2026

FAQ: Personal Portfolio

investing

Jan 05, 2026

Why did the price I bought or sold my investments at change? What are Trading Windows?

investing

Dec 11, 2025

How to Invest through the Holidays—Without the Stress

investing

Oct 23, 2025

Why Millions Are Canceling Disney+ and Hulu and What It Means for Investors

investing

Sep 30, 2025

Securities Lending

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.