Mar 28, 2025

How to Invest in Index Funds in 2025

Investing might sound intimidating, but building long-term wealth doesn’t have to involve managing complex portfolios or day trading. If you’re a beginner investor or a young professional looking to grow your money steadily, index funds might just be the perfect fit for you.

This guide will walk you through everything you need to know about investing in index funds, including what they are, the benefits they offer, and a step-by-step approach to get started. By the end, you’ll feel confident in taking your first steps toward achieving your financial goals.

What Are Index Funds and Why Should You Consider Them?

Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to track the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. This means that when you invest in an index fund, you’re essentially buying a small piece of the entire market or sector that the index represents.

Instead of trying to "beat the market" through frequent trading or picking individual stocks, index funds take a passive approach, aiming to replicate the performance of the entire index.

Why Consider Index Funds?

Simplicity: You don’t need to be a stock market expert. Index funds eliminate the need for constant research and monitoring of individual stocks.

Accessibility: With many platforms today, you can start investing with as little as $1.

Proven Performance: Historically, indexes like the S&P 500 have delivered solid long-term returns, making them ideal for building wealth over time.

Benefits of Investing in Index Funds

1. Diversification

Index funds provide instant diversification by investing in a wide range of companies within the index. For example, an S&P 500 index fund invests in 500 of the largest U.S. companies spanning multiple industries, reducing the risk of any single stock negatively impacting your portfolio.

2. Low Costs

Since index funds are passively managed (they simply track an index rather than actively selecting stocks), their operating expenses are much lower compared to actively managed funds. This means more of your money stays invested, helping your returns grow over time.

3. Passive Management

With index funds, there’s no need to constantly monitor the market or adjust your investments, which is perfect for beginners or busy professionals. Simply invest and allow the market to do the work.

4. Stability for Long-Term Growth

While individual stocks can be volatile, indexes usually represent the broader market's performance. Over decades, major indexes have historically demonstrated upward trends, making index funds ideal for long-term wealth building.

Step-by-Step Guide to Investing in Index Funds

Step 1: Understand Your Investment Goals

Before you invest, ask yourself these questions:

