May 01, 2024

How to invest in cryptocurrency: a beginner’s guide

In this article:

- What is cryptocurrency?

- Types of cryptocurrencies

- Understanding Blockchain Technology

- Setting Up Your Crypto Wallet

- Long-Term Crypto Investment Strategies

- Risks and Challenges of Crypto Investing

- What to consider before investing in cryptocurrency

- Pros of investing in cryptocurrency

- Cons of investing in cryptocurrency

- How to keep your cryptocurrency secure

- How to invest in cryptocurrency in 2025

- Related investments to explore

- Cryptocurrency investing FAQ

Over the past decade, cryptocurrency has grown from a niche hobby to a global financial phenomenon. With its potential for high returns, it’s no wonder new investors are eager to learn how to invest. But understanding where to start can feel overwhelming — there’s just so much information available to parse through.

Let this guide help cut through the noise. This beginner’s guide to investing in cryptocurrency will walk you through the basics of cryptocurrency, explain key concepts like blockchain technology, and provide you with actionable steps to make your first crypto investment with confidence.

What is cryptocurrency?

Cryptocurrency is a form of digital currency that uses encryption techniques to regulate its creation, secure transactions, and verify transfers. Unlike traditional currencies such as the U.S. dollar or euro, cryptocurrency operates independently of any central bank or government.

Unlike most forms of currency, cryptocurrencies are decentralized, meaning they are not issued, backed, or regulated by a central authority like the U.S. government. Units of cryptocurrency, known as coins or tokens, are created digitally through a validation process that relies on blockchain, a powerful technology that can be used in a vast array of processes, not just for crypto.

Also known as distributed ledger technology, blockchain produces a secure encrypted record of the value of each virtual coin and its associated transactions. Those records are distributed and linked across the network of parties, or computers, accessing the blockchain; in theory, the blockchain can be accessed by anyone with an internet connection. This system was designed with security, transparency, speed, and accuracy in mind.

But what’s behind the hype of Cryptocurrency?? Here are a few reasons why people invest in cryptocurrencies:

High Growth Potential: Early adopters of Bitcoin saw massive returns, which inspired a wave of interest for newer cryptocurrencies.

Decentralization: Cryptocurrencies operate on decentralized networks, providing financial freedom without intermediaries like banks.

Accessibility: Compared to traditional investments, crypto investing is open to anyone with an internet connection.

While the potential for high returns drives investor interest, it’s important to remember that cryptocurrencies are volatile by nature, which means prices can fluctuate rapidly.

Types of cryptocurrencies

While the word cryptocurrency itself is a generic term for virtual currencies using blockchain technology, there are many different cryptos: over 2.4 million as of May 2025, according to CoinMarketCap.com. Bitcoin was one of the earliest cryptocurrencies created and remains the best known. Collectively, all other coin-based cryptocurrencies are called “altcoin,” or alternative to bitcoin.

Several cryptocurrencies have gained high profiles, amassed large market value, and developed broad bases of users and investors in recent years.

Top 10 cryptocurrencies by USD market cap

As of May 2025:

It’s difficult to say which coins will be the most successful as the crypto ecosystem is new and many cryptocurrencies are young. Even though these coins are among the largest ones, they still have risk. The possibility of investment loss is real and substantial. For example, following strong gains in 2021, the value of most cryptocurrencies fell dramatically in 2022. And in 2024, crypto value has risen again to gains reminiscent of 2021. That’s why it is critically important to learn about each crypto before investing and determine if the investment makes sense to you.

Understanding Blockchain Technology

You can’t fully grasp how to invest in cryptocurrency without first understanding blockchain technology. Blockchain is the bedrock of cryptocurrencies. It’s a decentralized ledger that records all transactions across a network of computers.

Why Does Blockchain Matter?

Blockchain offers several key advantages:

Transparency: All transactions are publicly recorded on the ledger, making it tamper-proof.

Security: Cryptography ensures transactions are secure and verified.

Decentralization: No single authority controls the data, reducing the risk of manipulation.

While you don’t need to be a tech wizard to start investing, having a basic understanding of blockchain will help you appreciate how and why crypto works.

Setting Up Your Crypto Wallet

Before buying your first cryptocurrency, you’ll need a digital wallet. Think of it as your personal bank for crypto.

