Aug 05, 2024

How to track your expenses

Tracking your expenses means keeping a detailed record of where your money goes. It helps you understand your spending habits and make informed financial decisions.

Knowing where your money is going is essential for maintaining and adjusting a budget, saving money, reducing debt, and reaching financial goals. In this guide, we’ll cover the methods, tools, and benefits of tracking expenses to help you take control of your financial life.

1. Gather your financial documents

Start by assessing your current financial status. List all your income sources, including your salary, freelance work, and any side gigs. Then, list all your expenses, such as rent, groceries, utilities, and entertainment. Gathering these documents will give you a clear picture of where your money is coming from and where it’s going.

2. Create a budget

How do you make a budget, exactly? Creating a budget involves listing your income, categorizing your expenses, and ensuring that your budget balances — or that you’re bringing in more than you’re spending. Start by listing all sources of income. Then, break down your expenses into categories like housing, transportation, and entertainment. Finally, make sure your total expenses do not exceed your total income. A balanced budget is key to becoming financially stable. .

Track your income

You’ll want to be sure to log all sources of income to keep an accurate budget. This includes your regular salary, freelance work, and any irregular income. Keep a journal or use a spreadsheet to note down every dollar you make. Tracking irregular income can be challenging, but it’s essential for a complete financial picture.

Track everything you spend

To effectively track expenses, log every single purchase, no matter how small. From your morning coffee to your monthly rent, every expense should be recorded. Doing this immediately will help you avoid forgetting any transactions, ensuring an accurate and up-to-date record.

3. Categorize your expenses

Categorizing expenses helps you understand the difference between needs vs. wants, and help you bulk up your savings. Common categories for expenses include:

Housing (rent, mortgage)

Transportation (gas, public transit)

Groceries (food, household supplies)

Entertainment (movies, dining out)

Savings (emergency fund, retirement)

By separating your expenses into these categories, you can easily identify areas where you might be overspending and make necessary adjustments.

Ways you can track expenses

There are multiple ways to track your expenses, each with its own benefits and drawbacks.

Write your expenses down in a notebook

No judgment if you prefer to keep it old school. The traditional method involves writing down expenses in a notebook.

Pros | Cons |

|---|---|

No need for technology | Time-consuming |

Encourages active brain engagement | Prone to errors |

Simple and straightforward | Difficult to manage large volumes of data |

Organize expenses through the envelope system

The envelope budgeting method involves labeling envelopes with budget categories and using cash instead of credit.

