Jan 29, 2024

How To Invest $1,000: 10 Smart Ways to Grow $1K in 2025

How To Invest $1,000: 10 Smart Ways to Grow $1K in 2025

Contrary to popular belief, you don’t need a ton of money to start investing or to see significant returns. Believe it or not, just $1,000 can set the foundation for a brighter financial future. If you’ve found yourself with an extra $1,000 to spare, why not invest it somewhere that can make your money work for you?

There are many low-cost investment options that can help you maximize your lump sum—and help it grow. This guide will walk you through smart and accessible ways to make the most of your $1,000 investment.

Understanding the basics of investing

Before jumping into specific strategies, it’s important to get familiar with a few key investing basics.

What is investing?

Investing means putting your money into assets that can help you grow your funds and improve your long-term financial health. When people talk about investing, they’re usually referring to assets you buy through a brokerage account, like stocks, bonds, and funds. Investing works to grow your money by earning returns through things like stock market performance, dividends, or compound interest.

Key investing terms to know

Stocks: Shares of ownership in a company. When you own a stock, you own a piece of the company that issues the stock.

Bonds: Essentially, loans you give to companies or governments for a set term that pay you back with interest.

ETFs (exchange-traded funds): A bundle of investments (like stocks or bonds) traded like a single stock on the market.

Investment portfolio: A collection of all the investments you own across all your investment accounts.

Diversification: Spreading your money across different investments to reduce risk.

You can also think of investing more broadly as doing things that will improve your future financial outlook, such as putting money in a savings account that earns a high interest rate or taking actions that increase your earning potential.

Understanding these concepts will help you make confident decisions about how to invest $1,000 to best align with your financial goals. Now, let's explore some options to put your money to work for you.

10 smart ways to invest $1,000

1. Deal with debt

Best for: Those with high-interest debt or loans

The least glamorous but necessary answer to “how should I invest $1,000” should start with paying off any high-interest debt you have.

Consider this—you could be paying 30% interest on a high-interest credit card, but you might not ever find an investment that pays 30% in returns every year. And even if you have lower interest rates, they may still exceed the returns you could earn on an investment. The mounting interest can plummet you further into debt at a rapid speed, eating away at your ability to save, invest, and build wealth.

While dealing with debt may not be the most exciting $1,000 investment, it’s something that will move you closer to financial security and freedom. Your debt may be far more than what $1,000 can cover, but chipping away at it as much as possible is a smart priority if you want to build long-term wealth.

Investor tip: If you don’t have any debt (congratulations!) but haven’t yet built up an emergency fund, prioritize building one. When the inevitable unexpected expense arises, whether it’s replacing a car engine or an unforeseen medical emergency, an emergency fund can give you peace of mind—and prevent you from having to use a credit card to cover the costs. |

|---|

2. Open a high-yield bank account

Best for: Reaching short-term goals and building an emergency fund

If you’re looking for how to invest $1,000 to earn money in the short term, a bank account that earns high interest can be a wise move. Stock marketing investments can be volatile, making them better suited to long-term goals. On the other hand, you generally can’t lose money in a bank account, and you don’t have to worry about keeping funds invested for multiple years (or even decades) to avoid taking a loss.

Traditional savings accounts tend to offer pretty low interest rates. To help your $1,000 generate more earnings, consider financial vehicles that pay a higher interest rate.

High-yield savings accounts: These accounts work like a traditional savings account, but offer a much higher interest rate. Some limit you to six withdrawals a month, but many have no restrictions on how often you can take funds out of your account.

Money market accounts: These accounts are like a hybrid of a checking and a savings account. They tend to offer better interest rates than a traditional savings account, and come with the ability to write checks or use a debit card, making it even easier to access your money when you need it.

Certificates of deposit (CDs): With a CD, you deposit money up front for a set amount of time (called the term), and earn a fixed interest rate for the entire term. While you can’t add funds, and you’ll incur a penalty if you withdraw money early, you can earn a much higher interest rate with this kind of account.