Types of Crypto Wallets

Hot Wallets (Online): These wallets are connected to the internet and accessible via smartphones or computers. Examples include Coinbase Wallet and MetaMask.

Cold Wallets (Offline): These are physical wallets like hardware devices or paper wallets, making them more secure but less convenient for frequent trading.

Choosing the Right Wallet

Hot wallets are ideal for beginners, because they’re simple to use. That said, if you’re storing significant amounts of crypto, you might opt for cold wallets, which provide greater security.

Long-Term Crypto Investment Strategies

Cryptocurrency isn’t just for short-term gains; many investors are in it for the long haul. Here’s how you can build a sustainable strategy:

HODLing (Hold On for Dear Life): Buy and hold for years, ignoring short-term volatility.

Staking: Lock up your coins to help validate transactions on a blockchain and earn passive income.

Dollar-Cost Averaging (DCA): Invest small, consistent amounts over time instead of putting down a lump sum.

Long-term strategies require patience and a comfort around risk to ride out market fluctuations.

Risks and Challenges of Crypto Investing

There are undoubtedly risks and challenges when it comes to investing in cryptocurrency. Some of the most notable include:

Volatility: Crypto prices can swing dramatically within hours.

Security Risks: Poor security practices can lead to wallet hacks or lost investments.

Regulatory Uncertainty: Changing laws and regulations can affect the crypto market.

Research Intensity: Crypto investing requires constant learning.

Stay informed, only invest what you can afford to lose, and never trade based on hype.

What to consider before investing in cryptocurrency

Cryptocurrency can be volatile, with large swings in value over short periods of time, which may give you pause if you’re risk averse. Keep in mind that anyone can launch a cryptocurrency, and how it’s regulated is in flux, so it’s vital to thoroughly vet any possible investments to avoid scams.

You may also find it helpful to consider why you want to invest in crypto. Are you looking to follow and cash in on a trend, or do you have a thought-out strategy in mind? Remember, there is no such thing as an easy way to make a lot of money without risk so it’s important to never invest in anything with the belief that you can’t lose. Use caution and be clear about your intentions and expectations beforehand. You should only consider cryptocurrency as an investment if you believe in its long-term prospects and are willing to ride out large price swings.

When you invest, it’s critically important to take a long-term perspective. This is especially true for things like cryptocurrencies, which can quickly go up or down in value. When investing in highly volatile assets, it’s easy to make the mistake of letting emotions drive your decisions, such as buying when the price is rising in fear of missing out or selling out when prices go down. These emotional decisions usually aren’t good for your investments.

Looking for a deep dive into the crypto market? Read about 100+ cryptocurrency statistics here.

Is cryptocurrency a good investment?

Whether crypto will be a good investment for you depends on many factors. As with all investing, the answer comes down to things like your tolerance for risk, both in financial terms and in psychological terms, and your time horizon, as well as how diversified your portfolio is. The volatility of crypto means that the value of your coins can go up or down quickly, and sometimes dramatically.

Simply because an asset is available to trade does not necessarily mean that it’s the right investment for your situation. And as discussed above, all investing carries the risk that you could lose money.

How much should you invest in cryptocurrency?

Some experts recommend investing no more than 1% to 5% of your net worth. When looking at how much of your portfolio to invest in crypto, limiting your overall exposure to crypto is crucial. It’s important to never invest more than you can afford to lose. While having a small exposure to crypto may improve the risk adjusted return profile of a diversified portfolio, the overall amount that one should invest in crypto should be dictated by your overall investment portfolio and your risk tolerance.

With that in mind, diversification within crypto is another aspect to consider. The specific cryptocurrencies you choose to invest in matter as some coins have better long-term potential and are less likely to be manipulated in price.

While the entire cryptocurrency market tends to be very unpredictable and volatile, there may be less risk with the bigger, more commonly traded cryptocurrencies compared to the smaller-cap, more speculative cryptocurrencies. However, even the biggest and most well-known cryptocurrencies can have big price swings up and down. So, it’s a good idea to think about the variety of cryptocurrencies you have in your portfolio, as well as the total amount you invest in them.

At Stash, we recommend holding no more than 2% of your overall portfolio in any one crypto in order to limit crypto-specific risks. |

|---|

Pros of investing in cryptocurrency

Prior to 2022, the price of cryptocurrencies were not highly correlated to other investment classes, like stocks and bonds, so having a small exposure to this potentially high growth space may improve risk adjusted returns. While correlations between cryptocurrencies and other asset classes were high, it’s unclear if this is a new trend.

