Build Your Portfolio

Test-drive diversification with Stash's Portfolio Builder. When you're ready to invest for real, Stash can help you keep your portfolio balanced, growing, and on track with ongoing guidance. Learn the basics ›

$

Choose your investments

We've highlighted our recommendations below, or you can add and remove investments as you like!

Too much work?

Sit back and let Stash do everything for you.

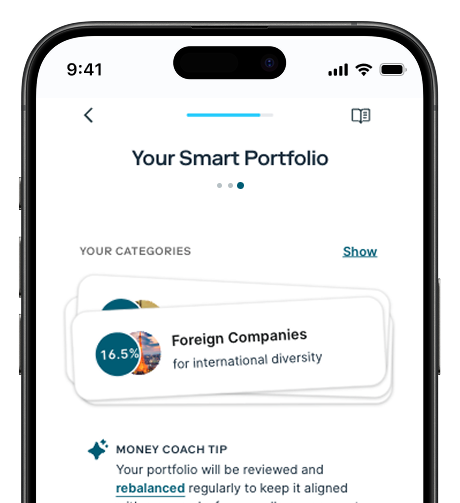

Skip & sign up for Smart PortfolioStash can pick your investments, rebalance, and diversify regularly for you with a Smart Portfolio.

Continue choosing my investments instead

🇺🇸

US Stocks

Invest in the American economy with diversified U.S. market exposure