Some of these bank accounts may come with downsides—like minimum required balances, maintenance fees, or limitations on withdrawals—but there are also benefits.

Pros | Cons |

|---|---|

Security thanks to FDIC insurance | Potential fees |

Quick and simple to open | Possible lower returns over the long term |

Easy to access your money | Some accounts restrict withdrawals |

Higher interest rates than traditional savings accounts | Interest rates may not keep up with inflation or stock market returns long term |

Investor tip: Whichever assets you choose, it’s usually wise to protect your portfolio with a diverse investment strategy. A single investment in an ETF can provide diversification and the flexibility you need to stay defensive as your portfolio grows. |

|---|

3. Invest in low-cost ETFs

Best for: First-time investors

If it’s your first time investing, you may want to invest $1,000 in an exchange-traded fund (ETF). A beginner-friendly alternative to traditional mutual funds, ETFs contain a mix of stocks, bonds, and other securities, giving you access to a broad range of asset classes within a single fund.

ETFs offer an inexpensive way to instantly diversify your portfolio across a variety of investments, and many come with low (or no) investment fees, making them an affordable pick. Be sure to read up on the ETF you’re considering, so you’re aware of its holdings, expense ratio, and fees.

Pros | Cons |

|---|---|

Lower fees if passively managed | Fees can be higher for actively managed ETFs |

Built-in diversification | Diversity not guaranteed if ETF is concentrated in a single segment or asset class |

More flexible than mutual funds: intraday trading allowed (trades on the market during the day like stocks or bonds) | May have lower dividend yield |

4. Invest in stocks with fractional shares

Best for: Diversifying your portfolio for a small amount of money

Instead of investing $1,000 in stocks that you pick individually, consider fractional shares instead. Fractional shares let you purchase a small piece of a whole stock that might otherwise be out of your budget—for example, if you’re eyeing a stock that costs $2,000, you could purchase a fractional share of that stock for, say, $100.

Not only do fractional shares make investing in big-name company stocks (like Apple, Amazon, or Microsoft) more accessible, but they also allow you to spread your investment dollars across a wider variety of securities—creating more opportunities to diversify your portfolio, even if you’re starting small.

To invest in fractional shares, simply find a brokerage firm that offers them (not all do) and purchase them like you would any other security, like whole shares of stocks, mutual funds, or ETFs. You should check if there are fees for purchasing fractional shares as that may take away from the amount you have available to invest.

Pros | Cons |

|---|---|

Start investing with an amount that fits your budget | Limits on when, how, and what you can sell |

Get access to more expensive stocks | Fees for trading fractional shares |

Invest in stocks that match your interests and strategy | Typically lower dividend income and profits |

5. Build a portfolio with a robo-advisor

Best for: New investors who want support choosing the right investments

A robo advisor is an automated investment manager that builds and manages your portfolio on your behalf using algorithm-driven technology. New investors are increasingly turning to robo-advisor platforms to take advantage of a managed portfolio for far less than what you’d pay at a traditional brokerage firm with human advisors.

When you invest with a robo-advisor, you’ll start by sharing information about your risk tolerance, time horizon, and financial goals. Your robo-advisor will use that information to craft a personalized investment portfolio tailored to your preferences.

You can start investing with many robo-advisors for as little as $5, so $1,000 is beyond sufficient if you want to get started. As far as what to invest in, you can invest in many of the investment ideas listed in this article, but ETFs and stocks are great starting points. You may decide to put $1,000 into a single ETF, or you could pick and choose individual stocks—and if you don’t know what to choose, that makes a robo-advisor all the more suitable for you.

