Mar 11, 2024

How to Build Credit: Why You Need It and How to Get It

Establishing and building credit in today’s world can be an essential component of setting yourself up for financial success. A good credit score can:

Make it easier to rent an apartment

Qualify you for a lower interest rate on a car or house loan

Improve your chances of being approved for a credit card or loan

Qualify you for lower auto insurance rates

In some cases, get a job

Because many institutions look at your credit as a way to assess risk, having no credit history can be as challenging as having a bad credit history.

If you’re not sure how to build credit, you’re not alone. The Consumer Financial Protection Bureau (CFPB) reports that approximately 1 in 10 American adults lack a credit record; that’s 26 million people. Another 19 million Americans have a credit record but no credit score because their credit history is either out of date or too thin to show up on a credit report (source).

If you’re starting from scratch, figuring out how to build credit doesn’t have to be complicated. Here are some simple credit-building steps you can take to get started.

Build credit with a credit card

Opening a credit card can be one of the fastest ways to build credit if you use your card wisely. But how can you get approved if you have little to no credit history? There are a few options to make it more accessible:

Get added as an authorized user: A family member or significant other can add you as a user on their credit card; that card’s payment history will then be added to your credit report

Open a student credit card: Many financial institutions offer this type of card for college students, who are attempting to build credit for the first time.

Open a secured credit card: This type of credit card is backed by a cash deposit you make upfront

If you’re not a college student and it’s not practical for you to become an authorized user on a family member’s card, that’s okay. Those solutions aren’t available to everyone. So let’s focus on building credit with a secured credit card.

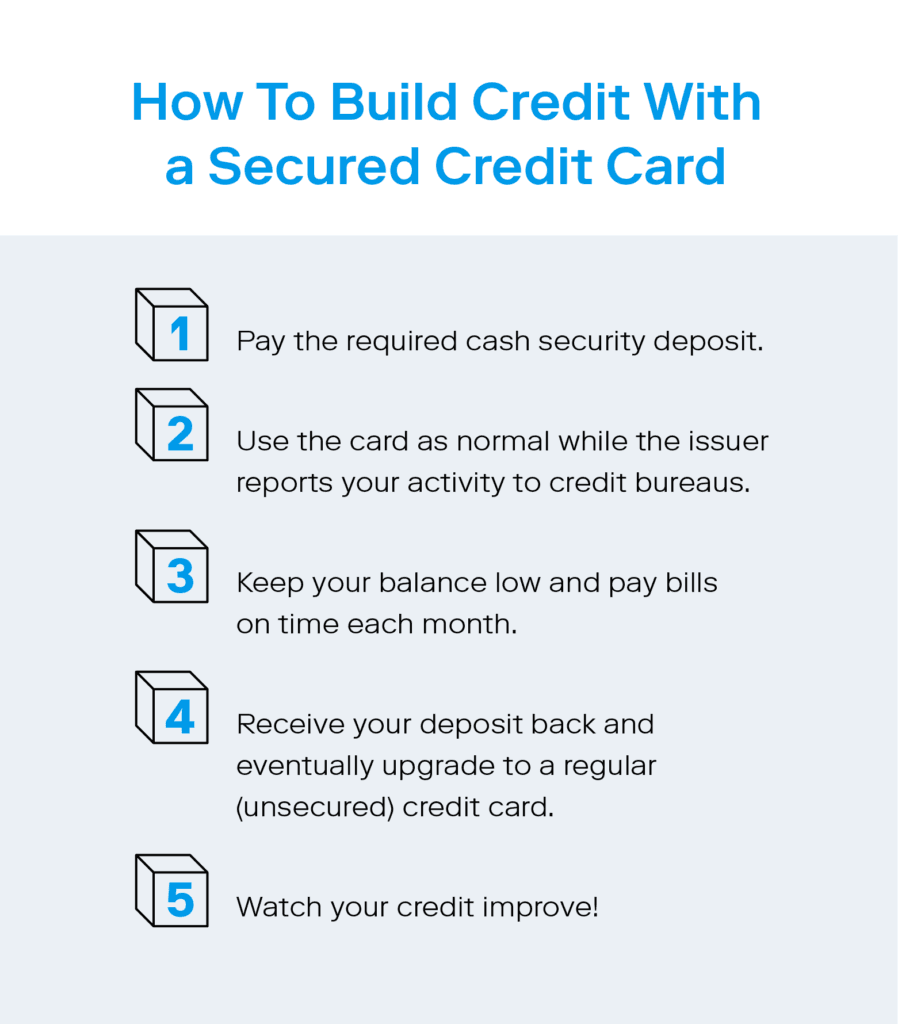

Get a secured credit card

A secured credit card functions like a standard unsecured credit card, with one major difference: you deposit cash when you open the card, which serves as collateral if you’re unable to make your payments. Generally, your secured card’s credit limit will be equal to the amount of your deposit. A secured credit card is not the same as a debit card; any money you charge to your card is a debt you have to pay back, and you’ll have to pay interest on any balance you don’t pay off each month.

Because the card issuer shares information about your credit usage with credit reporting agencies, regular responsible usage can help build up your credit history. Visa, Mastercard, and nearly all of the leading credit card lenders offer a secured card option. You can also inquire at your bank or credit union about applying for a secured credit card.

Keep your card balance low

Your card’s available credit limit is the maximum balance you can have at any given time, but just because you can borrow up to the limit doesn’t mean it’s a good idea. One factor that credit agencies use to calculate your credit score is credit utilization. That’s the amount of credit you have available compared to your balance. Generally speaking, using more than 30% of your available credit at one time can hurt your credit score. For example, if your credit limit is $1,000, keeping your balance below $300 is a good guideline. This shows the lender that you can practice self-control and limit your spending to your needs.

