Dec 01, 2023

Mutual Funds vs. Stocks: Which Is Better for Beginner Investors?

In this article:

- Why making an informed investment decision matters

- Mutual funds explained

- Stocks 101

- Key differences between mutual funds and stocks

- Mutual funds vs. stocks: which is the better investment?

- Pros and cons of mutual funds for beginner investors

- Pros and cons of stocks for beginner investors

- Personal finance strategies: Choosing what’s best for you

- Tips for getting started

- FAQs about mutual funds vs. stocks

What’s the difference between mutual funds and stocks?A stock is a sliver of ownership in a single company, while a mutual fund is a basket of many stocks and other assets from multiple companies. While investing in a single stock means investing in one company, investing in a mutual fund means buying into many investments at once – all within a single investment. |

|---|

As a new investor, one of the first decisions you'll face is whether to invest in mutual funds or individual stocks. It can feel overwhelming, especially when you're just starting out, but understanding the basics of these investment options can help you make informed decisions.

Both mutual funds and stocks have distinct features, benefits, and risks. This guide will walk you through what they are, their pros and cons, and how to decide which might be a better fit based on your financial goals as a beginner investor.

A mutual fund is a pooled investment containing many stocks and other assets within a single fund, while a stock is an investment in a single company. By divvying up your investment across hundreds of companies instead of just one, mutual funds spread out your risk and add more diversification to your portfolio than a single stock would.

Ultimately, choosing between stocks vs. mutual funds depends on your investment goals. Both can be a smart addition to your portfolio, but the right choice for you depends on factors like your risk tolerance and time horizon.

Why making an informed investment decision matters

Investing can be one of the most effective ways to grow your wealth over time. Having a grasp on key concepts helps you make confident, long-term decisions aligned with your financial goals—from funding a major milestone like buying a home to preparing for retirement.

So, first things first: What’s the difference between mutual funds and stocks? In short, a stock is a sliver of ownership in a single company, while a mutual fund is a basket of many stocks and other assets from multiple companies. Let's break down these options even further so you can feel empowered to take your next step.

Mutual funds explained

A mutual fund is an investment vehicle that pools money from multiple investors to purchase a diversified portfolio of securities, which may include stocks, bonds, or other assets. With a mutual fund, you’re investing in the many different shares that make up the single fund, giving you broader market exposure compared to a single stock. Since an investment fund manager actively manages mutual funds, they make a convenient investment avenue for those who prefer a more hands-off approach to investing. And they’re particularly appealing to beginner investors who may not have the time or expertise to research and manage individual investments

Stocks 101

Buying a stock means you're purchasing partial ownership of a company, giving you the opportunity to directly invest in companies you believe in. When you buy a stock, your returns are based on the performance of that company’s share price. When the company does well, the stock price typically goes up, and stockholders who own shares reap the benefit. Investing in individual stocks requires more involvement and research when compared to mutual funds. It should also be noted that stock purchases come with the potential for both high rewards and significant risks.