Pros | Cons |

|---|---|

Lower fees than human advisors | Limited flexibility with certain platforms |

Low-to-no minimum balances | No face-to-face human advisors |

Quick and easy to get started | Less personalization than a human advisor may offer |

6. Contribute to a 401(k)

Best for: Saving for retirement

If you haven’t opened a retirement account and your employer offers one, you could be missing out on a serious wealth-building opportunity. An employer-sponsored retirement account like a 401(k) may be one of the best $1,000 investments you could make.

A 401(k) is a tax-advantaged retirement plan that an employer offers to its employees, often along with an employer match program. The money in the plan is invested, like the money in an IRA, but the employer decides what options are available.

That matching program is what makes a 401(k) such a great investment—if your employer offers one, they may match your contributions up to a certain percentage. That’s free money! If you’ve been wondering how to invest $1,000 and double it, a 401(k) can help you get there—and to truly make the most of this investment, contribute enough to get the entire amount of your employer’s matching contribution.

As a reminder, 401(k) contributions must be made through payroll contributions. If your $1,000 is currently located in a bank account, you may choose to increase your payroll contributions by $1,000 for a month. This will reduce your take-home pay; however, you can replace that income with the $1,000 from your bank account in order to pay your monthly bills. This way you’re essentially shifting that $1,000 from your bank into your 401(k) account for the associated benefits.

Pros | Cons |

|---|---|

Employer matching contributions | Fewer investment options |

Pre-tax contributions and tax-deferred growth | Potential for higher taxes, as tax benefits aren’t guaranteed |

High contribution limits | Strict withdrawal rules and penalties for withdrawing your funds before the age of 59½ |

7. Contribute to a Roth IRA

Best for: Those who want tax-free income in retirement

A Roth IRA is another type of retirement account to consider. People often opt for a Roth IRA for a few reasons, like when their employer doesn’t offer matching contributions for a 401(k), they’ve already maxed out the 401(k) contribution limit, or if their employer doesn’t offer a 401(k).

Unlike a 401(k), IRAs are not employer-sponsored, so there’s no company match to take advantage of. Roth IRAs are also funded with post-tax dollars—or the money you’ve already paid income tax on—so you don’t get a tax deduction now.

But the flip side is that you won’t have to pay any taxes at all on your earnings as long as you don’t withdraw them before age 59½. This allows your money to grow tax-free.

As you continually make contributions, the goal is that the value of your investments will increase over time. You can invest Roth IRA funds in just about any security, like stocks, bonds, mutual funds, and ETFs. You can open a Roth IRA with any standard brokerage that offers them.

Pros | Cons |

|---|---|

Tax-free growth | Must pay taxes up front |

Tax-free withdrawals | Income limits |

Penalty-free withdrawals of contributions (not earnings) at any time | Contribution limits |

Investor tip: There are two types of IRA accounts: a Roth IRA and a traditional IRA. The main difference is that traditional IRAs are funded with pre-tax dollars, which can lower your tax liability now, and the money grows tax-deferred. When you make qualified withdrawals after age 59½, you’ll pay income taxes on your contributions and earnings. |

|---|

8. Participate in peer-to-peer lending

Best for: People seeking regular passive income

Peer-to-peer lending allows investors to loan money to individuals without going through a financial institution. Instead, you can sign up for a peer-to-peer lending platform and make your $1,000 available as a loan. An individual or business can then borrow that money and pay you back with interest through the platform. You’ll generally be paid what you earn every month, which makes peer-to-peer lending a source for ongoing passive income.

Some investors get excited by peer-to-peer lending because the return can often be much higher than a high-yield savings account. However, this strategy does come with risks: the platform may charge high fees that eat into your returns, and if a borrower defaults on your loan, you could lose your money.

Pros | Cons |

|---|---|

Potentially higher returns | Possible defaults |

Passive monthly income | Platform fees |

Control over types of loans you fund | Lack of liquidity |

9. Start a side business

Best for: Aspiring entrepreneurs

If you’ve ever dreamed of owning your own business or transforming a hobby into a money-making venture, you could take this opportunity to invest in making that aspiration into a reality.