Another important reason to keep your balance low is to avoid spending money on interest or running up debt you can’t pay off without squeezing your budget. Think of your credit card as a convenient way to pay for everyday things you know you can pay off within your billing cycle, not a long-term loan.

Best practices for keeping your card balance low:

Keep your credit utilization at 30% or less

Make more than one payment per billing cycle

Don’t use your card to buy more than you can afford to pay off every month

If you can’t pay your full balance each month, at least pay more than the minimum

Set up automatic monthly payments

Payment history makes up about 35% of your credit score, so delinquent payments can quickly turn your efforts to build credit into creating bad credit. Additionally, late credit card payments are often subject to fees or penalties, so you’ll end up owing even more the next month.

Setting up automatic monthly payments ensures you won’t miss the crucial deadline. Most cards give you several options for autopay, such as the minimum balance, a fixed amount, or the entire credit card balance each month.

Tip: Put the date of your autopay on your calendar and keep an eye on your bank balance so you’re confident you have enough money to cover the payment when it processes. |

|---|

Request a credit limit increase

Increasing your credit limit without increasing your spending lowers your credit utilization ratio, which could benefit your credit score. After you’ve established a track record of on-time payments, your credit card company may be willing to increase your credit limit. If you have a secured card, you might have to add additional funds to your security deposit, but not always. In some cases, the institution might even automatically increase your credit limit after a certain period of time. A higher limit does not mean you need to or should spend more on your credit card, it simply means you are able to. Since credit utilization is an important part of developing a good credit score, it’s worth calling your institution to ask about your options.

Open a second credit card

Once you’ve been using your secured credit card responsibly for about a year, you may be eligible to upgrade to an unsecured card. With your credit history established, there might be many more options for cards you could qualify for, so shop around to find the right one for you. Consider factors like the interest rate and whether the card has an annual fee. Some credit cards even offer added benefits like points or cash back that might interest you.

When you open a new credit card, it may be wise to stop using your first card so you don’t have to keep track of balances and bills for multiple credit cards each month. But don’t close that account. Credit reporting bureaus look at the age of your accounts when calculating your credit score; the longer an account has remained open and in good standing, the more it works in your favor. Essentially, older credit accounts give more credence to your credit history than new credit.

Tip: If you have a small, recurring charge each month for something like a subscription service (ie. Spotify, Netflix, etc.), use your old card for that one bill. This will keep the card active so that your credit card issuer doesn’t close the account based on inactivity. |

|---|

Build credit without a credit card

Responsible use of a credit card is one of the best ways to establish your credit history, but it’s not the only path. It’s possible to build new credit without a credit card through a credit builder loan or by leveraging your rent and utility payments.

Apply for a credit builder loan

A credit builder loan (CBL) is a type of personal loan made specifically to help borrowers build credit history and improve their credit scores. Here’s how it works: Instead of the bank loaning you a lump sum that you repay over time like a standard loan, your lender will hold the loaned money in a secured savings account until the loan is repaid. You make fixed monthly payments and then get the principal back at the end of the loan term.

Research shows that opening a CBL can increase your likelihood of establishing a favorable credit score by 24% and increase existing credit scores by 60 points or more, depending on your individual financial situation. While CBLs are not as common as other types of loans, you may be able to establish one with your bank or credit union.

Keep in mind that, just like with credit cards, making your payments on time is crucial; late payments reflect poorly on your credit score. And you’ll likely pay interest on the money you borrow, though some institutions will credit you back some of the interest after you’ve paid off the loan.

Leverage your rent and utility payments

If you pay your rent and utilities on time every month, you might be able to use your good payment history to build credit. These kinds of payments aren’t automatically shared with credit reporting agencies, but all three major credit bureaus, Equifax, Experian, and TransUnion, will include rent and utility payment information in credit reports if they receive it.

You can’t report your payments to the bureaus yourself, and landlords and utility companies often won’t do so on your behalf because they have to pay a fee. The good news is that there are many rent-reporting services that will verify and report your payments.

The options offered by these services and the fees they charge vary, so comparison shop to find the right one for you. Some just report rent, while others will also include various types of utilities. Some will also report your past payments, which can be a benefit if you’ve always paid on time. You’ll also want to find out which bureaus the service reports to, as not all of them include all three agencies.

If you use a rent-reporting service to help build credit, remember that consistent on-time payments are essential if you want a positive impact on your credit score.

Take your time and watch your numbers climb

Building credit takes patience and diligence; after all, it’s called credit history for a reason. It can take six months or more to generate your first credit score after you get started with a credit card or CBL loan. Having only that new credit won’t necessarily get you to a high credit score; keeping accounts in good standing over a longer period of time, maintaining a low credit utilization ratio, and making all your payments on time are key to increasing your score over time.

As you put your plan for how to build credit into action, keep an eye on how your credit score is affected. You can get a free credit report once a year from all three of the major credit reporting bureaus; check it to see your progress and make sure no issues bring your credit score down. If you want to keep an even closer eye on your progress, a free credit score app will give you a more frequent look at your credit report, and many offer personalized tips for improving your credit score. And remember: building credit is just one piece of the puzzle. Your budget, savings, and investments are also core components of working toward a brighter financial future.

Investing made easy.

Start today with any dollar amount.

Related articles

borrowing

Oct 14, 2024

How To Use Personal Loans

borrowing

Oct 07, 2024

Cash Advances vs. Personal Loans: Which is Better?

borrowing

Oct 07, 2024

How To Use Cash Advances

borrowing

Oct 07, 2024

How To Pay Off a Cash Advance Quickly

borrowing

Oct 07, 2024

What To Know Before Taking a Cash Advance

borrowing

Oct 07, 2024

How to Avoid Cash Advance Fees

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.