Key differences between mutual funds and stocks

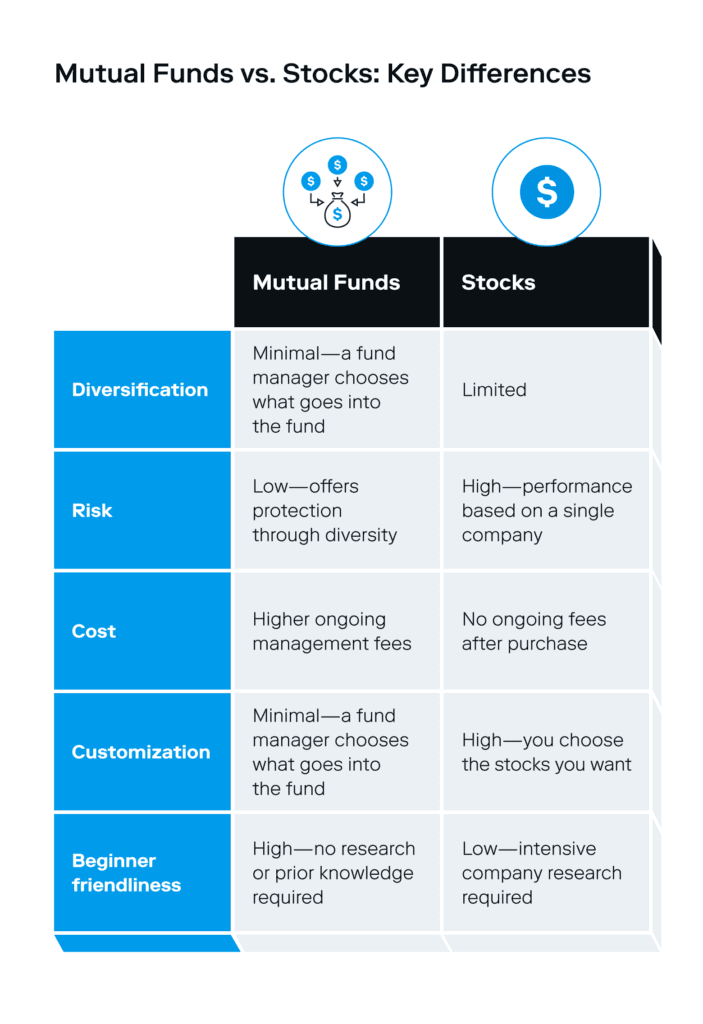

When deciding between mutual funds and stocks, consider how these key features and differences may affect your investment strategy.

What’s the difference between mutual funds and stocks? Purchasing a stock means buying a small piece of ownership, or a share, in a company. When you buy a stock, your returns are based on the performance of that company. When the company does well, the stock price typically goes up, and stockholders who own shares reap the benefit.

A mutual fund is a basket of hundreds of stocks, securities, and other assets within a single fund. With a mutual fund, you’re investing in the many different shares that make up the single fund, giving you broader market exposure compared to a single stock.

Since an investment fund manager actively manages mutual funds—the individual responsible for implementing a fund’s investment strategy and making the behind-the-scenes trading decisions—they make a convenient investment avenue for beginners who would rather leave the research and stock-picking decisions to an expert.

Here’s a quick overview of the difference between stocks and mutual funds, based on key investment characteristics:

Diversification | Instant diversification as funds typically invest in a mix of securities with exposure to many investments at once | Limited based on the number of companies you invest in |

|---|---|---|

Risk | Lower—offers protection through diversity and professional oversight | Higher—performance is based on a single company, and stock prices can fluctuate rapidly |

Cost | Higher ongoing management fees due to a portfolio manager making investment decisions for the fund | No ongoing fees after purchase |

Customization and control | Minimal—a hands-off approach for investors, as fund manager chooses what assets go into the fund | High—a hands-on approach as you choose the stocks you want |

Beginner friendliness | High—no intensive research of individual assets required | Low—extensive company research required |

Return potential | Steadier, but often lower potential returns | Higher potential returns, but with increased volatility |

Investment horizon | Better suited to those with specific goals like retirement or who prefer moderate risk over time | Better suited to investors with a longer time horizon and higher risk tolerance |

Mutual funds vs. stocks: which is the better investment?

For long-term investors looking to build wealth over time, mutual funds are considered a dependable investment, as they aim to reduce overall risk—an important factor in a successful retirement portfolio. They’re also well suited for beginner investors who want to reap the benefits of the stock market without any prior investment knowledge.

For investors who want to capture the potential growth of a particular company, individual stocks offer the potential for larger returns. Investors who go this route must be able to stomach more risk and be confident in their ability to analyze individual stocks.

Investing in mutual funds vs. stocks comes down to your investment goals and risk tolerance. The main difference between stocks and mutual funds is the number of eggs in your basket—and diversification is usually considered a solid investment strategy. But it really does come down to weighing the pros and cons of each type of investment for your needs.

Pros and cons of mutual funds for beginner investors

Whether you’re new to the market or a seasoned veteran, investing in mutual funds comes with benefits and drawbacks. Consider the pros (like lower risk) and the cons (like potential lower returns) before investing.

Pros:

Minimizes risk: It’s unlikely that every company within a mutual fund will go down at the same time, which protects your portfolio from volatility.

Simplified diversification: Because you get exposure to an array of companies, industries, and sectors, mutual funds instantly diversify your portfolio, which can help to reduce the impact of a single investment’s performance on your overall portfolio.

Professional management: Mutual funds require little effort from investors, leaving the complex research to an expert.

Cons:

Higher costs: High management fees or expense ratios can eat into returns over time.

Less control: Since a fund manager decides which stocks and other assets make up the fund on your behalf, you have no say in what’s included. Additionally, mutual funds can only be bought or sold at the end of a trading day, limiting the ability to respond quickly to market changes.

Lower returns: Returns may be lower compared to high-performing stocks.