Some experts compare certain cryptos, such as Bitcoin, to gold: both are fungible and durable because they’re hard to destroy, scarce due to finite supply, and their purchasing power is not defined by any central authority.

Thanks to the decentralization and transparency of the distributed ledger, it’s difficult to compromise the network integrity behind cryptocurrencies.

Cons of investing in cryptocurrency

The cryptocurrency market is highly volatile; it can be difficult to predict when values will rise or fall, and the drivers of large swings in value may not always be clear.

Though crypto blockchains are very difficult to hack, individuals can be susceptible to hacking, due to the same risks inherent in any online activity.

Cryptocurrencies are not currently subject to much government regulation, so transactions don’t come with legal protection (unlike traditional investments like stocks).

How to keep your cryptocurrency secure

Taking precautions to keep your crypto investment secure is one of the unique concerns that come with this type of investing. Some tips that may help:

Deal only with reputable exchanges and digital wallet providers.

Protect access with strong passwords, two-factor verification, and secure internet connections.

Be vigilant about phishing scams that target crypto users.

Don’t share your password or key with anyone.

How to invest in cryptocurrency in 2025

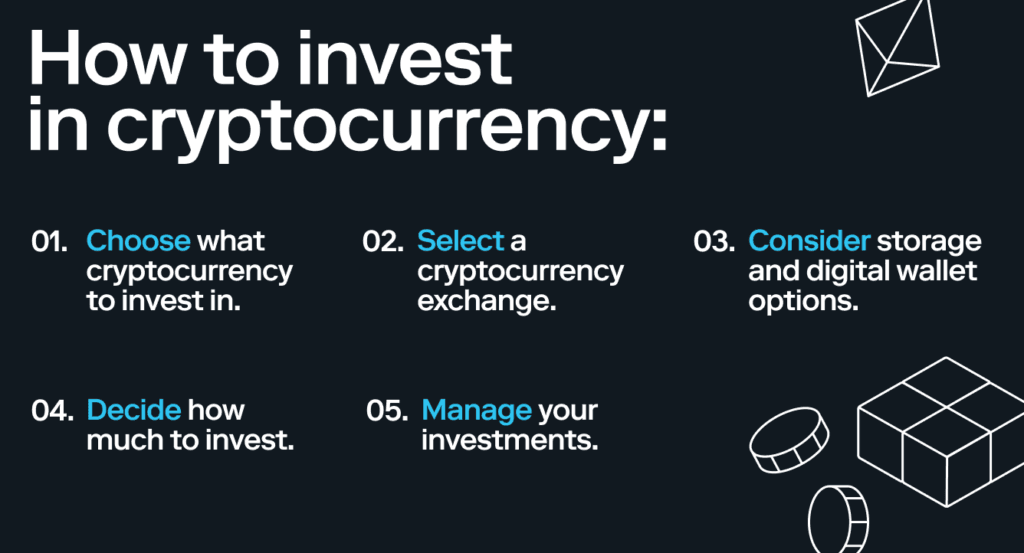

Interested in investing in cryptocurrency? Understanding where and how to buy and store it is crucial. With numerous exchanges available, similar to traditional investment platforms, setting up an account is quick and easy. However, conducting thorough research on each currency is advisable before investing. For beginners wondering how to start, follow these five steps:

Choose what cryptocurrency to invest in

Choose a reputable cryptocurrency exchange

Explore storage and digital wallet options

Decide how much to invest

Stay informed and manage your investments wisely

Step 1: Choose what cryptocurrency to invest in

In the same way that you’d evaluate the potential risks and financial health of a company before buying its stock, you’ll want to understand and carefully evaluate the different, unique characteristics of each cryptocurrency you’re considering for investment. You may choose to invest in one or several different cryptocurrencies.

Vetting cryptocurrencies can be more difficult because they have become a popular vehicle for fraud, such as pump-and-dump schemes. Those risks might leave you wondering how to invest in cryptocurrency without falling victim to a scam. In order to avoid pump-and-dump schemes, avoid smaller/newer cryptos that are being heavily promoted on social media platforms. It’s critical to analyze the investment risk of a given cryptocurrency and social media experts may not have your best interests in mind.

