Mar 21, 2025

How to Diversify Your Investment Portfolio

When it comes to growing wealth and ensuring financial security, diversification is one of the most important strategies you can apply to your investment portfolio. Think of it as not "putting all your eggs in one basket." By spreading your investments across multiple asset classes, markets, and industries, you can reduce risks and increase the likelihood of long-term financial growth.

If you’re just starting out or looking to refine your existing strategy, this guide will take you through the essentials of investment diversification, helping you protect your assets and make smarter financial decisions.

Why Diversification Matters

Diversification isn’t just an industry buzzword; it’s a core principle of sound investment strategy. Why? Because markets are unpredictable. Even the most rock-solid stocks or industries can experience downturns. Diversifying your portfolio spreads out these risks so that underperformance in one area doesn’t jeopardize your entire portfolio.

For instance, during economic downturns, stocks may falter, but safe-haven assets like bonds or commodities (e.g., gold) often rise in value. A diversified portfolio can act as a cushion, balancing losses in one area with gains in another.

Section 1: Understanding Asset Classes

To build a truly diversified portfolio, you need to understand different asset classes and how they operate. Each offers distinct advantages and risks.

Stocks

Stocks are ownership stakes in a company. They offer the potential for high returns but come with greater risks, as stock prices can fluctuate depending on market conditions or company performance.

When diversifying your stock investments, consider factors like industry, geographic location, and market capitalization (e.g., small-cap vs. large-cap stocks). Adding international stocks or ETFs (Exchange-Traded Funds) can further insulate your investments from economic shifts in specific regions.

Bonds

Bonds are essentially loans you provide to governments or corporations in exchange for regular interest payments. They’re considered low-risk compared to stocks, making them a great stabilizer in your portfolio.

For a diversified portfolio, aim to include different types of bonds, such as:

Government Bonds (e.g., U.S. Treasury bonds)

Corporate Bonds (issued by companies)

Municipal Bonds (issued by local governments)

Bond yields tend to be inversely related to stock performance, providing balance during stock market volatility.

Real Estate

Real estate investments can offer consistent cash flow through rental income and potential property value appreciation. You can gain exposure to real estate without directly owning property by investing in REITs (Real Estate Investment Trusts).

REITs allow you to invest in property markets worldwide, making them a great diversification tool in your portfolio.

Commodities

Commodities, such as gold, silver, oil, and agricultural products, are physical assets often used as hedges against inflation or economic instability. For example, gold prices tend to rise during uncertain times, offering additional risk protection.

You can invest in commodities directly or through ETFs or mutual funds that focus on commodity markets.