Pros and cons of stocks for beginner investors

Stocks can be an attractive investment, namely due to the potential for outsized returns, but there are some drawbacks to be aware of, especially for beginners.

Pros:

Higher returns: Depending on the company’s performance, you could see higher-than-average returns compared to other asset classes.

Direct ownership: Buying individual stocks means there’s no fund manager involved, so you’re in control of every trading decision—and you can focus on investments in companies or sectors you're passionate about.

No management fees: By self-managing your own stock picks, you avoid the management fees you’d have to pay for an actively managed mutual fund.

Cons:

Higher risk and volatility: The potential for higher returns comes with the potential for bigger losses if the company underperforms. Betting on a single company also increases the risk of your portfolio being impacted by market volatility.

Requires time-intensive research and investment knowledge: Knowing what company to invest in requires research on stocks—investors must analyze earnings reports and market performance, and make predictions about future price movements.

Low diversification: Allocating your portfolio toward just one or two companies doesn’t provide diversification.

Personal finance strategies: Choosing what’s best for you

When deciding between mutual funds and stocks, consider the following strategies to guide your choice:

Define your financial goals: Are you saving for a long-term goal like retirement or looking for faster growth? Your objectives can determine whether steady mutual funds or growth-focused stocks are better suited for you.

Assess your risk tolerance: Are you comfortable with the ups and downs of the stock market, or would you prefer more stable returns?

Evaluate time commitment: If you're willing to spend time researching companies, stocks may appeal to you. If you prefer a hands-off approach, mutual funds might be a better fit.

Start small: Regardless of your choice, begin with a small investment to learn without taking on excessive risk.

Tips for getting started

Ultimately, choosing between stocks vs. mutual funds depends on your investment goals. Either could be a smart addition to your portfolio, but the right choice for you depends on factors like your risk tolerance and time horizon. Here are some tips to get your investment journey started, regardless of which assets you choose.

Educate yourself: Congratulations! You’re doing it right now! Keep dedicating time to learning the basics of investing. Financial blogs, webinars, and podcasts can be great starting points.

Diversify early: Even if you're investing in individual stocks, diversifying across different sectors and industries can help reduce risk. Instead of buying several shares in one company, consider going with a few shares in multiple companies for a diversified portfolio from the start.

Start with what you can afford: Only invest money that you can afford to lose, especially if you’re experimenting with stocks. Look for brokerages that offer fractional shares, which allows you to buy a portion of a stock—that can allow you to invest in a stock even if you don’t have enough for a full share.

Making your first investment decision

Whether you choose mutual funds or stocks depends on your goals, risk tolerance, and personal preferences. You may even decide to invest in both!

What matters most is getting started, no matter how small the investment. Building financial literacy and confidence as an investor will serve you well in the long run. It’s never too late—or too early—to start building your wealth.

Investing made easy.

Start today with any dollar amount.

FAQs about mutual funds vs. stocks

Still have lingering questions about stocks vs. mutual funds? Find the answers below.

Are mutual funds safer than stocks?

Generally, yes. Since diversification is a risk-management strategy, the instant diversification that mutual funds provide lowers their overall risk compared to individual stocks.

Why would someone choose a mutual fund over a stock?

The most common reason someone would choose a mutual fund over a stock is that it’s a convenient, hands-off way to profit from the stock market without any active management on their part. It’s also an easy way to diversify your holdings, which isn’t the case when you purchase a single stock.

Is it better to invest in stocks or mutual funds?

Whether it’s better to invest in stocks or mutual funds depends on your individual preferences and circumstances, as stocks offer potentially higher returns but come with higher risk and require more active management, while mutual funds provide instant diversification, convenience, and professional management at the cost of potentially lower returns.

Do mutual funds outperform the stock market?

The performance of mutual funds compared to the stock market can vary widely, as some mutual funds may outperform the market over certain periods, while others may underperform. It ultimately depends on factors such as the fund’s investment strategy, the skill of the fund manager, and market conditions.

Related articles

investing

Feb 09, 2026

Trump Accounts: Invest Early

investing

Jan 13, 2026

FAQ: Personal Portfolio

investing

Jan 05, 2026

Why did the price I bought or sold my investments at change? What are Trading Windows?

investing

Dec 11, 2025

How to Invest through the Holidays—Without the Stress

investing

Oct 23, 2025

Why Millions Are Canceling Disney+ and Hulu and What It Means for Investors

investing

Sep 30, 2025

Securities Lending

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.