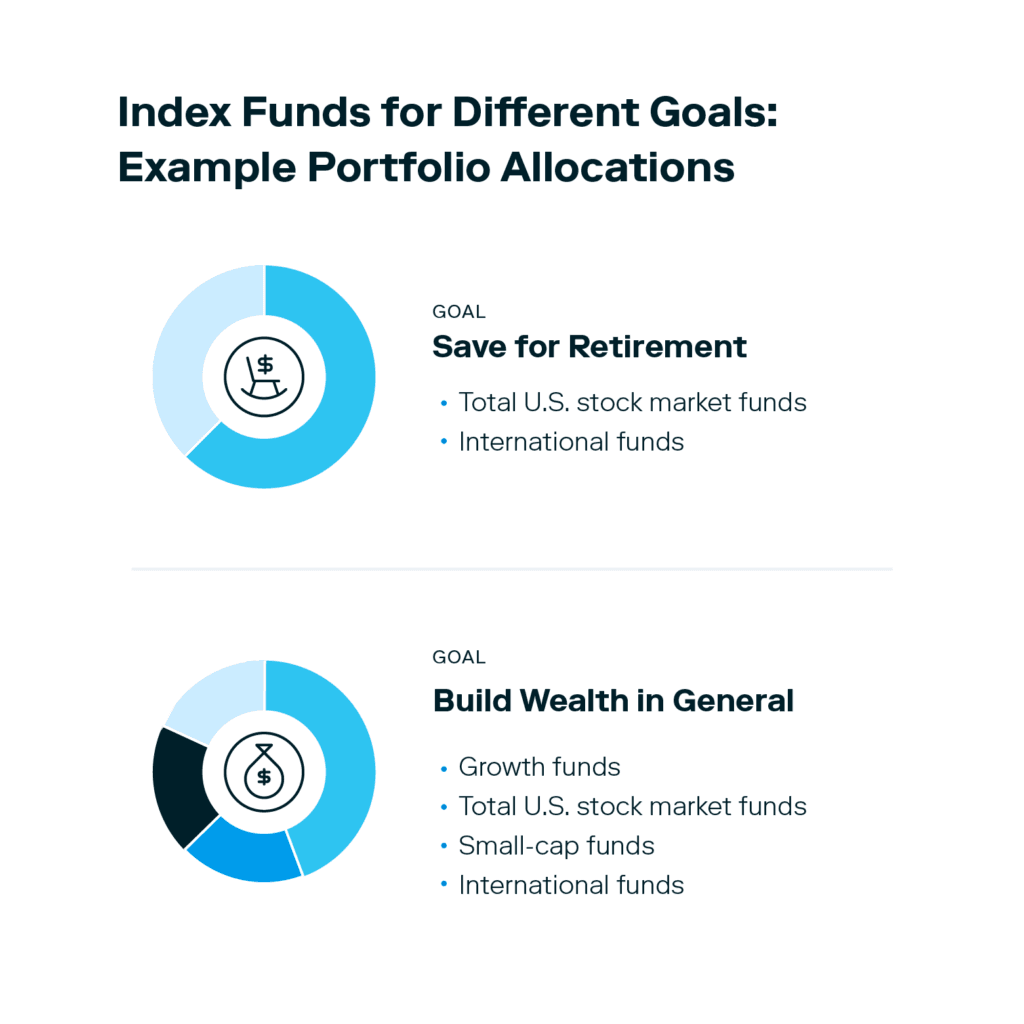

Are you investing for retirement, to purchase a home, or general wealth building?

What is your risk tolerance? (How comfortable are you with market fluctuations?)

Your answers will help guide your decisions when choosing specific index funds.

Step 2: Select a Brokerage Platform

To invest in index funds, you’ll need a brokerage account. Popular platforms like Vanguard, Fidelity, Schwab, or apps like Stash and Robinhood can help you get started easily.

Look for platforms with low fees and a user-friendly interface, especially if you’re a first-time investor.

Step 3: Research Available Index Funds

Not all index funds are created equal. Consider the following key factors before making a decision:

Expense Ratio: This is an annual fee expressed as a percentage. Lower is better (ideally under 0.20%).

Fund Performance: While past performance doesn’t guarantee future returns, it can help you see how a fund has fared over time.

Tracking Error: A fund’s ability to replicate its index. Lower tracking errors mean better alignment with the index.

Step 4: Decide on an Investment Amount

It’s okay to start small! Most platforms allow partial (fractional) investments, so you can begin with whatever amount fits your budget.

Step 5: Set Up Automatic Contributions

Automating your investments will ensure you consistently contribute over time, taking advantage of dollar-cost averaging (investing a fixed amount regularly, regardless of market conditions).

Step 6: Monitor Periodically but Don’t Overreact

Your index fund investments are designed to grow over the long term. Market ups and downs are normal, so resist the urge to make frequent changes based on short-term trends.

Choosing the Right Index Fund

Here are some popular options to consider based on their underlying indexes and purposes:

S&P 500 Index Funds: Tracks the largest 500 companies in the U.S. (e.g., Vanguard 500 Index Fund, Fidelity 500 Index Fund).

Total Stock Market Funds: Invests in a broader range of U.S. companies, from small-cap to large-cap (e.g., Vanguard Total Stock Market Index Fund).

International Index Funds: Tracks companies outside of the U.S. for global exposure (e.g., iShares MSCI EAFE Index Fund).

Sector-Specific Funds: Focuses on industries such as technology, healthcare, or clean energy.

Potential Risks and How to Mitigate Them

While index funds are generally safer than investing in individual stocks, they still come with risks.

Market Risk

Since index funds follow the market, they can lose value during market downturns. To mitigate this, hold your investments for the long term and focus on diversification.

Inflation Risk

If inflation outpaces market returns, your purchasing power could decline. Consider diversifying into inflation-hedged funds like TIPS (Treasury Inflation-Protected Securities).

Foreign Exchange Risk (for International Index Funds)

Currency fluctuations can impact returns. To mitigate this, balance international funds with domestic investments in your portfolio.

Understanding Tax Implications

Index funds are tax-efficient, but they’re not entirely tax-free.

Capital Gains: You’ll incur capital gains taxes when you sell your shares for a profit.

Dividends: Many index funds pay dividends, which are considered taxable income unless invested through tax-advantaged accounts like 401(k)s or IRAs.

To minimize your tax liabilities, consider holding your index funds in tax-deferred retirement accounts or reinvesting dividends automatically.

Start Building Long-Term Wealth Today

Index funds offer a straightforward, affordable way for beginner investors and young professionals to start building wealth. By focusing on diversification, low costs, and passive management, they allow you to grow your investments with minimal time and effort.

If you’re ready to take control of your financial future, set up a brokerage account and make your first investment in an index fund today. Remember, the key to success is consistency, patience, and a long-term outlook.

To make investing even simpler, platforms like Stash offer tools and tips to help you get started right away. Learn more and start your investment journey today.

Related articles

investing

Feb 09, 2026

Trump Accounts: Invest Early

investing

Jan 13, 2026

FAQ: Personal Portfolio

investing

Jan 05, 2026

Why did the price I bought or sold my investments at change? What are Trading Windows?

investing

Dec 11, 2025

How to Invest through the Holidays—Without the Stress

investing

Oct 23, 2025

Why Millions Are Canceling Disney+ and Hulu and What It Means for Investors

investing

Sep 30, 2025

Securities Lending

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.