Section 2: Building a Diversified Portfolio

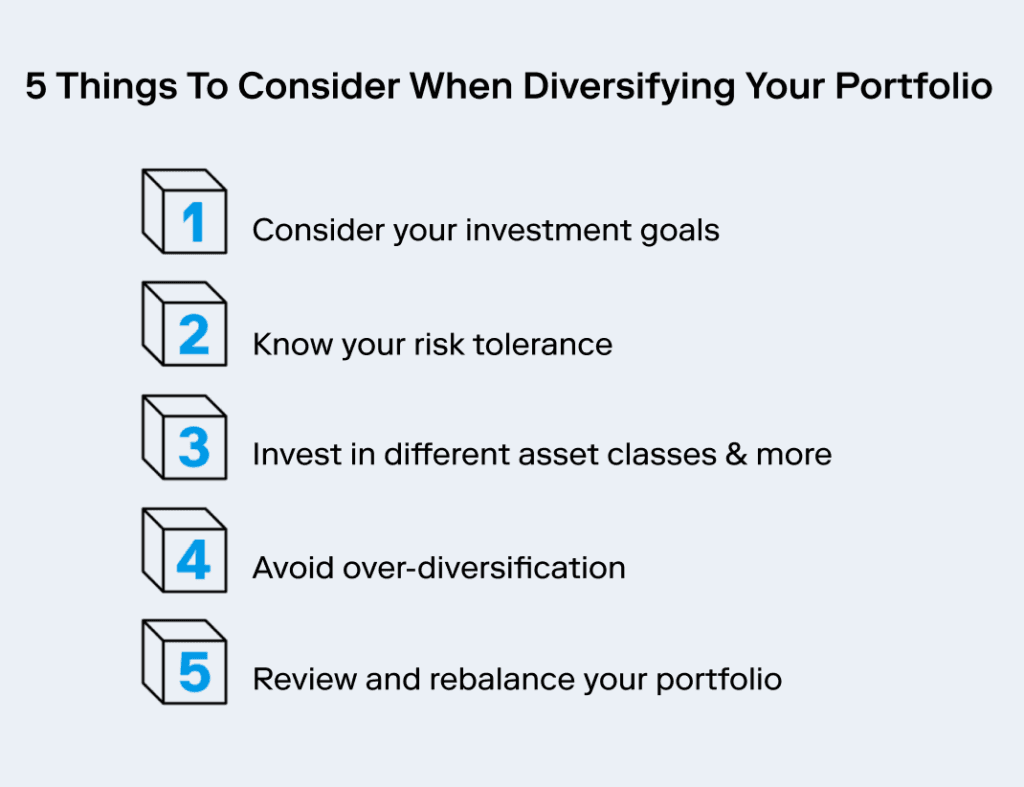

Now that you understand the different asset classes, it’s time to start building your diversified portfolio.

Assessing Risk Tolerance

Understanding your personal risk tolerance is critical before making investment decisions. Risk tolerance refers to how much risk you’re willing to accept in pursuit of financial returns. Generally, younger investors with longer time horizons can take on more risk, while older investors may prefer safer investments.

Ask yourself these questions:

How do I react when markets drop?

Do I want long-term growth or short-term stability?

What’s my financial goal in the next 5, 10, or 20 years?

Aligning your portfolio with your risk tolerance ensures you’ll stick with your strategy during market highs and lows.

Setting Investment Goals

Clearly defined investment goals provide direction and focus. Are you saving for retirement? Building an emergency fund? Or working toward buying a home?

Your goals will influence how you allocate assets within your portfolio. For example:

Retirement Savings priorities may include long-term growth through stocks while staying diversified with some bonds.

Short-Term Goals like saving for a home might lean toward lower-risk investments like bonds and money market funds.

Asset Allocation Strategies

Asset allocation refers to how you divide your investment portfolio across different asset classes.

A simple rule of thumb for a balanced portfolio is the "100 minus your age" rule. For example, if you're 30 years old, you might keep 70% of your portfolio in stocks and 30% in bonds.

Beyond this, ensure you're allocating across industries and geographies. For example, global index funds or ETFs can spread your investments across developed and emerging markets.

Section 3: Monitoring and Adjusting Your Portfolio

Diversification isn’t a one-and-done process. It requires consistent monitoring and adjustments to ensure your portfolio evolves with market trends, your goals, and your risk tolerance.

Regular Reviews

Take time to review your portfolio at least once or twice a year. Analyze the performance of your investments and check if the current allocations align with your goals.

Tools like online brokerage platforms or investment apps can simplify this process, providing real-time insights into your portfolio's performance.

Rebalancing

Over time, certain assets in your portfolio may outperform others, resulting in misaligned asset allocation. For example, strong stock performance might increase your stock holdings beyond your target allocation.

Rebalancing involves selling overperforming assets and reinvesting in underperforming ones to restore your desired allocation. Regular rebalancing prevents overexposure to certain asset classes.

Adapting to Market Changes

Markets evolve, and so should your portfolio. Economic conditions, interest rates, and technological innovations can impact the performance of asset classes. Stay informed about changes in global and local markets, and adjust your portfolio accordingly to remain competitive.

The Path to Financial Security Through Diversification

Diversifying your investment portfolio isn’t just about minimizing risk; it’s about building a resilient and sustainable strategy that aligns with your financial goals. By understanding asset classes, setting clear investment objectives, and regularly monitoring your portfolio, you can position yourself for long-term success.

Remember, diversification doesn’t guarantee profits, but it does significantly lower the potential for catastrophic losses. Whether you’re new to investing or seasoned in trading, the key lies in understanding your unique needs and making informed decisions.

Take your first step toward smarter investing today and explore tools like [Brand Name] to simplify the process. By being proactive and disciplined, you’re well on your way to achieving financial security and peace of mind.

Related articles

investing

Feb 09, 2026

Trump Accounts: Invest Early

investing

Jan 13, 2026

FAQ: Personal Portfolio

investing

Jan 05, 2026

Why did the price I bought or sold my investments at change? What are Trading Windows?

investing

Dec 11, 2025

How to Invest through the Holidays—Without the Stress

investing

Oct 23, 2025

Why Millions Are Canceling Disney+ and Hulu and What It Means for Investors

investing

Sep 30, 2025

Securities Lending

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.