Although you may be able to minimize your exposure to fraud and cybersecurity risk by investing through a large, reputable platform, because the whole industry isn’t regulated, it’s impossible to eliminate this risk. For example, in 2022, we learned FTX, which was formerly considered a reputable platform, was being run by bad actors who misappropriated clients’ funds. On November 2, 2023, its founder, Sam Bankman-Fried was found guilty of fraud and money laundering. And on March 28, 2024, the court sentenced Bankman-Fried to 25 years in prison.

Step 2: Select a cryptocurrency exchange

Cryptocurrency must be bought through an exchange or investment platform, such as Coinbase, Gemini, or Kraken. Some factors you may wish to consider when selecting an exchange are security, fees, the volume of trading, minimum investment requirements, and the types of cryptocurrency available for purchase on a given exchange.

Step 3: Consider storage and digital wallet options

Cryptocurrency is completely digital, which means you should have a digital place to keep your coins safe. One choice is to keep them on the same platform where you’re investing. Nowadays, many new cryptocurrency investors prefer this method. Just make sure you pick a platform that will be responsible for custody and safekeeping of your assets. Such platforms are regulated, have strong protection against hackers and online threats, and carry financial insurance.

If you choose not to hold your cryptocurrency on the more popular platforms, you’ll need a crypto wallet; these hold the private keys that allow you to access your crypto by unlocking the digital identity that is associated with your ownership, recorded on the blockchain. You can opt for either a “hot” or “cold” digital wallet. A hot wallet is accessible via the internet and is generally more convenient. A cold wallet is a physical storage device, much like a USB drive, that keeps your cryptocurrency keys completely offline and generally more secure. Holding your cryptocurrency in a wallet provides an extra layer of protection.

Step 4: Decide how much to invest

Just like any investment, the amount you choose to put into crypto will depend on many factors, such as your budget, risk tolerance, and investing strategy. You’ll also want to consider any minimum investment requirements and transaction costs, which vary across crypto exchanges.

If you want to invest in a cryptocurrency with a high value per coin, most exchanges allow you to invest on a dollar basis, rather than buying a whole coin. This means you don’t need a huge amount of money to invest in something like Bitcoin. Focus on the total amount of money you want to invest, rather than the number of coins you want to buy. And always remember, don’t invest more than you can afford to lose. At Stash, we recommend holding no more than 2% of your overall portfolio in any one crypto in order to limit crypto specific risks.

Step 5: Manage your investments

Cryptocurrency is a unique investment because it can be used to buy things and can also be held as a long-term investment; how you manage your crypto holdings depends on your investing strategy and goals. You may wish to consider applying the Stash Way, a philosophy focused on regular investing, diversification, and investing for the long term.

Related investments to explore

If you’re not quite ready to dive into cryptocurrency, there are some related investments to consider. For example, some Exchange Traded Funds (ETFs) offer “ways to play” in the crypto market, but do not directly hold cryptocurrency or its derivatives. In general, these ETFs hold stock in companies with exposure to or involvement in processes that interact with or support crypto markets by participating in mining or simply by holding large balance-sheet positions in cryptocurrency. These investments allow you to dabble in this emerging landscape without taking the cryptocurrency plunge.

Cryptocurrency investing FAQ

What do I need to know before buying cryptocurrency?

Cryptocurrency is a risky investment, so approach it with your eyes open to potential pitfalls. Digital currency is volatile, it’s largely unregulated, and there are many unknowns about how this new form of currency will develop in the future.

What to look for in a cryptocurrency investment

Every cryptocurrency is different, so the best option depends on your individual circumstances. That said, beginning investors may wish to explore more established currencies, as there is plenty of information about how they work and their performance over time.

How much should I invest in cryptocurrency as a beginner?

Never invest more than you can afford to lose. At Stash, we recommend holding no more than 2% of your overall portfolio in any one crypto in order to limit crypto-specific risks.

Related articles

investing

Oct 23, 2025

Why Millions Are Canceling Disney+ and Hulu and What It Means for Investors

investing

Aug 15, 2025

Money Insights

investing

Jul 07, 2025

How to start investing: a guide for beginners

investing

Jun 04, 2025

Growth Stocks to Invest in for 2025

investing

Jun 03, 2025

Sustainable Investing Stocks to go after in 2025

investing

Jun 02, 2025

Learn REITs and Start Investing for 2025

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.