With $1,000, you could lay the foundation for a profitable side hustle. Whether it’s designing custom products, launching a small online store, or offering freelance services, the initial investment can go toward materials, marketing, or essential startup tools to get your business off the ground. And with hard work and good fortune, you may be able to grow your business into a successful enterprise that eventually becomes your full-time vocation.

You’ll need to ensure you have enough time to devote to your side business. That includes creating your products or services as well as things like marketing and operations. And keep in mind that you’ll owe taxes on any money you make, so set aside a portion of your income to pay them so you’re not blindsided by a high bill at tax time.

Pros | Cons |

|---|---|

Turning a passion into profit | Large time investment |

Flexibility | Need to handle payroll taxes |

Potential for long-term success | Can take time to turn a profit |

10. Invest in your future self

Best for: Those who want to learn a new skill or improve their overall well-being

Sometimes, the best investment is in your own growth—especially in the realm of your career or education. While this may not be what people traditionally think of as investing, it could easily be a valuable $1,000 investment opportunity if it allows you to enhance your earning potential by landing a promotion or new job with a higher salary.

There are countless ways to use $1,000 to invest in yourself. For example, you could expand your skill set to be qualified for higher-paying jobs or a more lucrative industry. You might take an online course, earn a certification, or apply for a degree program. Another option is to hire a career or business coach to help you map out a stable and rewarding career path.

Investing in yourself doesn’t have to be career-related either—perhaps you put it towards mental health services like a therapist, or use it to dive into a hobby you’re passionate about.

While these ideas won’t technically earn you money directly or immediately, improving your skills or your mental health can make a big impact on your overall well-being or earning potential—and that can set you up for a stronger future. Don’t overlook the potential ROI of investing in yourself!

The importance of diversification

When deciding how to invest $1,000, avoid putting all your eggs in one basket. Diversification protects your money by spreading it across different types of financial vehicles—such as stocks, bonds, funds, and even bank accounts—so if one investment underperforms, others can help balance the risk.

For example, you could divide your $1,000 like this:

$300 in a high-yield savings account for liquidity

$400 in a tax-advantaged retirement account

$300 in individual stocks or ETFs for growth potential

By spreading your money among different types of accounts and investment vehicles, you'll be better equipped to handle fluctuations in the market and improve your chances of consistent growth over time.