Pros | Cons |

|---|---|

Visual and tangible method | Inconvenient for online purchases |

Limits overspending | Not suitable for all expenses |

Easy to understand | Requires carrying cash |

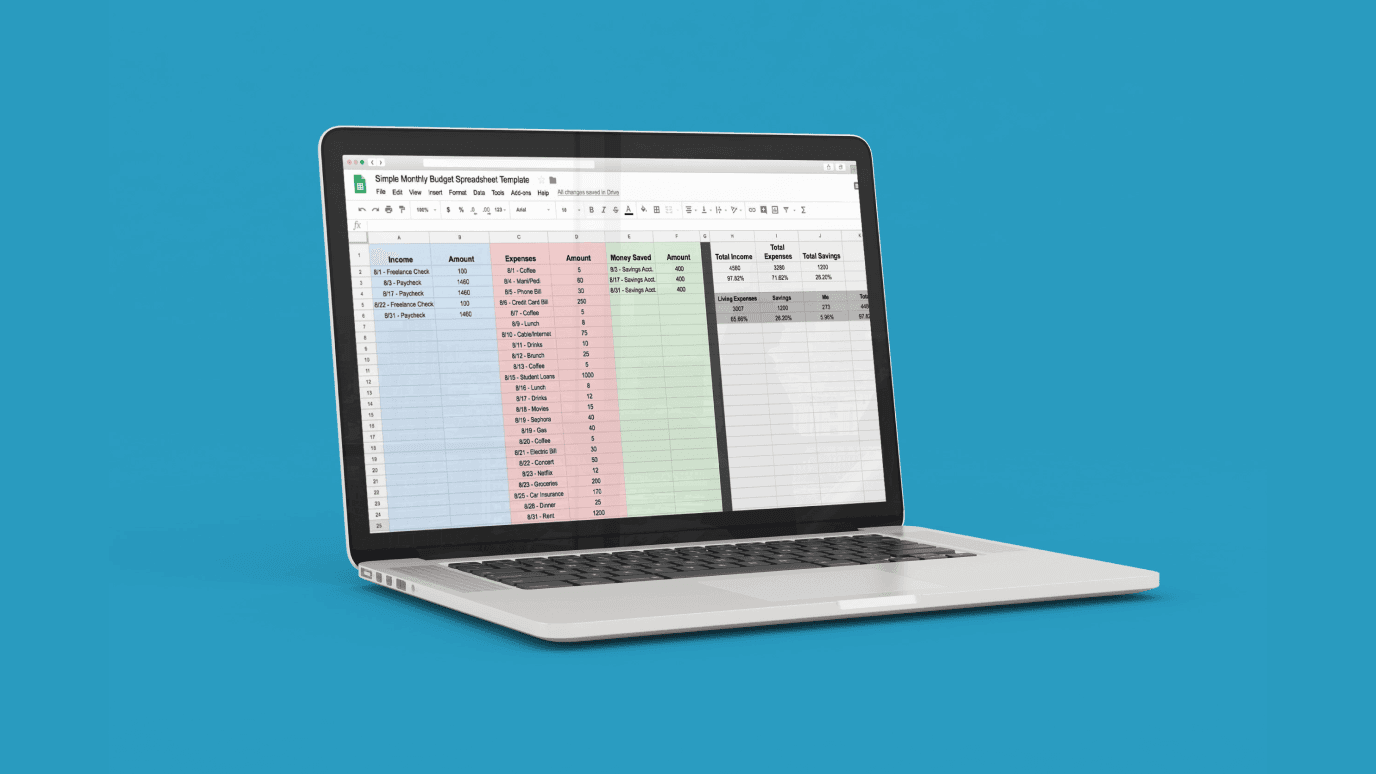

Use a budgeting spreadsheet

Spreadsheets like Excel or Google Sheets are effective for expense tracking.

Pros | Cons |

|---|---|

Customizable | Requires computer access |

Automated calculations | Can be complex for beginners |

Easily shareable | Time-consuming to set up |

Try a budgeting app

Budgeting apps like YNAB, Goodbudget, Monarch, PocketGuard, or Honeydue offer a tech-savvy solution.

Pros | Cons |

|---|---|

Convenient | Dependence on technology |

Accessible | Potential data privacy concerns |

Feature-rich | Subscription costs for premium features |

Review and adjust your budget

Your budget won’t be the same forever, so regularly reviewing your budget is crucial for staying on track. Set aside time weekly or monthly to go through your expenses and identify patterns. As you make more money, you’ll want to be mindful that lifestyle creep doesn’t make its way into your spending. If you’re overspending in certain categories, adjust your budget accordingly. Cut discretionary spending and reallocate funds to savings or debt repayment. This ongoing process will keep your budget aligned with your financial goals.

Start tracking your spending

It sounds simple, but tracking your expenses is a powerful tool for financial management. It helps you understand your spending habits, maintain a budget, save money, reduce debt, and achieve your financial goals.

Whether you prefer a notebook, the envelope system, a spreadsheet, or a budgeting app, there’s a method that will work for you. Start tracking your expenses today and take control of your financial future. The long-term benefits of consistent expense tracking and financial management are well worth the effort.

Investing made easy.

Start today with any dollar amount.

Related articles

budgeting

May 04, 2025

How to Build Credit from Scratch in 2025

budgeting

Apr 27, 2025

Who gets the insurance check when a car is totaled?

budgeting

Apr 09, 2025

How to Make Extra Income While Working Full-Time

budgeting

Apr 08, 2025

How Much Does the Average American Make?

budgeting

Apr 07, 2025

How to Calculate Monthly Income

budgeting

Mar 14, 2025

How to Budget for Large Expenses

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.