May 01, 2020

Auto-Stash Can Help You Double Your Savings

Auto-Stash makes saving money easier by making it automatic. Learn how a few taps can help get you to your goals faster.

Light a fire under your cash with just a tap of a button.

We tested it: As of August 2018, Stash customers that kept Auto-Stash turned on for a year saved twice as much on average as Stashers who didn’t. (We also found that if you used Auto-Stash from the Great Recession of 2008 to March 2020, you could’ve doubled your savings.)

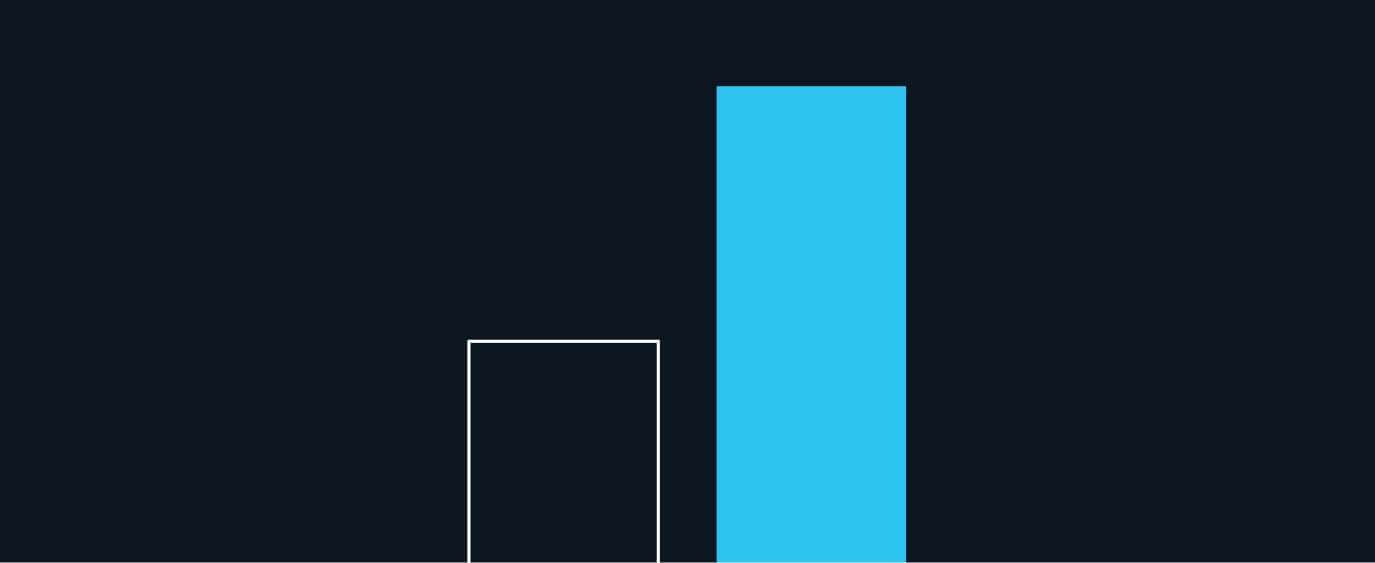

Stash customers who had Auto-Stash turned on for a year saved $1,432. Customers who didn’t? $665.59.

That’s a big difference.

What is Auto-Stash?

With Auto-invest through Auto-Stash, you can easily build a schedule to save and invest a set amount. You select the amount you want to set aside, when and how often you want to set it aside, and whether you’d like Stash to automatically invest it in your ETFs and stocks, or simply place the money in your cash to invest balance.

Convince me, why should I invest automatically?

Making small deposits and investments on a regular basis is one of the keys to smart investing. When you invest a little bit on a regular basis, you don’t need to worry about picking the right time to invest. If you invest on a schedule, you’ll get some at a higher price, and some at a bargain and your average price will be somewhere in the middle.

Regular investing has dollar-cost averaging benefits and is a key part of the Stash Way.

One thing to remember: When turning on Auto-Stash is that this money will be taken out of your account automatically so if you don’t have enough money to cover the Auto-Stash, your bank may charge you an overdraft fee.

Yes, I want to automate my savings!

Right on, just go to the Stash app and turn on Auto-Stash.

Don’t have Stash yet? You can sign up now.

Related articles

budgeting

May 04, 2025

How to Build Credit from Scratch in 2025

budgeting

Apr 27, 2025

Who gets the insurance check when a car is totaled?

budgeting

Apr 09, 2025

How to Make Extra Income While Working Full-Time

budgeting

Apr 08, 2025

How Much Does the Average American Make?

budgeting

Apr 07, 2025

How to Calculate Monthly Income

budgeting

Mar 14, 2025

How to Budget for Large Expenses

By using this website you agree to our Terms of Use and Privacy Policy. To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.