Oct 11, 2018

Markets Go Down, Don’t Panic

We believe in a strategy you can use for the long-term, a note from our CEO.

In this article:

Will the markets go up and down? YES.

One of the questions I get asked when the market goes down is, “Should I sell?”

My answer, which I’ve formed over the past 20 years, is not necessarily.

Selling is often the wrong thing to do. We encourage you to follow the Stash Way.

The U.S. has a strong economy, but occasionally interest rates rise, which the markets sometimes don’t like. Recently rising bond yields and tech stocks triggered a sell-off.

Think of an angry three-year-old child. He or she eventually gets over it. Markets do too. I have seen this movie play out time and time again. (I also have three kids!)

History shows us

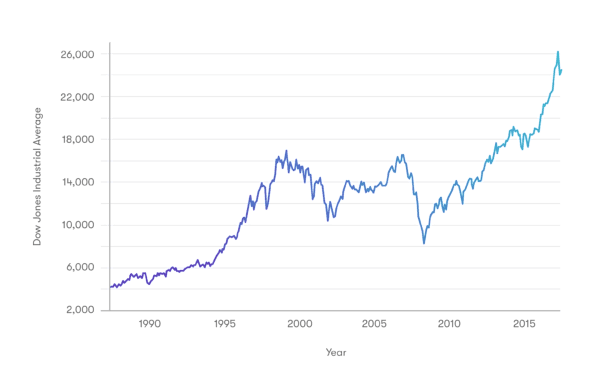

Over the past 15 years, there have been turbulent periods in the market. Check out the graph below.

You’ll see gains and declines through the dot-com bust, 9/11, the Great Recession, wars in Iraq and Afghanistan, and four separate presidential administrations. You’ll see how staying the course is oftentimes the way to go.

The key to “investing” through market volatility, is to invest small amounts on a regular basis. Auto-Stash allows you to do just that. If you have it on, keep it on. If you’ve never tried it, now is the time. It’s an automated way to buy investments while they’re going up and when they’re going down. (This is known as dollar-cost averaging, and it’s really important.)

Long-term investors (that’s you) shouldn’t be concerned with timing the market. I’ve said this before and I’ll keep saying it—no one can predict exactly what will happen tomorrow or next week.

Stash is your investment adviser, and our goal is to look out for you and your interests by helping you continue to save and invest for your future. Although we can’t predict the future, try not to sweat the ups and downs.

It’s all about the time you are in the market that counts, not how you time it.

Brandon KriegCEO – Stash

Investing made easy.

Start today with any dollar amount.

Related articles

financial-news

Apr 07, 2025

Investing During Volatile Times

financial-news

Apr 03, 2025

How to Stay the Course Through Tariffs and Turbulence

financial-news

May 15, 2024

Rebirth of the meme stock craze? 5 brutally honest reasons why you shouldn’t be buying, despite the hype

budgeting

Jan 09, 2024

9 ways to celebrate financial wellness month

financial-news

Nov 09, 2023

What is a Recession?

financial-news

May 15, 2023

The Stash Way: Invest Regularly

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.