Oct 22, 2024

Real-Life Examples of Compound Interest Growth Over Time

By now, you’ve likely heard about the magic of compound interest, one of the most powerful forces in investing.

Unlike simple interest, which only earns interest on the original amount invested, compound interest earns interest on both the initial investment and the accumulated interest over time. This means your money can grow exponentially, given enough time and consistent contributions.

But though you may have heard about the concept as well as the different accounts you can invest in to earn compound interest on your investments, you may still not be convinced of the massive returns compound interest can have on your investments.

So, in this piece, we’ll explore some real-life scenarios of compound interest working for you. Read on to see how far your money can go.

How it works

Compound interest can be an effective way to earn money both in the short-term and long term.

Here’s how it works in the short term:

Let’s say you have $1,000 to invest in a high yield savings account with a 5% annual interest rate. In the first year, you’d earn $50 in interest, bringing the total to $1,050. That may seem like a small amount of money, but compared to other accounts like regular savings or checking accounts, you’re earning way more money from simply having your money in the account. Plus, that number grows larger and larger with each passing year, as the amount of interest grows and your new balance is based on accruing interest of the new total number.

And here’s an even more convincing argument for investing long term, using the stock market as an example:

Say you have $10,000 to invest in the stock market, and you invest it in a diversified portfolio with an average annual return of 7%. After 10 years, your investment will have already grown to $19,672. Over 30 years, that very same investment could exceed $76,000 just from being invested.

If you’re not investing in compound interest, you are leaving money on the table. And, because the earlier you invest the more your investment grows, it’s worth it to start as early as you can – even if you don’t currently have a ton of money to invest with.

Another great way to invest in compound interest is through a 401k through your employer. Many employers will match your contributions, making it even easier to set and forget investments. Plus, the percentage that stocks gain compound each business day, making it even easier to grow your balance faster.

Even if your deposits are small, you will be earning much more over time than you would if you used simple interest, or let your money sit in an account with no interest whatsoever. Stash contributor Jamie has an account with Ally, which offers an interest rate of 4.0%. While one of her accounts currently has just $1,800, she has still earned $35 this year without making any additional contributions. It sounds small, but when starting to invest, every little bit counts to go one step at a time toward more income.

OK, I want to invest. What are best practices?

The best way to start investing is… to just start! But if you want to tap into the full earning potential, there are a few tips to keep in mind.

Start early! The sooner you begin investing, the more time your money has to grow. Even small contributions can make a significant difference long term.

Keep contributing. Once you start investing, try to get in the habit of continually depositing into your accounts. You can set up automatic contributions to help you stay on track.

Reinvest. When your investments generate dividends or interest, you can reinvest them to reach your maximum growth potential

Diversify. They say not to put all of your eggs in one basket, and the same can be said of investments. A diversified investment portfolio can help manage risk and enhance returns. You can invest in a wide range of assets like stocks, bonds and real estate.

Compound Interest FAQs

How is compound interest calculated?

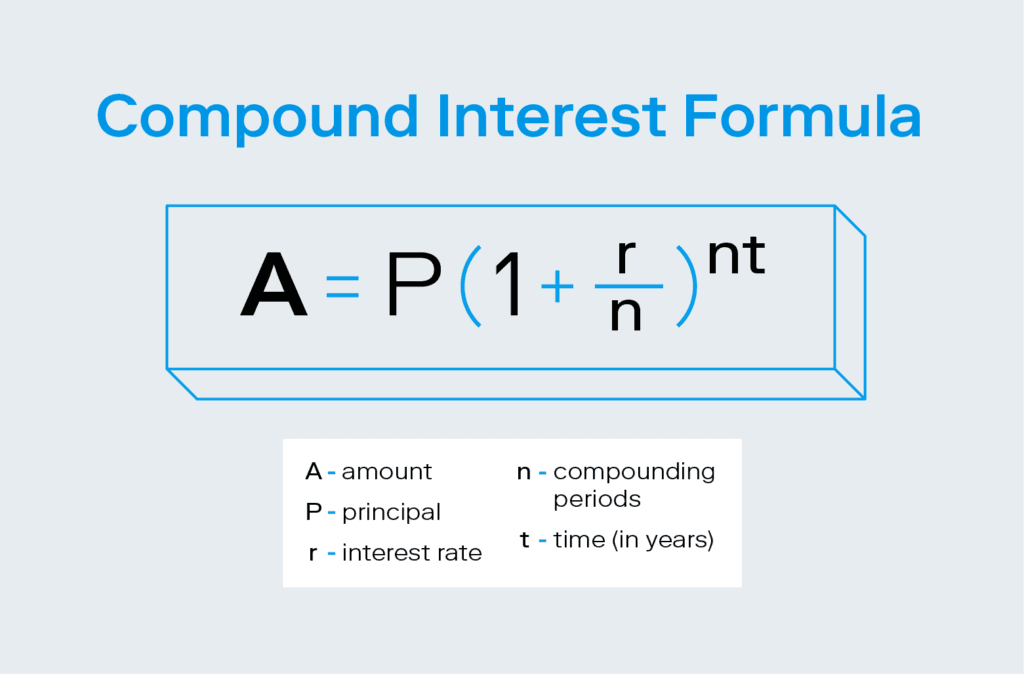

Compound interest is calculated using the formula A = P(1 + r/n)^(nt), where A represents the final amount, P is the principal, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years.

Is compound interest better than simple interest?

Yes, yes and yes again. In general, compound interest generally leads to higher returns when compared to simple interest. This is because compound interest accumulates both on the initial investment and previously earned interest, while simple interest accumulates only on your initial investment.

Can I use compound interest for short-term investments?

As outline in the above examples, compound interest has a major payoff for long term investments. However, it can still be effective for short term investments as well. Just be sure to do your math – some factors like fees and taxes could impact your overall returns.

The bottom line

When it comes to making sound investments for your future, interest can be your best friend. Invest early and often, and watch the magic happen.

Eager to take the next step toward financial growth? Check out Stash’s vast library of investment resources and remember that when it comes to finances, knowledge is the best investment of all.

Related articles

investing

Feb 09, 2026

Trump Accounts: Invest Early

investing

Jan 13, 2026

FAQ: Personal Portfolio

investing

Jan 05, 2026

Why did the price I bought or sold my investments at change? What are Trading Windows?

investing

Dec 11, 2025

How to Invest through the Holidays—Without the Stress

investing

Oct 23, 2025

Why Millions Are Canceling Disney+ and Hulu and What It Means for Investors

investing

Sep 30, 2025

Securities Lending

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.