Feb 12, 2020

What Stash Does to Keep You Safe

Learn more about how we work hard to keep your money and data safe.

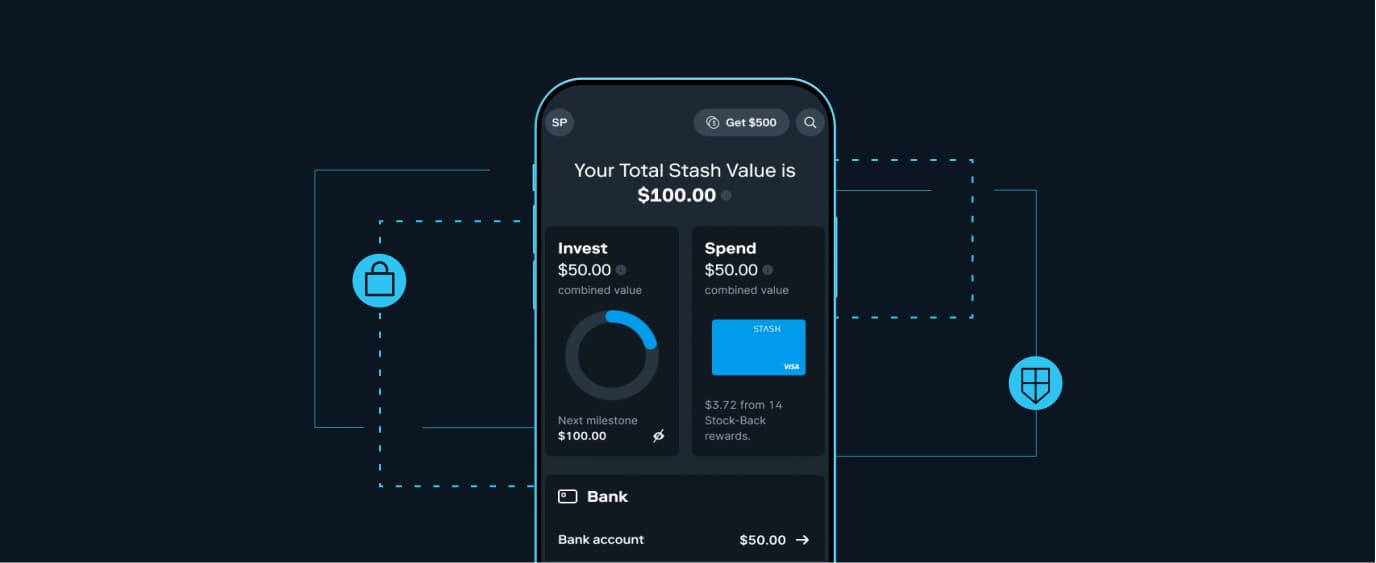

You’ve come to expect innovative financial products from Stash, that help you with banking, investing, and smart spending.

But we also want you to have confidence that when you use Stash, you know that we take the security of your money, accounts, and personal information very seriously. That way, you can rest assured that your experience with us will always be a great one.

Here’s how Stash works to keep you safe:

Protecting your money

Your Stash debit account1 is insured by the Federal Deposit Insurance Corporation, a federal agency that protects consumer bank accounts against loss.

Your investments are held by our custodian Apex Clearing Corporation, a third party SEC registered broker-dealer and member FINRA/SPIC.

Apex Clearing is a member of the Securities Investor Protection Corporation (SIPC). This means your investments in your account are protected up to $500,000 total (including $250,000 for claims for cash). For details, please see www.sipc.org.

Protecting your personal information

Stash has undergone an extensive internal examination called a Payment Card Industry Data Security Standard audit (PCI DSS), which all merchants and organizations that store, process or transmit credit and debit data must perform. It ensures your cardholder data is stored and safeguarded against malicious attacks.

We use 256-bit encryption, an industry-standard, to protect information as it moves across the network, and to encode information such as your Social Security number and transaction history.

We also use something called Transport Layer Security (TLS), which protects your information when you’re communicating with Stash via the Web or your mobile device.

Biometric recognition: You can use your fingerprint—to log into your Stash account. Since your fingerprint is unique to you, it can provide greater account access security than simply using a password.

Access controls: Stash times your sessions, and will automatically log you out after a set period of inactivity. We also continuously monitor log-ons for access from unauthorized users.

What you can do

You can also take action to make sure your account stays secure. Here’s how:

Don’t use easy-to-guess passwords, such as your birth date, your name, or names of friends, as well as current or past addresses.

Use complex passwords that combine upper and lower case letters, numbers, as well as symbols.

Don’t use the same password for multiple web sites or apps.

Change your passwords every 90 days.

And remember, Stash is always here to help. Contact us 24 hours a day if you suspect fraud or other suspicious activity related to your account.

Email: [email protected]

Phone: 800-205-5164

Related articles

investing

Feb 09, 2026

Trump Accounts: Invest Early

investing

Jan 13, 2026

FAQ: Personal Portfolio

investing

Jan 05, 2026

Why did the price I bought or sold my investments at change? What are Trading Windows?

investing

Dec 11, 2025

How to Invest through the Holidays—Without the Stress

investing

Oct 23, 2025

Why Millions Are Canceling Disney+ and Hulu and What It Means for Investors

investing

Sep 30, 2025

Securities Lending

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.