Oct 01, 2024

How to Use a Cash Advance Responsibly

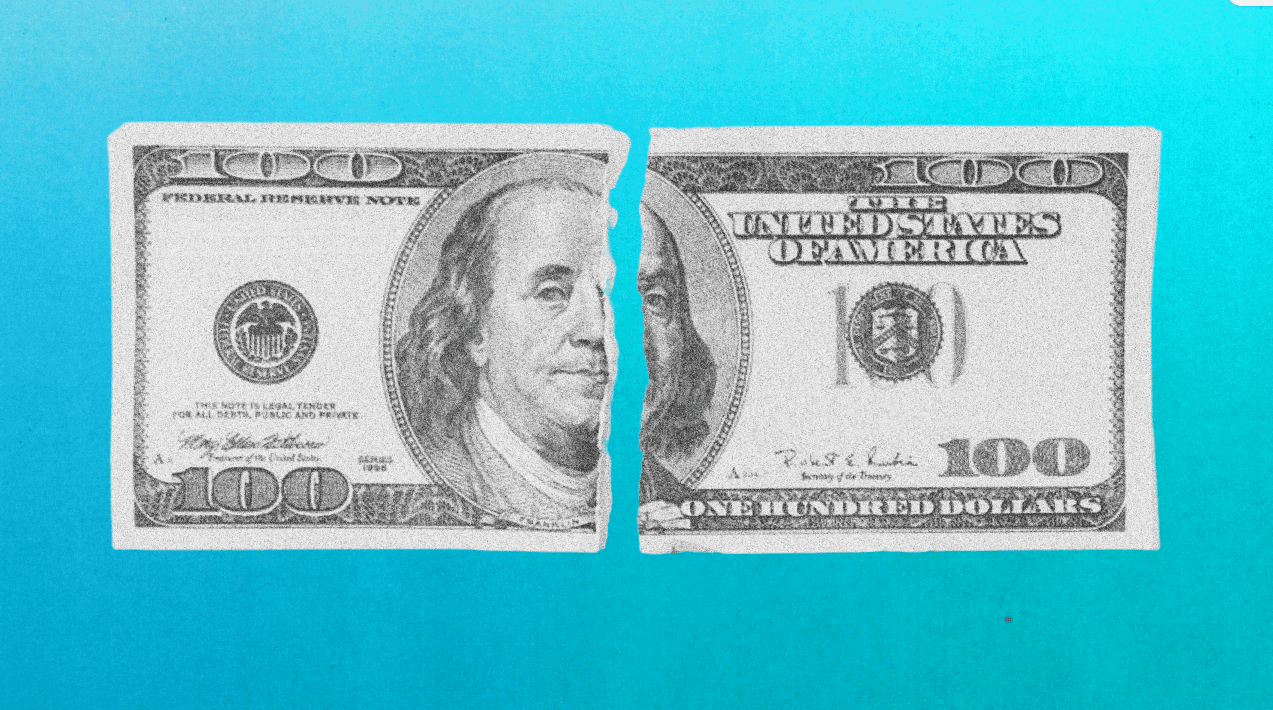

Cash advances are small, short-term loans designed to help see you through in case of an emergency or until your next payday.

There are many reasons why you might take out a cash advance – for groceries, gas, living expenses, etc. But it’s important to be completely aware of exactly how they work, and the risks associated with them, before you commit to taking one out.

Below, we’ll discuss pros, cons, and best practices for responsible use.

Pros of a cash advance

Quick, even instant, access to cash. The biggest draw of a cash advance is its accessibility. Unlike with personal loans, which can take some time to grant approval, cash advances are approved much, much faster. This can be extremely helpful for an emergency situation to help you get out of a tight bind when you need it the most.

No credit check. Cash advances are not contingent on passing a credit check, making them an appealing option for those with poor or low credit.

Flexible repayment terms. Whether you take out a cash advance against your credit card or through one of the many available cash advance apps, there are typically either zero or low fees in order to access the cash, and flexible terms when it comes to paying the money back. Some companies offer extensions if you do not have the funds by your next payday, and credit card cash advances are simply paid back in the same way you pay your credit cards.

Cons of a cash advance

High costs and fees. The fees associated with cash advances can add up – quick. Despite there not being a high fee to take the advance itself, interest rates for cash advances on credit cards are astronomical. Similarly, while many cash advance apps do not charge fees, they will deduct the loan amount from your bank account at the time of your next paycheck – regardless of whether or not you have the funds in your account. That could result in even more fees for lateness or overdrafting.

Potential impact on credit score. Since you are often taking a cash advance out against your credit card, it counts for your total utilization amount in your credit cards. The closer you get to maxing out your cards, the more harmful impact it could have on your credit score.

Risk of falling into a cycle. If you do not have the funds to repay the short-term loan, you may end up in a vicious cycle of falling further into debt as the high interest rate grows – you start getting charged for a cash advance by your credit card company from the moment you take it out.

Best practices for using a cash advance

The most important factor to keep in mind when you’re considering a cash advance is how big of a financial risk you are taking. Do you need the funds quickly for something that you’ll be able to pay off right away? Do you know for sure that your paycheck is coming imminently? Is there another route you can take to pay for your emergency needs, like paying with a credit card (which typically has lower interest rates than a cash advance), applying for a personal loan or, if you have access to it, asking friends and family to help you out temporarily?

It can be appealing to get your hands on some cash, but it’s crucial to weigh all the potential risks and benefits before you jump in.

Once you have assessed your risk, be sure to also have a firm understanding of the repayment terms, and calculate how much you’re going to owe when all is said and done. You might find you’ll end up having to pay way more than you anticipated, and might be inclined to find alternatives.

Finally, be sure to set up a repayment plan. Once you know when your paycheck is coming in, try to pay the cash advance off right away, as soon as it comes in. it’s all too easy to avoid our bank accounts and credit card balances, but forcing yourself to look at the numbers, and putting the money away as soon as it hits your account, will pay off way more in the long run.

Cash advances are not for everyone, and every financial situation – but they can be useful for an emergency, and if handled responsibly. Using tools from Stash, including financial planners, budgeting tools and even signing up for features like early access to your paychecks are all ways to get in control of your finances and set yourself up for success.

Related articles

borrowing

Oct 14, 2024

How To Use Personal Loans

borrowing

Oct 07, 2024

Cash Advances vs. Personal Loans: Which is Better?

borrowing

Oct 07, 2024

How To Use Cash Advances

borrowing

Oct 07, 2024

How To Pay Off a Cash Advance Quickly

borrowing

Oct 07, 2024

What To Know Before Taking a Cash Advance

borrowing

Oct 07, 2024

How to Avoid Cash Advance Fees

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.