Jun 04, 2019

How to Manage Credit Card Spending

In this article:

Credit Card Spending Strategies:

Prioritize spending with cash, or a debit card. Cash is a physical thing, and you can actually see it leaving your wallet or purse when you use it for purchases. That may help you spend less.

When you use a debit card, the money comes directly from your checking account. Generally speaking, you won’t be able to spend using the card unless you have funds in the account. (Consider opting out of overdraft protection.)

If you must spend using a credit card, always try to pay off your balance in full each month. That way you won’t have to pay interest.

Interest rate

Every credit card account comes with an interest rate. It’s the amount that’s charged on any unpaid amount, or balance every month.

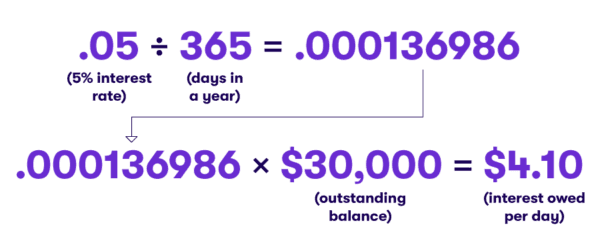

Here’s something else that’s important to know: When you have credit card debt, or an unpaid balance, the interest is charged daily. It’s called the daily periodic interest rate. Here’s an example:

Good to know: Credit card companies give you a grace period, generally between the statement closing date and the payment due date, to pay for your new charges. During that period, no interest will be charged. If you don’t pay your balance at the end of the grace period, you will owe interest. And any new charges will also accrue interest.

Investing made easy.

Start today with any dollar amount.

Related articles

borrowing

Oct 14, 2024

How To Use Personal Loans

borrowing

Oct 07, 2024

Cash Advances vs. Personal Loans: Which is Better?

borrowing

Oct 07, 2024

How To Use Cash Advances

borrowing

Oct 07, 2024

How To Pay Off a Cash Advance Quickly

borrowing

Oct 07, 2024

What To Know Before Taking a Cash Advance

borrowing

Oct 07, 2024

How to Avoid Cash Advance Fees

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.