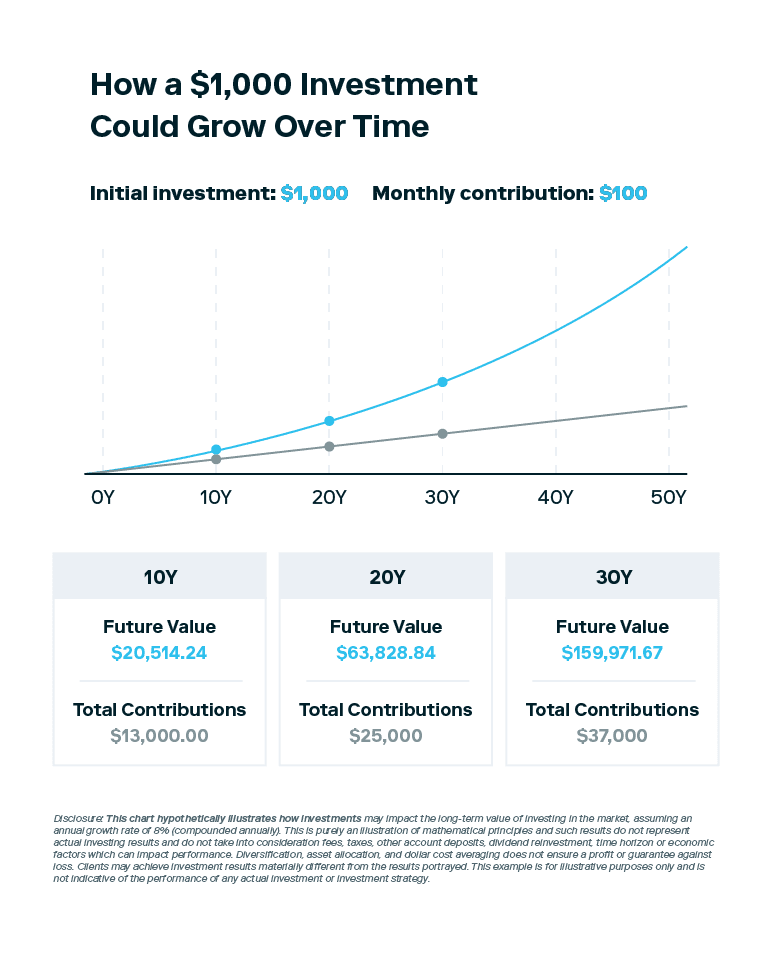

Tips for long-term growth

The whole idea of investing is to make your money work for you. Instead of spending your $1,000 or letting it sit idle in your checking account, investing can help grow your money for the future. Investments made today can gain value over time, especially when you follow a long-term strategy. Here are some pointers to ensure your $1,000 continues to grow:

Be patient: The market can be volatile in the short term, but history shows that steady, long-term investments usually yield positive results.

Reinvest earnings: If your investments generate dividends, reinvest them instead of cashing out to maximize compound growth.

Set clear goals: Define your financial goals before investing. Are you saving for a house down payment? Building up a retirement fund? Your goals will shape your investment choices.

Stay educated: The financial world is always evolving. Continue increasing your financial literacy by reading blogs and news sites, listening to podcasts, and following finance-focused brands or influencers. The more you learn, the more confident you’ll become in your investment decisions.

Start growing your $1,000 today

When you explore how to invest $1,000, you’ll discover lots of ways to set your financial future in motion. Getting out of debt, investing in the stock market, saving for retirement, investing in yourself… every pathway can help you work toward financial stability and long-term goals.

Investing long-term is an incremental process, and the truth is, you really don’t need lots of money to start investing. Regardless of how much you can invest right now or how much money you earn, it’s possible to start on the path toward growing your future wealth today.

The bottom line of how to invest $1,000 dollars? It doesn’t matter as much how you invest it—what matters most is that you do.

Have a little more money on hand? Learn how you could invest more:

FAQs about how to invest $1,000 dollars

Still have questions about how to invest $1,000? Find answers below.

Is $1,000 enough to start investing?

Yes. While $1,000 is a relatively small sum of money, investing on a regular basis—even just $30 or $100—is worthwhile. Successful wealth-building depends on investing regularly and consistently, not on whether you have a huge amount to invest at this moment.

How can I invest $1,000 dollars for a quick return?

In general, avoid attempting to earn a quick return with a $1,000 investment, as this generally involves high-risk investments that could leave you with nothing.

However, dividend stocks that offer regular cash payouts are a good option if you want immediate positive returns. Alternatively, short-term investments like short-term bonds, certificates of deposit, or high-yield savings accounts are safer options for short-term earnings.

How can I invest $1,000 dollars and double it?

If your employer offers a 401(k) with matching contributions, it’s entirely possible to double your $1,000 investment. How much money your company matches will vary, but many offer to match half or even all of your contributions. If they offer 100% matching, you can double your money in no time.

Related articles

investing

Feb 09, 2026

Trump Accounts: Invest Early

investing

Jan 13, 2026

FAQ: Personal Portfolio

investing

Jan 05, 2026

Why did the price I bought or sold my investments at change? What are Trading Windows?

investing

Dec 11, 2025

How to Invest through the Holidays—Without the Stress

investing

Oct 23, 2025

Why Millions Are Canceling Disney+ and Hulu and What It Means for Investors

investing

Sep 30, 2025

Securities Lending

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.