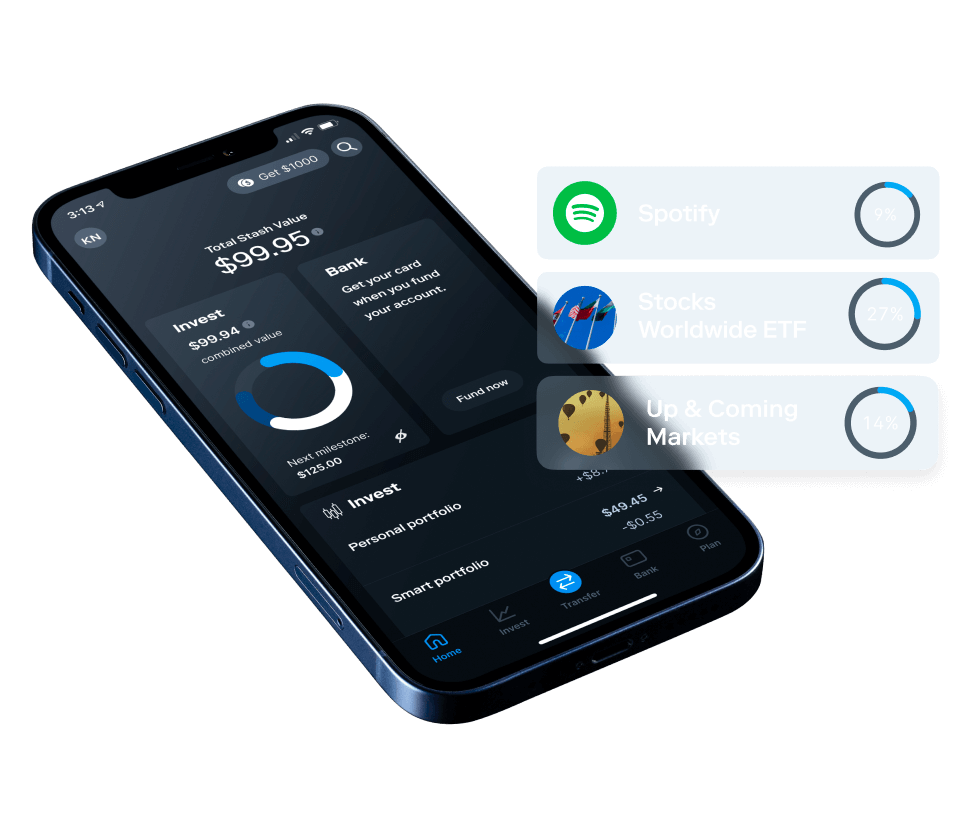

You’re in control.

Choose from thousands of investments and get started at any amount.

Disclosures

ETFs

Exchange-traded funds (ETFs) allow you to invest in many companies, bonds and other assets all at once.

Learn more →Here’s how we set you up for

investing success.

The Stock-Back® Card.1

Get the debit card that rewards you with bonus stock.

Recurring investments.

Just tell us how much and how often to auto-invest—we’ll do the rest.

Dividend Reinvestment.

Invest in companies or funds that pay dividends and we can instantly reinvest them for you.

Stock Round-Ups.13

Automatically turn your spare change into real wealth.

Invest anywhere.

Buy, sell, and manage your investments online or from our easy-to-use app.

Personalized guidance.

Get advice on how to start investing and recommendations on diversifying your portfolio.

See what Stashers are saying:

Best investing app there is! I love it.” 14

I’ve received $224 in stock back this year. I love my Stash [Stock-Back] Card.” 1,14

Love the app! It started a completely new chapter of my life.” 14

One subscription.

More ways to invest.

Smart Portfolio

The stress-free way

to invest automatically.7

We can invest for you based on your goals and risk level. The best part? It's already included in your subscription.

Learn more →Retirement Accounts

Own your tomorrow.

Invest in your retirement with a tax-advantaged traditional or Roth IRA—it’s part of your subscription.

Learn more →Custodial Accounts

Unlock generational wealth.

Give the gift of wealth with a custodial account from Stash.

Learn more →

We’re invested in you.

Stash is on a mission to make investing affordable and easy for everyday Americans.

We’re a Registered Investment Advisor (RIA) and fiduciary—which means we provide unbiased, personalized advice and educational tools that put your interests first.

You're safe with us.

- Stash uses cutting-edge security features that monitor your account 24/7.

- Investments (securities only) in your brokerage account are protected up to $500,000 by SIPC ($250,000 in cash).

- Brokerage account uninvested funds are enrolled in the Apex FDIC Insured Sweep Program and deposits to the Sweep Program are covered by FDIC insurance up to $250,000.

- Get answers from our customer support team.

Get started today.

STEP 1

Sign up for Stash.

STEP 2

Complete registration and open

a Personal Portfolio.

STEP 3

Choose your first investment.

STEP 4

Then you’re all set!